W47 2024: Beef Weekly Update

.jpg)

1. Weekly News

Australia

Australia's Beef Production Reached Record Levels in Q3-2024

According to the Australian Bureau of Statistics Q3-2024 report, the Australian beef herd is experiencing destocking, with female slaughter accounting for 52% of total processing. This is consistent with the trend of the past few years, where female slaughter has remained above 47%, indicating a decline in the national herd. The natural maturity of the herd drives the destocking following a three- to four-year rebuild, with older breeding cows being sent for slaughter. This differs from climate-driven reductions, which typically involve processing younger heifers.

National beef production reached new records of 690.69 thousand metric tons (mt), a 7% rise from Q2-2024 and a 17% increase from Q3-2023, marking the largest volume produced in a three-month period. While slaughter levels remained high, they did not set new records, increasing by 5% from Q2-2024 to 2.2 million heads in Q3-2024. Growth in carcass weights (cwt) has contributed to a divergence between slaughter and production, with cwt stabilizing at 308 kilograms (kg) in the short term. However, investments in genetics, efficiencies, and feedlot growth have significantly improved average cwt, which is now about 30 kg heavier than in 2014.

Brazil

Brazil's Beef Market Recovery and the 2025 Outlook

Brazil's beef cattle market is recovering, driven by reduced supply and rising demand. According to Itaú BBA's Agro Consulting, prices rebounded from a low of USD 37.08 (BRL 215) in Jun-24, climbing steadily from Sep-24, fueled by severe drought in key producing regions that pressured supply. This drought damaged pastures and pressured supply, particularly in states less reliant on feedlots like Mato Grosso, where female slaughter slowed. Meanwhile, low feed and lean cattle costs boosted feedlot margins, partially offsetting supply challenges in some areas.

Rising real wages, lower unemployment, and gross domestic product (GDP) growth boosted domestic consumption, allowing wholesale beef prices to rise alongside a 42.7% increase in cattle prices between Sep-24 and Nov-24. Exports hit record volumes in Sep-24 at 252 thousand mt and Oct-24 at 270 thousand mt, though higher beef prices slightly reduced export margins. Calf prices also surged, with a 25% rise per head and a 43% increase per kg in the same period.

With limited supply and strong demand, high beef prices are expected to persist into early 2025. Strong Chinese demand and increasing United States (US) imports add to export optimism, but producers must address rising costs and potential market volatility. Strategic planning is essential in navigating this favorable yet uncertain market environment.

Brazil's Cattle Cycle Opens Doors for Australian Beef in 2025

Brazil has cemented its position as the world’s largest beef exporter and a key competitor for Australia. According to Meat and Livestock Australia (MLA), the Brazilian Boi Gordo processor steer indicator has risen by 49% since Jun-24 to USD 3.96/kg (AUD 6.10/kg) cwt, surpassing Australian cattle prices at USD 3.80/kg cwt (AUD 5.85/kg). This price surge is due to tightening cattle supplies following years of drought-driven high slaughter rates, alongside steady export demand.

In Oct-24, Brazil's monthly cattle slaughter dropped to 2.13 million heads, 5% below Oct-23 levels, marking the first year-on-year (YoY) decline since 2021. Meanwhile, Australian finished steer prices remained stable in 2024, trading within USD 3.57/kg (AUD 5.50/kg) to USD 4.02/kg (AUD 6.20/kg) since Jul-24. This stability is supported by a consistent supply from Australia's herd rebuild and rising export demand.

Looking to 2025, Brazil's tightening cattle cycle offers opportunities for Australia. Reduced Brazilian exports due to rising prices and supply constraints could tighten global beef markets, especially in price-sensitive regions. With record beef production expected in 2025, Australia is well-positioned to meet growing demand and expand its market share.

Denmark

Denmark to Tax Methane Emissions from Livestock Starting in 2030

Denmark has become the first country to introduce a tax on methane emissions from cattle and pigs, set to take effect in 2030. The tax will start at USD 42.14/mt (EUR 40.2/mt) of carbon dioxide (CO₂) equivalent, rising to USD 104.82/mt (EUR 100/mt) by 2035. However, farmers will receive significant tax breaks, reducing their effective cost to USD 16.77/mt (EUR 16/mt) from 2030 and USD 41.93/mt (EUR 40/mt) from 2035. This measure is part of a broader agreement to achieve carbon neutrality by 2045. The deal was reached in late Jun-24, involving the government, livestock associations, and trade unions.

Japan

Japan Suspends Wagyu Beef Exports Amid LSD Outbreak

Japan confirmed its first case of lumpy skin disease (LSD) on a cattle farm in Fukuoka prefecture, leading to the suspension of Wagyu beef exports to prevent the spread of the disease. Caused by a poxvirus, LSD affects only cattle and causes symptoms such as fever, skin nodules, and, in severe cases, death. The Japanese Ministry of Agriculture reported that 23 cattle from 8 farms showed symptoms, prompting immediate actions, including a vaccination campaign for livestock within a 20-kilometer radius, set to run until Mar-25.

Fukuoka authorities have also implemented strict hygiene measures and advised against moving suspected infected cattle. Primarily spread by mosquitoes and ticks, LSD has a mortality rate of 1% to 5%. While humans are not at risk from consuming meat or milk from infected cattle, the outbreak significantly impacts Japan’s beef industry, which exported USD 372 million (JPY 57.8 billion) in beef in 2023, with Wagyu beef being a key product.

The disease has spread across Asia since its first detection in Indonesia in 2022, with South Korea reporting cases in 2023. Japan’s outbreak highlights the need for global cooperation to control cross-border livestock diseases. The suspension of Wagyu beef exports is a blow to Japan’s beef trade, especially after the recent reopening of the Australian market to Japanese beef following a 17-year ban due to bovine spongiform encephalopathy (BSE) concerns.

2. Weekly Pricing

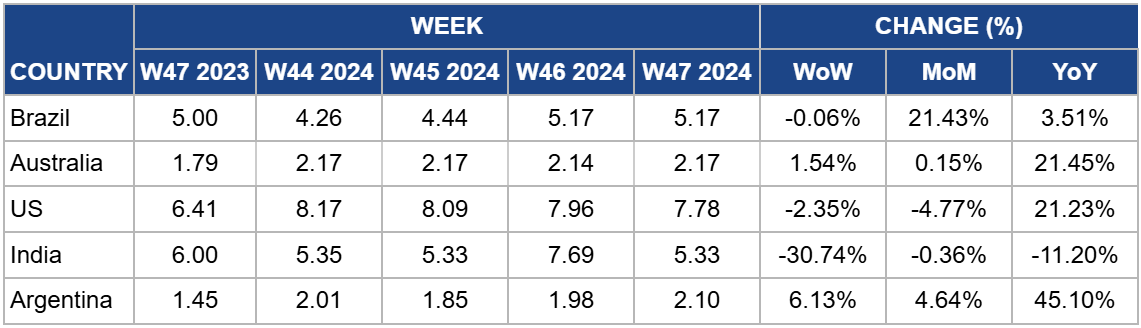

Weekly Beef Pricing Important Exporters (USD/kg)

Yearly Change in Beef Pricing Important Exporters (W47 2023 to W47 2024)

Brazil

In W47, Brazil's wholesale price for boneless rear beef remained stable at USD 5.17/kg, with a slight 0.06% week-on-week (WoW) decrease. However, the price saw a notable 21.43% month-on-month (MoM) increase and a 3.51% YoY rise. This price elevation is attributed to robust external demand, and the approaching holiday season has prompted retail market players to secure beef, driving up prices in the wholesale market. According to the Center for Advanced Studies on Applied Economics (Cepea), meatpacking plants continue to adjust slaughter prices positively each week, and similar trends are observed in livestock replacement negotiations. Despite meat prices reaching their highest levels in the past three and a half years, consumers are showing resilience in purchases.

Australia

Australia’s National Young Cattle Indicator averaged USD 2.17/kg in W47, showing a 1.54% WoW increase, a 0.15% MoM rise, and a significant 21.45% YoY gain. According to MLA, cattle prices have been mixed, with increased interest in lightweight restockers. Yardings decreased by 10.38 thousand heads to 56.45 thousand heads, mainly driven by declines in the Feeder Steer and Processor Cow Indicators. Prices rose in most states, with New South Wales seeing the largest increase due to strong demand from local restockers, especially for lightweight steers. In contrast, the export market in Victoria faced weaker competition, leading to reduced demand for grown steers.

United States

In W47, the price of lean beef (92% to 94%) in the US averaged USD 7.78/kg, reflecting a 2.35% WoW decline and marking the eleventh consecutive week of price drops, reaching the lowest level since W14. This also represents a 4.77% MoM decrease. Despite this decline, prices remain up 21.23% YoY, driven by a tightening domestic supply due to a shrinking cow herd. The price drop aligns with the typical seasonal dip in demand as winter approaches, following the peak consumption period in the summer. However, limited production continues to keep lean beef prices relatively high overall.

India

The average price of cow beef in India fell to USD 5.33/kg in W47, marking a significant 30.74% WoW decline, a 0.36% MoM decrease, and an 11.20% YoY drop. These fluctuations reflect the ongoing volatility in India's beef market, which is influenced by changing domestic and international regulations, and variable local supply. The market has become increasingly erratic, with prices driven by evolving policies and shifting supply chain dynamics.

Argentina

In W47, Argentina's average steer beef price increased to USD 2.10/kg, reflecting a 6.13% WoW rise and a 4.64% MoM increase. This marks the second consecutive weekly price hike, likely driven by increased demand around the National Sovereignty holiday on November 18. Despite a significant 45.10% YoY price rise, Argentina's beef market has seen relatively low prices in 2023 and 2024, largely due to reduced domestic demand amid the ongoing economic crisis. According to the Chamber of Industry and Commerce of Meat and Derivatives of the Argentine Republic (CICCRA), per capita beef consumption dropped by 12.3% in the first nine months of 2024, averaging 46.8 kg, a decrease of 6.6 kg per person. However, beef consumption in Argentina is expected to reach 2.3 million metric tons (mmt) in 2025, a 1.5% increase from 2024, driven by larger supplies supporting domestic consumption and exports.

3. Actionable Recommendations

Optimize Herd Management Amid Record Production

The ongoing destocking trend in Australia, with female slaughter making up 52% of the total processing, indicates a declining national herd. Producers should focus on strategic herd management to maintain production growth amidst this trend. This could involve optimizing breeding programs, enhancing genetics, and continuing to improve feedlot efficiencies. Additionally, leveraging investment in technologies that improve cwt while managing herd size can ensure sustained production levels without overstraining resources.

Seize Opportunities as Brazil’s Cattle Cycle Tightens

With Brazil's cattle cycle tightening and cattle prices surging, Australia’s beef industry stands to benefit significantly in 2025. Reduced Brazilian cattle exports and tightening supplies in Brazil present an opportunity for Australia to increase its global market share, particularly in price-sensitive regions. To capitalize on this, Australian producers should maintain production stability through herd rebuilding and feedlot growth. Moreover, enhancing the marketing of Australian beef as a premium product in emerging markets, such as Southeast Asia, will help Australia expand its export footprint. Developing sustainable practices and focusing on export diversification will further solidify Australia’s position in the global beef market.

Navigate Denmark's Methane Tax

Denmark's decision to impose a methane tax on livestock from 2030 introduces new challenges and opportunities for farmers. To mitigate the impact of this tax, Danish livestock producers should invest in more sustainable farming practices, such as improving livestock feed efficiency, exploring alternative feeding strategies, and adopting technologies for methane reduction. Collaborating with the government and livestock associations to explore subsidies and tax breaks will also be essential. Furthermore, producers can diversify their offerings by focusing on higher-value, low-emission products and seeking out opportunities in markets that prioritize sustainable farming, ensuring continued profitability despite the additional costs.

Mitigating the Effects of the LSD Outbreak

The suspension of Japan’s Wagyu beef exports due to the LSD outbreak is a significant setback for the country’s beef industry. To mitigate the impact, Japan’s beef producers and exporters should implement enhanced biosecurity measures across the entire supply chain, including stricter controls on cattle movements and more extensive vaccination programs. Additionally, to protect Japan’s beef trade reputation, it is essential to work closely with international partners to address the disease’s spread and limit future disruptions. Producers should also diversify export markets and strengthen internal demand strategies to maintain industry stability. Cooperation with global stakeholders to combat cross-border livestock diseases will be key to preventing further outbreaks and ensuring long-term market resilience.

Sources: Tridge, Agromeat, Milknews, MLA, Portal Do Agronegócio