1. Weekly News

Australia

Australian Avocado Industry Targets Lucrative Chinese Market as Relations Improve

With improving China-Australia relations, Avocados Australia, a non-profit organization representing avocado growers, is actively pursuing access to the high-demand Chinese market. Recently, an Australian delegation visited China's Yunnan and Guangdong provinces to discuss quarantine measures and market entry requirements. The interest in entering the Chinese market has grown since 2013. China's avocado imports have surged by over 310% since 2015, reaching nearly 70 thousand tons annually and valued at USD 106 million in 2023. With demand expected to reach 100 thousand tons, Australian avocado producers, particularly those in Queensland (which supplies 65% of the country's avocados), see an opportunity to secure up to 50% of this growing market, valued at USD 198.6 million (AUD 300 million).

Chile

Chile Leads in the European Avocado Market

The Avobook report for W41 highlights a notable shift in the European avocado market, with Chile rising to the top position. Colombia now holds the second spot due to increased harvests and shipments, while Peru drops to third. This transition underscores a market characterized by stable prices that many producers favor. Mexico dominates the avocado market in the United States (US), with an impressive 93% share, while California, Chile, Peru, and Colombia each contribute no more than 1%. In Asia, China maintained its import of 22 containers from the previous week. However, prices declined across nearly all sizes, particularly impacting the largest avocados, which experienced a 10% year-on-year (YoY) drop.

Mexico

Michoacán Supports Pro-Forest Certification to Combat Avocado-Driven Deforestation

In Michoacán, Mexico, the voluntary Pro-Forest Avocado certification is gaining momentum as an effective measure to combat deforestation associated with avocado production. Climate Right International’s Senior Advisor for the Americas recently discussed the initiative’s value with the state governor, highlighting how it promotes sustainability within the avocado export sector. Covering 49.1 thousand orchards over 148.1 thousand hectares (ha), the certification assures consumers that avocados come from legally established, deforestation-free farms. The initiative aims to regulate illegal orchards, restore deforested areas, and strengthen Michoacán’s commitment to sustainable agriculture.

Morocco

Morocco Prepares for Record Avocado Harvest

Morocco's avocado production farms have started hiring seasonal workers in preparation for a harvest expected to exceed 90 thousand tons, with plans to export over 80 thousand tons. The focus is on three smooth avocado varieties: Fuerte, Bacon, and Zitano, while plans are underway to introduce the rough-skinned Hass variety. The harvest season runs from late September to late December, and industry professionals emphasize the quality and quantity of avocados this inaugural season, highlighting its potential to create direct and indirect employment opportunities for local day laborers between Moulay Bousselham and Larache. Furthermore, avocado cultivation is noted for its lower water requirements than other crops, positioning it as an environmentally sustainable choice.

Myanmar

Increased Avocado Trade in Myanmar's Shan State

Myanmar's Shan State, the country's top avocado-producing region, is experiencing a surge in avocado trade this season, driven by strong demand from buyers in Yangon and Mandalay. The sales season, which spans from October to February or March, is expected to see lower prices due to increased production, particularly during peak months in November and December. In Yangon, demand is notably high for avocados used in juice, further fueling regional sales and boosting the fruit's popularity in local markets.

Peru

Peruvian Avocado Production Faces Challenges but Closes on a Positive Note in 2024

Peruvian avocado production in 2024 faced significant challenges due to ongoing climatic issues that disrupted regular harvest levels. Nevertheless, the industry demonstrated resilience, wrapping up the campaign positively. By the end of Sep-24, Peru exported nearly 587 thousand tons of fresh avocados valued at approximately USD 1.26 billion. This figure marks a 9% YoY decrease in volume but an impressive 23% YoY increase in value, with an average price of USD 2.15 per kilogram (kg), 34% higher than the previous year. Many producers chose to delay their harvest to prevent overburdening crops and optimize yields for 2025. Europe remains the primary market for Peruvian avocados, accounting for 68% of shipments, while the US represents 14%, where competition from Mexican avocados continues to be strong. Despite a 16% drop in exports to the US, a 35% increase in average prices mitigated the impact, underscoring the significance of price dynamics amid production challenges.

South Africa

Westfalia Fruit Launches South African Avocado Exports to China

Westfalia Fruit celebrated a significant milestone with the successful arrival of its first shipment of avocados from South Africa to China, which passed customs inspection on October 8. This shipment marks a strategic move into new export markets, including China and India, to enhance the commercial success of the South African avocado industry. The avocados will be distributed to retail supermarkets across Southern and Northern China, catering to the growing demand for healthy food options among the middle class. Westfalia's Group Commercial Director for Africa highlighted the company's commitment to quality and sustainability, noting South Africa's advantage of shorter transit times to Asia compared to Latin American suppliers. This inaugural shipment was facilitated by a phytosanitary agreement established between South Africa and China in Aug-23, indicating strong potential for growth in this dynamic market.

2. Weekly Pricing

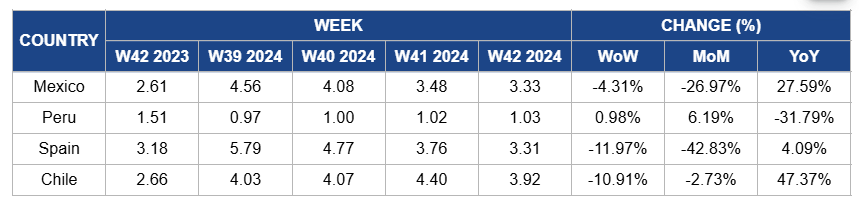

Weekly Avocado Pricing Important Exporters (USD/kg)

Yearly Change in Avocado Pricing Important Exporters (W42 2023 to W42 2024)

Mexico

In W42, avocado prices in Mexico decreased by 4.31% week-on-week (WoW) to USD 3.33/kg, reflecting a notable 26.97% decline month-on-month (MoM), primarily due to increased supply from favorable growing conditions. However, YoY prices rose by 27.59%, driven by strong consumer demand for sustainably sourced avocados and limited availability of certified products following the introduction of the Pro-Forest Avocado certification in Michoacán, alongside ongoing challenges related to illegal orchards and deforestation.

Peru

In W42, Peru's avocado prices increased slightly by 0.98% WoW to USD 1.03/kg, with a 6.19% MoM increase due to the resilience shown amid climatic challenges and strategic harvest delays by producers aimed at optimizing yields for 2025. The average export price has risen significantly, reflecting a strong market demand. Europe, in particular, remains the primary destination for Peruvian avocados. However, YoY prices declined by 31.79% due to a 9% decrease in export volume compared to last year and heightened competition from Mexican avocados in primary markets like the US, impacting overall pricing dynamics.

Spain

Spain's avocado prices declined by 11.97% WoW to USD 3.31/kg in W42, with a more significant decrease of 42.83% MoM due to ongoing oversupply in the market. The oversupply can be attributed to the early arrival of green-skinned varieties. This oversupply, combined with a persistent water shortage that has limited production volumes, has intensified supplier competition, leading to further price reductions. Additionally, increased imports from other regions have disrupted the market balance despite the overall high quality of the crop. These factors have contributed to the continued downward pressure on avocado prices.

Chile

In Chile, avocado prices declined by 10.91% WoW to USD 3.92/kg in W42, with a 2.73% MoM decline due to a slight easing in export demand following the previous week's significant increase. Additionally, the market experienced increased competition from Colombian avocados, which have gained traction in Europe, potentially affecting Chile's pricing strategy. However, YoY prices increased by 47.37% due to sustained high export demand, reduced supply from competing Southern Hemisphere producers, and ongoing investments in port infrastructure that have enhanced Chile's export capacity, driving the overall price up despite recent fluctuations.

3. Actionable Recommendations

Promote Pro-Forest Certification in Avocado Production

Michoacán avocado producers should actively adopt the Pro-Forest Avocado certification to enhance market appeal and demonstrate commitment to sustainable practices. This certification ensures avocados are sourced from legally compliant, deforestation-free farms, supporting responsible agricultural practices. By pursuing certification, producers contribute to forest conservation, reduce environmental impact, and position Michoacán as a leader in sustainable avocado production, which strengthens consumer trust and export opportunities.

Optimize Harvest Timing for Avocado Production

Peruvian avocado producers should strategically optimize harvest timing to enhance yield and profitability amidst climatic challenges. Producers can delay harvest when necessary by carefully assessing crop conditions, ensuring optimal fruit quality, and maximizing returns in upcoming seasons. Maintaining strong export relationships with key markets, particularly in Europe, will also help stabilize sales and leverage increased average prices. This proactive approach will position producers to better navigate market dynamics and capitalize on high-value opportunities.

Strengthen Market Entry Strategies for Chinese Avocado Market

Australian avocado producers should intensify their efforts to strengthen market entry strategies for the growing Chinese avocado market. This includes establishing robust partnerships with local distributors and retailers to navigate quarantine measures effectively. Producers should also invest in targeted marketing campaigns highlighting Australian avocados' quality and benefits to reestablish a customer base. Additionally, ongoing engagement with trade delegations will be crucial for addressing regulatory challenges and ensuring a smooth entry into this lucrative market. This proactive approach will position Australian avocados as a preferred choice in China.

Sources: Tridge, Agraria, Fresh Fruit, Freshplaza, Global Times, GNLM, Larazon, MXfruit, Portal Del Campo, Simfruit.