W46 2024: Strawberry Weekly Update

1. Weekly News

Egypt

Egypt Prepares for 2024/25 Strawberry Export Season

Egypt's Ministry of Agriculture continues to accept applications for coding strawberry farms in preparation for the 2024/25 export season. Coding involves assigning unique identification codes to farms to ensure traceability, monitor compliance with export standards, and verify adherence to international trade requirements. Currently, 64 strawberry farms have been coded through the Exporters Service Department, facilitating compliance with export standards. This initiative supports Egypt's growing presence in global strawberry markets while ensuring adherence to international trade requirements.

Europe

European Strawberry Supply Declines as Seasons End

Strawberry availability in Europe is currently limited as the Dutch, Belgian, and United Kingdom (UK) seasons conclude, while Egypt's season is yet to begin. Some UK strawberries remain from glasshouses and tunnels, but recent dull weather has reduced volumes. Dutch strawberry prices stood at around USD 60.70/box (GBP 48/box) and are expected to rise further until alternative sources emerge, with deliveries made to the UK. The Egyptian season is expected to gain momentum by late November 2024, but it may face challenges in meeting initial demand. Meanwhile, Morocco has shifted its focus to blueberries and raspberries, planting fewer strawberries this season, adding to the overall supply challenge.

Greece

Greek Strawberry Harvest Begins with Strong Export Demand

The strawberry harvest in Greece started, with growers and exporters primarily targeting European markets, particularly Germany, where demand from supermarket chains is high despite limited supply. Early harvests feature Fortuna and Arwen varieties, with additional trial varieties like Marisma being tested. Growers in Manolada and nearby areas have expanded strawberry cultivation to 2.5 thousand hectares (ha), a 200-ha increase from last season. Victory remains the dominant variety, with 100 to 110 million bare-root plants expected to yield their first harvest early next year. Challenges include adverse weather during planting and labor shortages, with concerns about worker availability during the peak season in spring.

United States

Florida's Strawberry Industry Stays Resilient Amid Hurricanes

Despite the impact of Hurricanes Helene and Milton, Florida's strawberry industry remains on track to meet seasonal consumer demands. Growers have completed planting by early November, maintaining the industry's timeline. Introducing two new University of Florida Institute of Food and Agricultural Sciences (UF/IFAS) strawberry varieties, 'Ember' and 'Encore,' which resist phytophthora root rot caused by excess soil moisture, is aiding recovery efforts. These varieties account for 10% of Florida's 14 thousand acres of strawberry fields in their first year of commercial use, with expectations of increased adoption. A favorable weather outlook suggests a typical Florida strawberry harvest season.

2. Weekly Pricing

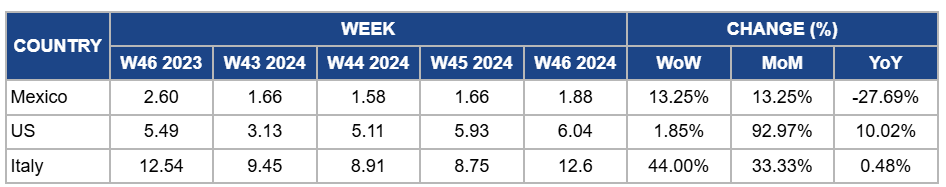

Weekly Strawberry Pricing Important Exporters (USD/kg)

Yearly Change in Strawberry Pricing Important Exporters (W46 2023 to W46 2024)

Mexico

In Mexico, strawberry prices in W46 soared by 13.25% week-on-week (WoW) and month-on-month (MoM) to USD 1.88 per kilogram (kg) due to reduced harvest volumes caused by rainy and primarily cloudy weather, which disrupted picking and slowed production. However, year-on-year (YoY) prices declined by 27.69% due to the normalization of supply compared to last year's weather-impacted season, such as excessive rainfall or unfavorable temperatures, significantly impacted strawberry production, which had constrained considerably output and driven prices higher.

United States

Strawberry prices in the United States (US) rose by 1.85% WoW and 10.02% YoY to USD 6.04/kg, with a significant surge of 92.97% MoM. The price increase is due to ongoing strong demand. Despite challenges from Hurricanes Helene and Milton, the recovery efforts, aided by the introduction of resilient varieties like 'Ember' and 'Encore,' have supported supply stability. However, planting delays and earlier weather-related disruptions have limited full market replenishment, increasing prices.

Italy

Italy's strawberry prices surged by 44% WoW and 33.33% MoM, with a slight increase of 0.48% YoY due to limited domestic supply caused by rainy and cloudy weather conditions, which disrupted harvest volumes. The weather delays affected the early-season output in primary growing regions such as Basilicata, reducing availability. Additionally, strong demand for high-quality strawberries during this transitional period contributed to the sharp price increase. Despite imports supporting year-round supply, the premium on local produce sustained upward price pressure.

3. Actionable Recommendations

Expand Adoption of Disease-Resistant Strawberry Varieties

Florida strawberry growers should expand the adoption of UF/IFAS varieties like ‘Ember’ and ‘Encore’ across more fields to combat phytophthora root rot and mitigate risks from excess soil moisture. These resilient varieties enhance crop health and provide stable yields under challenging weather conditions. Integrating these varieties into planting strategies can reduce reliance on chemical treatments, improve profitability, and support long-term sustainability. By proactively adopting these innovative cultivars, growers can better position themselves to meet market demands and safeguard production against future environmental challenges.

Secure Alternative Strawberry Suppliers

European strawberry importers and distributors should partner with Egyptian growers and diversify sourcing channels to mitigate supply shortages. Early communication with suppliers from emerging markets, such as Spain and Portugal, could help bridge the gap before Egypt’s season fully begins.

Streamline Farm Coding Applications

Strawberry exporters in Egypt should actively assist farmers in completing the coding process to meet export standards for the 2024/25 season. By offering technical support and ensuring adherence to international trade requirements, exporters can enhance compliance and strengthen Egypt’s competitiveness in global markets.

Sources: Tridge, Alfallahalyoum, Arvanitakis, Eastfruit, Freshplaza, Growingproduce, Nationwide Produce