In W19 in the soybean oil landscape, some of the most relevant trends included:

- Brazil's soybean oil exports are projected to decline by 16% in 2024/25 to 1.3 mmt, despite a record soybean harvest, as rising domestic biodiesel demand continues to divert supply away from exports.

- In the US, soybean oil prices softened due to export uncertainty tied to trade tensions with China and policy ambiguity, though renewable diesel demand continues to support the domestic market.

- The Netherlands experienced a price drop amid market corrections and geopolitical risk, with the EU’s approval of retaliatory tariffs on US agricultural products threatening to disrupt transatlantic trade flows and increase market volatility.

1. Weekly News

Brazil

Rising Biodiesel Demand in Brazil to Curb Soybean Oil Exports Despite Record Harvest

Brazil's soybean oil exports are projected to decline by 16% in 2024/25 to 1.3 million metric tons (mmt), according to the United States Department of Agriculture (USDA), despite a record soybean harvest and increased crushing. The reduction is driven by rising domestic biodiesel production, which continues to outpace soybean oil supply, even after the government maintained the biodiesel blend rate at 14%.

Global vegetable oil markets are experiencing tightening supply, as slower palm oil output in Southeast Asia and higher biodiesel use in Indonesia reduce export availability. While this has supported global vegetable oil prices in early 2025, a strong Argentinian soybean crop and crush may temper further increases. Overall, Brazil's growing biodiesel sector is expected to limit soybean oil export volumes despite strong production fundamentals.

India

India Shifts Toward Soybean Oil as Palm Oil Imports Fall Sharply in Apr-25

In Apr-25, India's edible oil imports declined by 11% to 865,000 metric tons (mt), driven by a sharp 24% drop in palm oil purchases due to high prices. However, soybean oil imports rose by 2% to 363,000 mt as buyers favored its relative affordability. Despite recent downward pressure on prices, soybean oil remains competitively positioned. May delivery quotes are at USD 1,065.65/t free-on-board (FOB) Brazil, and USD 1,157.63/mt FOB European Union (EU), down over USD 65/mt since late Apr-25.

2. Weekly Pricing

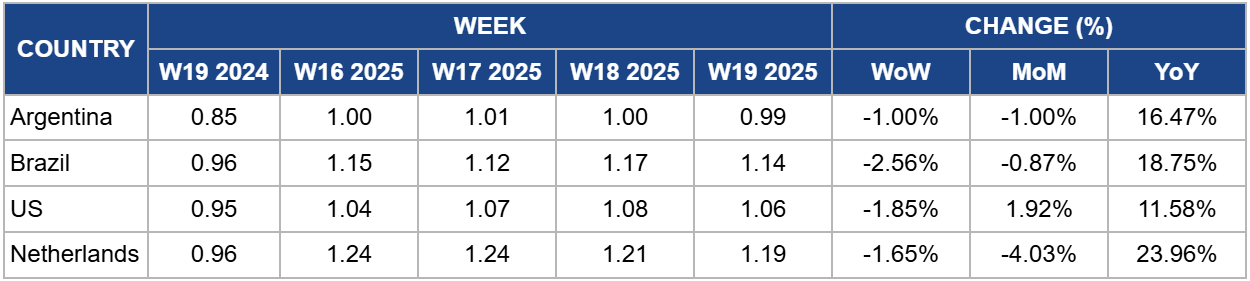

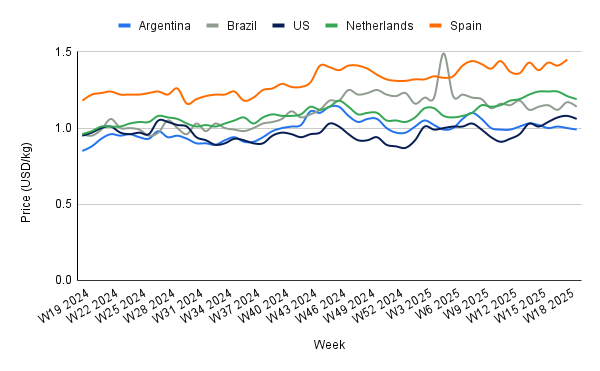

Weekly Soybean Oil Pricing Important Exporters (USD/kg)

Yearly Change in Soybean Oil Pricing Important Exporters (W19 2024 to W19 2025)

Argentina

Argentina's soybean oil price declined slightly to USD 0.99 per kilogram (kg) in W19, a decline of 1% week-on-week (WoW) but still up 16.47% year-on-year (YoY). This modest price correction reflects seasonal harvest pressures and persistent logistical challenges that continue to limit crushing activity and export flows. Further compounding these pressures, heavy rains and high humidity across Argentina's grain belt have halted harvest progress, which is now 9% behind last season, with only 25% of the area harvested. According to meteorological experts, rainfall between 30 to 50 millimeters (mm) has increased the risk of crop damage and fungal infections, raising concerns over oil yield and quality. Although harvest activity may resume by the end of W19, any prolonged delays could tighten domestic supply and exert upward pressure on soybean oil prices in the coming weeks.

Brazil

In W19, Brazil's wholesale soybean oil price fell to USD 1.14/kg, a decline of 2.56% WoW, though still 18.75% higher YoY. The weekly decline reflects localized supply pressure amid strong crushing activity following a record soybean harvest. However, the yearly gain highlights continued market support from firm global demand and tightening export availability. According to the USDA, Brazil's soybean oil exports are expected to drop by 16% in the 2024/25 season to 1.3 mmt, largely due to increased domestic biodiesel production. While the biodiesel blend rate remains at 14%, industrial demand continues to outpace soybean oil supply, redirecting volumes away from the export market.

United States

In W19, the United States (US) soybean oil prices declined to USD 1.06/kg, down 1.85% WoW but still up 11.58% YoY. The recent decrease reflects near-term market adjustments amid tightening export prospects and policy uncertainty. Trade tensions with China, including unresolved tariffs and limited diplomatic progress, continue to pressure US soybean oil exports. This has left the export outlook fragile and contributed to the recent price softening. However, the domestic biofuel sector, particularly growing renewable diesel demand, remains a critical support for prices, absorbing a substantial share of soybean oil production.

Netherlands

Soybean oil prices in the Netherlands declined to USD 1.19/kg in W19, experiencing a drop of 1.65% WoW but up 23.96% YoY. The weekly drop reflects short-term market adjustments amid persistent supply uncertainties and geopolitical risks, while the strong YoY gain underscores elevated import costs and tight global fundamentals. As a major import and distribution hub for the EU, the Netherlands is particularly exposed to shifts in global trade flows. The EU's recent approval of retaliatory tariffs on US agricultural products, including soybeans, poses a potential risk to transatlantic trade. Any reduction in US soybean shipments could tighten supply for EU crushers, strain processing margins, and lead to further price volatility.

3. Actionable Recommendations

Secure Forward Contracts with Argentina to Hedge Against Climatic Disruptions and Export Constraints

Given Argentina's logistical bottlenecks and delayed harvest, at 9% behind last season as of W19, importers and processors in Asia, the EU, and the Middle East and North Africa (MENA) should prioritize forward contracts with Argentinian suppliers while prices remain temporarily subdued. With rising humidity and fungal risks threatening oil yields, supply disruptions are likely in the near term. Locking in volumes now mitigates the risk of reduced availability and price surges later in the season, particularly as global vegetable oil supply tightens due to lower palm oil exports and redirection of Brazilian soybean oil toward biodiesel.

Expand Procurement from the US Before Domestic Renewable Diesel Demand Tightens Supply

Despite short-term price declines and export uncertainty linked to trade tensions with China and EU tariffs, US soybean oil remains competitively priced at USD 1.06/kg. Importers should take advantage of this price window to secure volumes before rising domestic renewable diesel demand absorbs additional supply. Processors in the EU and Asia should also monitor US policy developments and consider diversifying away from reliance on US volumes, as retaliatory tariffs and biofuel-driven domestic use may constrain exports in the medium term.

Sources: Tridge, Oils & Fats International, Ukr AgroConsult, Successful Farming