In W16 in the sugar landscape, some of the most relevant trends included:

- Brazil’s sugar output fell 3.4% YoY due to drought and wildfires, yet prices rose 2.08% WoW in W16 amid tightening supplies. Ethanol output grew, but sugar exports stayed stable, reinforcing Brazil’s global dominance.

- India’s sugar production plunged 18% YoY, driven by declines in Maharashtra, Uttar Pradesh, and Karnataka. Ethanol diversion reached 3.5 mmt, intensifying domestic supply constraints and limiting export potential.

- In Australia, production is forecast to drop to a decade low of 3.8 mmt, but raw sugar exports are set to rise due to strong domestic and regional demand, indicating resilient trade flows despite harvest challenges.

- The Dominican Republic and El Salvador expect higher sugar outputs for 2025/26, supported by favorable rainfall, irrigation investments, and rising exports to China and the US, reflecting regional production recovery.

- Russia’s sugar beet sowing is progressing well, driven by favorable weather and hybrid seed adoption. However, Ukraine faces delays from cold snaps, reducing planting progress and risking future yield.

1. Weekly News

Global

Mixed Global Sugar Outlook for 2025/26 as Australia’s Production Declines and El Salvador Expands Exports

According to the United States Department of Agriculture's (USDA) Foreign Agricultural Service (FAS) reports, global sugar production shows mixed trends across key producing countries. In Australia, sugar output for 2025/26 is forecast to decline to 3.8 million metric tons (mmt), the lowest in over a decade, due to wet harvest conditions and reduced cane growth. Despite this, raw sugar exports are expected to rise to 3.1 mmt in 2025/26. Domestic consumption, at 20% as of W16, is expected to grow with Australia's population. The Dominican Republic is projected to produce 600,000 metric tons (mt) of sugar in 2025/26, aided by favorable rainfall and the lifting of United States (US) import restrictions on Central Romana. In El Salvador, production is forecast to grow to 740,000 mt, driven by irrigation and processing upgrades, with exports expected to rise 19% amid strong Chinese demand and extended duty exemptions.

Brazil

Brazil's 2023/24 Sugarcane Output Declined 5.1% YoY

Brazil's 2023/24 sugarcane harvest reached 676 mmt, the second-highest volume on record but down 5.1% year-on-year (YoY) due to drought, high temperatures, and field burning, according to the National Supply Company (CONAB). Sugar production declined by 3.4% to 44.118 mmt, while exports remained stable at 35 mmt, maintaining Brazil's position as the world's top sugar supplier. Ethanol production rose 4.4% to 37.2 billion liters (L), driven mainly by increased corn-based output. However, ethanol exports fell 31% to 1.7 billion L.

India

India's 2024/25 Sugar Output Falls 18% YoY to 25.49 MMT Amid State Declines and Higher Ethanol Diversion

India’s sugar production for the 2024/25 season has declined to 25.49 mmt as of mid-Apr-25, marking an 18% YoY decrease, according to the Indian Sugar Bio-Energy and Manufacturers Association (ISMA). Lower output in the top-producing states drove the drop, with Maharashtra down to 8.07 mmt, Uttar Pradesh at 9.11 mmt, and Karnataka at 4.04 mmt. Of 534 mills, only 38 remain operational. ISMA also reported that approximately 3.5 mmt of sugar are expected to be diverted for ethanol production, up from 2.15 mmt last year.

Russia

Russia Advances Sugar Beet Sowing in 2025

As of mid-Apr-25, sugar beet sowing in Russia is progressing steadily, with over 366,000 hectares (ha) sown, around 30% of the planned 1.17 million ha. The Southern and North Caucasian Federal Districts are leading the effort, with the Southern District already surpassing its forecast by 6%, reaching 241,000 ha. Krasnodar Krai has completed sowing across all 205,000 planned ha. Voronezh and Tambov Oblasts follow with 130,000 ha each. Favorable weather, early readiness, and increased use of domestic hybrids, an increase of 18.2% YoY, compared to 3% in 2024, have supported progress. The Russian Ministry of Agriculture anticipates a modest annual expansion of the total sown area by 4,000 ha.

Ukraine

Weather Delays Sugar Beet Sowing in Ukraine's Vinnytsia Region with Planting Rates Halved

Weather conditions in Ukraine's Vinnytsia region have significantly delayed sugar beet sowing, with planting rates more than halved compared to last year. As of April 11, sugar beet was sown on 18,400 ha, 28% of the forecast, compared to 42,000 ha 70% at the same time in 2024. The delays are attributed to adverse weather conditions and a sudden cold snap.

2. Weekly Pricing

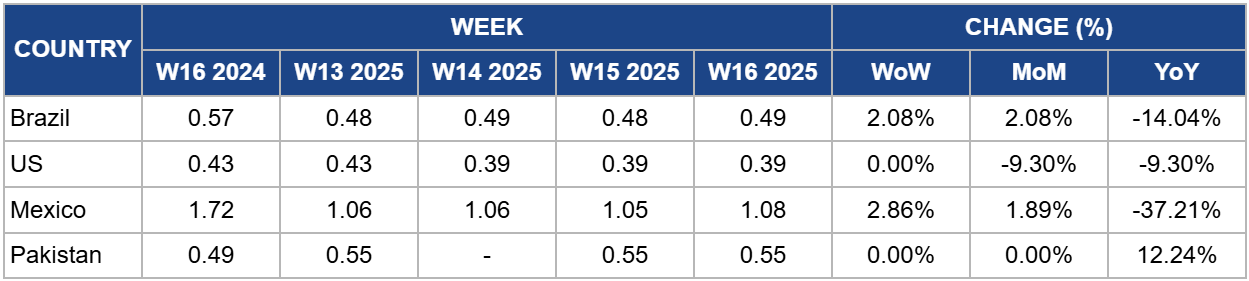

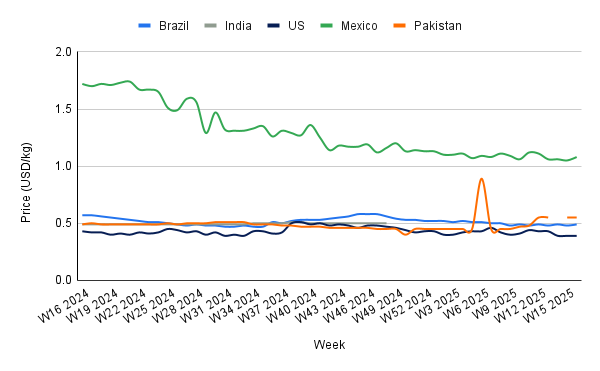

Weekly Sugar Pricing Important Producers (USD/kg)

Yearly Change in Sugar Pricing Important Producers (W16 2024 to W16 2025)

Brazil

Brazil's sugar prices rose to USD 0.49 per kilogram (kg) in W16, reflecting a 2.08% increase both week-on-week (WoW) and month-on-month (MoM). This upward movement is closely linked to tightening supply. According to the Brazilian Sugarcane Industry Association (UNICA), cumulative sugar output in Brazil's Center-South region, the country's key producing area, fell 5.3% YoY through Mar-25, totaling 40.169 mmt. Conab further forecasted a 3.4% decline in national sugar production for the 2024/25 season to 44.118 mmt, citing reduced sugarcane yields caused by prolonged drought and excessive heat. Notably, wildfires in São Paulo, the top-producing state, may have destroyed up to 5 mmt of sugarcane. The combination of crop damage, yield pressure, and constrained supply is likely to support firm or rising sugar prices in the short term. If adverse weather conditions persist or recovery is slow, elevated price levels may extend into the next marketing cycle, particularly amid steady global demand.

United States

In W16, US sugar prices held steady at USD 0.39/kg, showing no weekly movement but reflecting a 9.3% decline MoM and YoY from USD 0.43/kg. The drop in prices coincides with regulatory changes in US import policy. The US has temporarily suspended a planned 17% tariff on sugar imports, opting instead for a reduced 10% rate in addition to the existing USD 0.146 per pound (lb) quota tariff. This suspension is set to remain in effect until July 9, 2025, after which future tariff levels remain uncertain.

Furthermore, the Philippines, holding a 143,000 mt quota share, plans to export 66,235 mt of raw sugar to the US in two shipments by Jun-25, aiming to land deliveries before the tariff policy potentially changes. The temporary tariff reduction may support the US sugar supply in the near term and exert continued downward pressure on domestic prices. However, uncertainty beyond Jul-25 and broader trade policy risks could reintroduce price volatility later in the year.

Mexico

Mexico's sugar prices rose to USD 1.08/kg in W16, reflecting a 2.86% WoW increase but remaining 37.21% lower YoY. The recent price uptick aligns with improved harvest progress and ongoing efforts to fulfill sugar export commitments for the 2024/25 cycle. According to the National Union of Sugarcane Growers (CNPR), 76% of the estimated 543,237 mt slated for export has been shipped, with several processors nearing full compliance.

However, overall sugar extraction remains lower than expected, with only 71% at 3.62 mmt of the projected 5 mmt completed, due to reduced yields and delayed harvests. Despite this, the CNPR anticipates a clearer picture by May-25, which may influence future pricing. While tariff threats from the US persist, the sugar sector currently avoids the direct competition affecting other Mexican agricultural exports, such as tomatoes. Continued export efforts, tight domestic supply, and external trade uncertainty may support higher domestic sugar prices. However, weak extraction rates and broader market volatility could temper gains or result in further fluctuations depending on harvest outcomes and US trade policy developments.

Pakistan

In W16, Pakistan's sugar prices remained stable at USD 0.55/kg, with no WoW change but up 12.24% YoY, reflecting upward cost pressures despite stagnant short-term dynamics. The price increase aligns with structural inefficiencies and environmental strains tied to sugarcane cultivation.

Sugarcane remains a heavily water-intensive and inefficient crop in Pakistan, consuming 18 million acre-feet (MAF) annually, 17% of national water resources, despite low sucrose yields and outdated irrigation. Refining inefficiencies add to this burden, using 1.75 cubic meter (m³) of water/kg of sugar. While current sugar prices are stable, long-term cost pressures may rise due to water scarcity, declining productivity, and potential subsidy reforms. Without structural changes, Pakistan's sugar sector faces mounting sustainability and pricing risks.

3. Actionable Recommendations

Diversify Import Sources to Hedge Against Production Volatility

Amid forecasted declines in sugar output from major producers like Brazil, India, and Australia due to drought, heat stress, and weather disruptions, buyers in the US and other importing markets should diversify sourcing across emerging suppliers such as El Salvador and the Dominican Republic. With El Salvador boosting exports by 19% on the back of infrastructure upgrades and the Dominican Republic benefiting from favorable rainfall and relaxed US import restrictions, importers should explore forward contracts and supplier partnerships in these regions to mitigate supply risks and stabilize procurement costs.

Capitalize on Temporary US Tariff Reductions Before Jul-25

With the US temporarily reducing sugar import tariffs until July 9, 2025, traders and processors should expedite shipments and finalize supply agreements to capitalize on short-term cost advantages. Importers from countries such as the Philippines and the Dominican Republic, already planning pre-Jul-25 deliveries, can benefit from favorable pricing conditions before potential regulatory reversals later in the year. Strategic scheduling of imports ahead of this deadline may help buffer against future price increases driven by reinstated tariffs and broader global supply constraints.

Sources: Tridge, Spec Agro, The Economic Times, Hellenic Shipping News, Agravery, Infobae, Nasdaq, Digicast, La Jornada