In W23 in the banana landscape, some of the most relevant trends included:

- Banana export revenue in Belize declined from USD 9.2 million in Apr-24 to USD 7.8 million in Apr-25. This contributed to a broader 21.9% drop in local export revenue despite a strong monthly performance.

- Cameroon’s banana exports grew in 2025 with new entrant CDBM exporting 5.9 thousand mt.

- In Colombia, ongoing roadblocks in the Zona Bananera region are severely disrupting banana exports, raising costs and threatening quality. These challenges have prompted urgent appeals from the industry for government intervention.

- Banana exports in Costa Rica fell 1.1% in 2024 and are projected to decline another 5% in 2025. The country maintains steady acreage while facing rainfall variability, price pressure, and disease threats.

1. Weekly News

Belize

Belize’s Banana Export Revenue Falls Despite Strong Monthly Volumes

Despite achieving its highest monthly export total so far in 2025 at USD 44.5 million, Belize saw a year-on-year (YoY) decline in banana export revenues, dropping from USD 9.2 million in April 2024 to USD 7.8 million in Apr-25. This contributed significantly to a broader 21.9% contraction in local export revenue, largely driven by weaker performance in key agricultural industries. While citrus exports showed recovery, rising from USD 4.4 million to USD 8.1 million between Jan-25 and Apr-25, the banana industry's downturn weighed on overall export earnings, highlighting ongoing volatility in Belize’s agricultural trade.

Cameroon

Cameroon Banana Exports Rise as New Competitor Gains Ground

Cameroon’s banana industry has seen notable shifts in 2025. New entrant Compagnie des bananes de Mondoni (CDBM) has emerged as a major force after exporting 5.9 thousand metric tons (mt) between Jan-25 and Apr-25, outpacing long-established exporter Boh Plantations PLC. A subsidiary of France’s Compagnie fruitière de Marseille, CDBM has quickly become the country’s third-largest exporter, further consolidating the group’s dominant 70% to 80% share of national banana exports through CDBM and Plantations du Haut Penja (PHP). Support from the European Union’s (EU) Economic Partnership Agreements (EPAs), particularly duty-free access, has strengthened Cameroon's position in Europe and the United Kingdom (UK). The UK continues to absorb 13% of exports despite Brexit, reinforcing the crop’s role in sustaining rural jobs and export earnings.

Colombia

Roadblocks Hit Colombian Banana Exports in Key Growing Region

In Colombia, banana exports from the key Zona Bananera region are under significant threat due to ongoing roadblocks on the Troncal de Oriente highway. These blockages are disrupting transportation and causing fruit quality to deteriorate. The protests, now entering their third day, are driven by longstanding frustrations over poor infrastructure and lack of public services in nearby villages of the Sierra Nevada de Santa Marta. As export logistics grind to a halt, production costs are rising, job security is at risk, and Colombia’s global competitiveness in bananas is eroding. The Magdalena and La Guajira Banana Growers Association (ASBAMA) has urgently appealed to authorities to restore order. They stressed the critical need to resume the flow of goods and labor to avoid long-term damage.

Costa Rica

Costa Rica Focuses on Banana Industry Resilience as Export Decline and Disease Threats Mount

Costa Rica continues to prioritize productivity over expansion in its banana industry, which has maintained a steady 42 thousand hectares (ha) of cultivated land for over 15 years. In 2024, exports declined slightly by 1.1% to 125.5 million boxes due to uneven rainfall, with a further 5% drop anticipated in 2025. Nonetheless, global demand remains stable, supporting European prices at around USD 18 per box, USD 1 higher than the previous year. Costa Rica remains a key supplier to the EU, the United States (US), the UK, and Middle Eastern markets, even as it faces pricing pressure from supermarkets, stricter sustainability demands, and threats like Fusarium oxysporum f. sp. cubense Tropical Race 4 (Foc Tr4). With 42 thousand direct and nearly 100 thousand indirect jobs, mainly in Huétar Caribe, the industry continues to emphasize cross-sector collaboration, investment in disease control, and long-term sustainability.

Panama

Strike Cripples Panama’s Banana Exports and Threatens Industry Stability

Panama’s banana exports have been severely disrupted by an ongoing strike. This follows Chiquita’s suspension of operations and the dismissal of 4.5 thousand workers, sparking unrest and logistical delays. Although the strike was declared illegal by a judge, continued protests and intermittent road blockades are hindering shipments to key markets in Europe and the US. The strike has escalated into a broader crisis affecting local supply chains, while uncertainty over worker compensation and legal disputes has created instability across the industry. Exporters are increasingly concerned about Panama’s reputation as a reliable supplier, with the long-term viability of its banana industry now in question.

2. Weekly Pricing

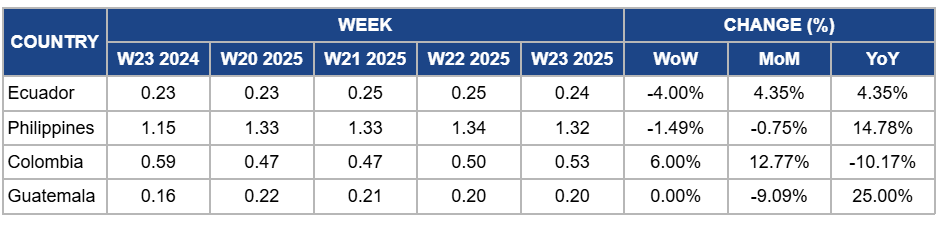

Weekly Banana Pricing Important Exporters (USD/kg)

Yearly Change in Banana Pricing Important Exporters (W23 2024 to W23 2025)

Ecuador

In W23, Ecuador's banana prices fell by 4% week-on-week (WoW) to USD 0.24 per kilogram (kg), driven by a seasonal slowdown in harvest that temporarily eased supply to local markets. However, both month-on-month (MoM) and YoY prices rose by 4.35%, supported by stronger international demand, particularly from the EU and Russia, and Ecuador’s new minimum support price per box and improved export logistics following container shortages

Philippines

Philippine banana prices dropped slightly by 1.49% WoW to USD 1.32/kg in W23, with a 0.75% MoM decline due to increased supply from peak harvest season and reduced buying interest in some Asian markets amid high competition from Ecuador and Vietnam. However, YoY prices surged by 14.78% due to lower production levels in 2024 caused by adverse weather conditions and disease pressure, which had previously tightened supply and pushed prices higher.

Colombia

In Colombia, banana prices increased by 6% WoW to USD 0.53/kg in W23, reflecting a 12.77% MoM surge due to a rebound in export demand, particularly from the US and Europe, driven by improved seasonal consumption patterns and restocking by international buyers. This was supported by favorable weather and smoother logistics, which reduced previous supply chain constraints. However, prices dropped by 10.17% YoY owing to a modest crop contraction in 2024 caused by excessive rainfall and disease pressure, including Black Sigatoka, which limited export volumes and contributed to a more cautious pricing environment despite overall growth in export revenues.

Guatemala

Banana prices in Guatemala held steady WoW at USD 0.20/kg in W23, reflecting a strong 25% YoY increase due to significant production disruptions caused by La Niña–driven dry weather and early-season rain, which slowed harvesting and constrained output than last year. However, MoM prices dropped by 9.09%, primarily because of a temporary oversupply in the low-production season, shipments picked up as harvests normalized following logistic constraints, while export demand briefly softened, easing short-term pricing pressure.

3. Actionable Recommendations

Secure Alternative Logistics and Diversify Market Access

Banana producers should proactively secure alternative logistics routes and diversify market access to protect exports during disruptions. Exporters in Panama, Ecuador, the Philippines, and Colombia can collaborate with independent freight operators, reroute shipments through less affected ports, and use multimodal transport options to avoid delays. At the same time, growers should reduce reliance on a few major buyers by exploring regional markets, such as the Middle East or Eastern Europe, and negotiating flexible contracts that redirect volumes during crises.

Implement On-Farm Cold Chain and Flexible Shipping Plans

Banana producers should invest in on-farm cold storage and develop flexible shipping schedules to preserve fruit quality during transit disruptions. Growers in Colombia, Ecuador, and beyond can install pre-cooling units and mobile cold storage to extend shelf life when road access is blocked. Exporters should also establish agreements with multiple transport providers and secondary port options to reroute shipments quickly. For example, producers can shift from overland to rail or use smaller regional ports to avoid chokepoints and minimize delays.

Enhance Disease Monitoring and Weather-Responsive Farming

Banana producers should strengthen field-level disease surveillance and adjust agronomic practices to respond quickly to weather fluctuations. Growers in Colombia, the Philippines, and West Africa can implement routine scouting for Black Sigatoka and use predictive weather tools to time fungicide applications more precisely. For example, producers can adopt leaf wetness sensors and disease forecasting models to optimize spraying schedules and reduce losses. Additionally, shifting to raised beds or improving drainage in flood-prone plots can mitigate damage from excessive rainfall, helping stabilize yields and pricing across fluctuating seasons.

Sources: Tridge, BBN, Business in Cameroon, Corbana, Freshplaza, Fruitnet, Itfnet