1. Weekly News

Belgium

High Demand and Limited Supply Drive Grape Prices Up

Belgium’s grape market is facing high demand and elevated prices, with most grapes coming from Peru and small quantities coming from regions like South Africa and Namibia. Despite the price increases, demand remains strong due to the excellent quality, particularly the sizes and calibers of both white and red grapes from Peru. A recent storm disrupted supply chains, worsening the shortage, while Italy's season ended early, further depleting the market. With strong holiday demand and limited supply, prices are expected to remain high. Though more supply from Namibia and South Africa is anticipated, the market remains tight, and younger consumers continue to favor grapes over traditional fruits like apples and oranges.

Chile

Chilean Table Grape Exports to Rise by 2.2% YoY in 2024/25 Season

The Chilean Fruit Grape Committee projects a 2.2% year-on-year (YoY) increase in table grape exports for the 2024/25 season, reaching over 65.9 million 8.2-kilogram(kg) boxes. This slight revision from earlier forecasts highlights the industry's focus on new grape varieties, which are expected to account for 67% of total exports, up from 62% last season. The United States (US) remains the leading market. Exports to Latin America are projected to rise by 19% YoY. In contrast, export declines are expected in Asia and Europe. Promotional efforts targeting the US and Mexico aim to strengthen demand for early-season shipments.

Namibia

Namibia's 2024/25 Table Grape Exports to Exceed Last Season

Namibia is projected to export 9.3 million 4.5-kg cartons of table grapes in the 2024/25 season, slightly exceeding the 9.1 million 4.5-kg cartons shipped during the previous season. However, a South African exporter involved in Namibian fruit exports highlighted a decline in red grape varieties this season.

Spain

Spain Faces Grape Shortages and Price Surge During Key Sales Period Due to Supply Delays

Spain faced severe grape shortages in Nov-24, which disrupted the critical New Year's Eve campaign. Shipment delays from Peru and Brazil led to a sharp drop in available volumes. These delays were caused by high demand in Europe and North America and harvest and transport challenges. This led to high prices and stock management issues for importers during a key sales period. While additional supply is expected soon, prices are predicted to stay elevated. Meanwhile, the United Kingdom (UK) sourced Namibian grapes via airfreight, and South Africa's early season with high prices added further strain to European markets.

South Africa

South Africa Projects Growth for 2024/25 Table Grape Season

The 2024/25 South African table grape season has started with an anticipated 1% YoY rise in export volumes and a projected crop of 76.4 million 4.5-kg cartons, reflecting a 6% increase over the five-year average. Despite a slow start, with 29% fewer cartons shipped by W48 than last year, growers expect high-quality fruit driven by new grape varieties. The UK and European Union (EU) remain priority markets, accounting for 77% of exports in the previous season. While challenges like rising costs, logistics issues, and climate variability persist, efforts to enhance efficiency and communication with stakeholders are progressing. South Africa also targets Southeast Asia, the US, and Canada to diversify its export destinations.

2. Weekly Pricing

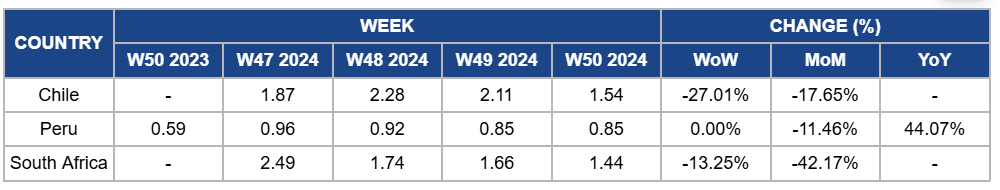

Weekly Grape Pricing Important Exporters (USD/kg)

Yearly Change in Grape Pricing Important Exporters (W50 2023 to W50 2024)

Chile

In Chile, grape prices dropped significantly by 27.01% week-on-week (WoW) to USD 1.54/kg, reflecting a 17.65% month-on-month (MoM) decrease in W50 due to lower export prices driven by reduced demand in primary markets such as Asia and Europe. Despite the increase in total export volumes projected for the 2024/25 season, especially in the US and Latin America, the price drop is due to intensified competition, particularly in the early-season shipments. The shift toward new grape varieties, which now account for a larger share of exports, has also contributed to the price reduction as the market adjusts to these changes.

Peru

Peru's grape prices remained steady at USD 0.85/kg in W50, with an 11.46% MoM drop due to logistical delays that impacted the ability to meet rising demand in key markets. These delays were especially notable during peak shipping periods and limited the timely availability of grapes. However, YoY prices increased by 44.07% due to stronger export demand, particularly from the US and Europe, along with continued growth in Peru's grape production, which helped maintain overall price support despite the logistical challenges.

South Africa

Grape prices in South Africa fell significantly by 13.25% WoW to USD 1.44/kg in W50, with a more pronounced decrease of 42.17% MoM due to the slower start to the 2024/25 season, with 29% fewer cartons shipped by W48 compared to last year. Despite expectations for high-quality fruit, logistical challenges and rising production costs have led to a backlog in shipments, resulting in a temporary surplus of grapes in local markets. Additionally, the seasonal dip in demand and the competition from other export regions further pressured prices in the short term. However, the longer-term outlook remains positive, focusing on high-quality fruit and introducing new grape varieties.

3. Actionable Recommendations

Improve Supply Chain Flexibility for Grape Importers

Grape importers in Spain should focus on diversifying their sourcing channels and enhancing supply chain flexibility to avoid disruptions during peak sales like New Year's Eve. Strengthening relationships with multiple suppliers, including from regions like Namibia and South Africa, will reduce dependency on any single source. Additionally, implementing more efficient stock management and forecasting strategies will help mitigate pricing volatility and ensure adequate supply even during high-demand seasons. These steps will improve market stability and provide a steady supply of grapes during critical periods.

Focus on Targeted Export Strategies for Grapes

Chilean grape exporters should prioritize strengthening their presence in the US and Mexico markets by intensifying promotional efforts, especially for early-season shipments. With the increasing share of new grape varieties in exports, tailored marketing campaigns should highlight the unique qualities of these varieties to attract consumer interest. At the same time, diversifying export destinations and exploring new opportunities in Latin American markets will help offset the expected decline in exports to Asia and Europe. These steps will ensure stable demand and optimize export volume growth in the 2024/25 season.

Optimize Grape Supply Chain and Promotions in Belgium

Grape importers in Belgium should focus on securing more consistent supply from South Africa and Namibia to complement imports from Peru, ensuring a more stable market amidst disruptions. In addition, retailers should leverage strong holiday demand by intensifying promotional campaigns, emphasizing the high quality and large calibers of the grapes. This strategy will help maintain consumer interest and mitigate the impact of the tight market. Importers and retailers should also explore partnerships with local logistics providers to streamline supply chains, minimizing delays caused by storms and other disruptions.

Sources: Tridge, Freshfruit, Freshplaza, MXfruit, Portalfruticola, USDA