W4 2025: Beef Weekly Update

.jpg)

In W4 in the beef landscape, some of the most relevant trends included:

- The global beef trade is experiencing mixed trends, with China maintaining high import volumes at low prices, while the US sees record-high cattle and meat prices due to strong domestic demand and supply shortages.

- Brazil faces tariff challenges in the US market but remains a crucial supplier due to the US cattle inventory crisis.

- Ireland's beef sector faces an estimated loss of USD 135.44 million due to the EU-Mercosur trade agreement.

- Paraguay saw a surge in beef exports in 2024, particularly to the US and Canada, after a 20-year absence.

- Fueled by strong export demand, Spain's beef market faces supply shortages, pushing prices to record highs.

- Brazil and the US saw price increases due to exchange rate changes and supply constraints, while Argentina's prices rose despite weak domestic demand. Australia's prices dropped due to more plainer types and fewer feeder cattle.

1. Weekly News

Global

Global Beef Trade Faces Mixed Trends as US Prices Rise and China Adjusts Strategy

While China maintains high beef import volumes at low prices, the United States (US) is experiencing record-high cattle and meat prices. Brazil, the world’s largest beef exporter, has struggled to fully transfer rising domestic cattle costs to export prices, with early Jan-25’s average beef price at USD 5,050 per metric ton (mt), just 11% above mid-2024 levels. Chinese importers now counter-offer at USD 4,800/mt from between USD 5,400/mt and USD 5,800/mt in Nov-24, as authorities investigate the impact of imports on local livestock. Despite China’s cautious approach, global beef trade surged by 1 million metric tons (mmt) in 2024, the largest increase in 20 years. The growth was driven by rising demand from the US, Russia, and Saudi Arabia, with Brazil supplying 60% of this growth, Australia 30%, and Argentina 10%. In the US, strong domestic demand and snowstorms pushed live steer prices to USD 4.30 per kilogram (kg), wholesale beef to above USD 7/kg, and profit margins to a record USD 660 per cow. However, herd recovery remains slow as aging ranchers retire and younger generations seek alternative careers.

Brazil

Brazil's Beef Export Strategy Amid US Tariff Hurdles and Supply Shortages

Brazilian beef companies have already filled their 65 thousand mt tariff-free quota for exports to the US through 2025, while Australia still benefits from a 448 thousand mt quota. Brazilian exports above this threshold will face a 26.4% tariff, along with potential new tariffs from the new administration, making Brazilian beef less competitive than other exporters like Australia and New Zealand. In 2024, Brazil reached its quota by Mar-24, a month earlier than in 2023. Despite these challenges, the Brazilian Beef Exporters Association (ABIEC) stated that Brazilian beef exports are unlikely to be significantly impacted by these tariffs due to the US cattle inventory crisis. In 2024, Brazil exported USD 1.3 billion worth of beef to the US, up 66% from 2023. With US cattle inventories at a historic low, Brazil remains a crucial supplier for US beef needs. Brazil is also in negotiations to increase its tariff-free quota to 150 thousand mt, though the outcome is uncertain with the new administration. Brazil’s beef exports to China, its largest market followed by the US, totaled USD 5.4 billion in 2024, subject to a 12% tariff.

Ireland

Ireland's Beef Sector Faces USD 135.44 Million Loss from EU-Mercosur Deal

Meat Industry Ireland (MII) has projected that the European Union (EU)-Mercosur agreement will result in a USD 135.44 million (EUR 130 million) loss for Ireland's beef sector. The agreement is expected to negatively impact the entire supply chain, with significant concerns over the differences in production, sustainability, and traceability standards between the EU and Mercosur countries. Upon full implementation, MII estimates an annual reduction of USD 1.35 billion (EUR 1.3 billion) in EU beef market production values, with Ireland facing a loss of USD 104.18 to USD 135.44 million (EUR 100 to EUR 130 million) due to its reliance on exports to other EU markets. This translates to a loss of USD 78.14 to USD 98.98 (EUR 75 to EUR 95) per head, based on Ireland's slaughter levels.

Paraguay

Paraguay's Beef Exports Surge to Record Highs in 2024, Reclaiming US and Canadian Markets

After a 20-year absence due to sanitary restrictions related to foot-and-mouth disease (FMD), Paraguay made a strong return to the US and Canadian markets in 2024, achieving record-breaking export volume and value. According to the National Service of Quality and Animal Health (Senacsa), Paraguay’s beef exports, including offal, reached 382.09 thousand mt from Jan-24 to Nov-24, earning nearly USD 1.7 billion. Chile remained the top market, accounting for 36% of exports, followed by Taiwan with 11%, and Brazil with 9%. Notably, the US emerged as the fourth-largest buyer, importing 25.31 thousand mt, worth USD 127.3 million within a year of Paraguay's market re-entry in Nov-23. Canada also imported 6.35 thousand mt, generating USD 29.6 million. Despite a record-breaking year, challenges lie ahead, as the 2025 US quota, shared with Brazil and others, is expected to be filled early, after which shipments will face a 26.4% tariff, affecting competitiveness. Nonetheless, Senacsa is optimistic that Paraguayan beef's positioning could strengthen further under the new US administration.

Spain

Spain's Beef Market Hits Record Highs Amid Supply Shortages and Strong Exports

The beef market remains tight in Europe as strong demand, limited supply, and rising prices reshape trade dynamics. Animal scarcity and declining carcass weights have driven prices to record highs, fueled by robust exports to Algeria and Morocco. While domestic consumption remains stable, uncertainties loom as the industry watches market trends leading up to Ramadan. In Spain, markets such as Ebro and Binéfar report soaring beef prices, influenced by export demand while buyers simultaneously seek more affordable meat. The Central Agropecuaria de Galicia ABANCA hit an all-time high in transaction volumes, surpassing USD 1.49 million (EUR 1.43 million), with attendance figures among the highest in history. Similarly, the Torrelavega market experienced strong demand, leading to easy and rapid sales with rising prices. Meanwhile, breeding cattle supply remains insufficient, particularly in the Friesian segment, where limited availability has met persistent buyer interest.

2. Weekly Pricing

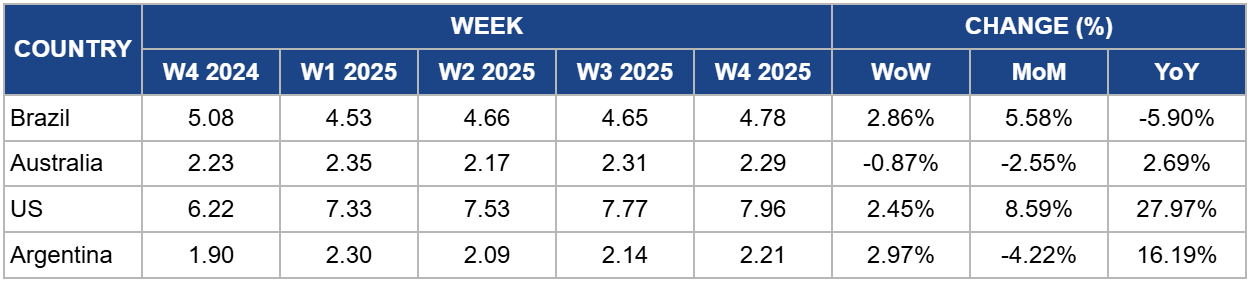

Weekly Beef Pricing Important Exporters (USD/kg)

Yearly Change in Beef Pricing Important Exporters (W4 2024 to W4 2025)

Brazil

In W4, Brazil's wholesale price for boneless rear beef increased by 2.86% week-on-week (WoW), reaching USD 4.78/kg. This also marks a 5.58% month-on-month (MoM) rise but a 5.90% year-on-year (YoY) decrease. In Brazilian real, prices held steady at BRL 28/kg for the fourth consecutive week, with fluctuations in the exchange rate affecting USD pricing. According to Safras and Mercado, the demand pattern for this period is steering consumption towards proteins with lower added value. However, high export levels and the current tight slaughter capacity remain crucial factors in supporting domestic prices.

Australia

Australia's National Young Cattle Indicator averaged USD 2.29/kg in W4, reflecting a slight 0.87% WoW decrease and a 2.55% MoM decline, but a 2.69% YoY increase. According to Meat and Livestock Australia (MLA), the cattle market generally softened, except for the Dairy Cow Indicator. Over the week, 90.05 thousand heads were yarded, marking the second largest yarding in the past three years, as reported by the National Livestock Reporting Service (NLRS). Despite the increase in numbers over the last two weeks, price fluctuations occurred due to a higher presence of plainer types and fewer cattle operating within the feeder categories. This caused a dip in the Feeder Steer Indicator, with New South Wales (NSW) and Queensland seeing the most significant price drops compared to other states.

United States

In W4, the US price for lean beef (92% to 94%) averaged USD 7.96/kg, reflecting a 2.45% WoW increase, marking the third consecutive weekly rise after 17 weeks of decline. This recovery is likely driven by improving demand following the seasonal winter slowdown, coupled with severe snowstorms impacting supply. The price also saw an 8.59% MoM rise and a significant 27.97% YoY surge. The YoY increase highlights a tightening domestic supply due to a shrinking cow herd, with ongoing production limitations continuing to support elevated lean beef prices.

Argentina

Argentina's average steer beef price rose to USD 2.21/kg in W4, reflecting a 2.97% WoW increase and a 16.19% YoY rise. However, the price saw a 4.22% MoM drop, likely due to the elevated holiday demand in Dec-24. Argentina's beef consumption faced significant challenges in 2024, with economic pressures leading to a 12% YoY decline, marking the worst sales year in two decades. Per capita consumption fell to 47.4 kg, down 11.1% from 2023, while apparent domestic consumption totaled 2.038 mmt, a 10.1% decrease from 2023, reaching a 22-year low.

3. Actionable Recommendations

Optimize Beef Export Strategies Amid Global Market Volatility

To navigate the current mixed global beef trade, stakeholders in Brazil, the US, and China should prioritize strengthening supply chain relationships and diversifying their export markets. Facing tariff hurdles and supply shortages, Brazil should continue expanding its presence in markets like Saudi Arabia which exhibits high demand while exploring partnerships with emerging economies in Asia and Africa. With its record-high cattle prices, the US should look to reduce domestic demand pressures by improving herd recovery through investment in modern farming techniques. China’s cautious stance and counter-offers at lower prices suggest a strategy of selective exports, with a focus on value-added products and long-term trade agreements that ensure consistent supply without sacrificing quality.

Explore New Trade Agreements and Support Producers

Ireland should consider exploring new trade agreements outside the EU, especially in Asia and the Middle East, where demand for high-quality beef is growing. The Irish government could also offer targeted subsidies or tax relief for producers most affected by the EU-Mercosur deal, helping them adapt to the market changes.

Strengthen Spain’s Beef Market Amid Rising Prices and Strong Export Demand

Spain should continue enhancing its beef export strategy, focusing on Algeria and Morocco while exploring new opportunities in the Middle East and Latin America. Given the supply shortages and rising prices, Spain’s beef producers can invest in improving herd management and breeding techniques to increase livestock availability. A focus on strengthening relationships with key international buyers, particularly in the halal meat sector, will further support Spain’s export growth. In addition, diversifying beef product offerings, such as introducing ready-to-eat or premium cuts, will provide added value and help maintain competitiveness in tight markets.

Sources: Tridge, Agromeat, Agropopular, UkrAgroConsult