1. Weekly News

Global

Global Sunflower Seed Exports Forecasted to Reach Nine-Year Low in 2024/25

According to information and analytical platform APK-Inform, global sunflower seed exports in the 2024/25 season are expected to hit a nine-year low, reaching 2.36 million metric tons (mmt) – down from 2.69 mmt in the 2023/24 season due to reduced sunflower seed production. The European Union (EU) export is forecasted to drop from 460 thousand metric tons (mt) in the 2023/24 season to 330 thousand mt in the 2024/25 season. The reduced production will likely impact processing plants in the EU. In addition, analysts from independent global market analyses and forecasts company Oil World predict that the EU's sunflower seed processing in the 2024/25 season will decrease by 0.4 mmt to 8.8 mmt.

India

India Increased Import Tax on Edible Oils to Protect Local Farmers

On September 13, 2024, India declared a 20% increase in the basic import tax on crude and refined edible oils, effective September 14, 2024, to support domestic oilseed farmers. This change is anticipated to raise local edible oil prices, lower demand, and reduce palm, soy, and sunflower oil imports. With the Agriculture Infrastructure and Development Cess (AIDC) included, the total import tax on crude soybean, palm, and sunflower oils rose from 5.5% to 27.5%. In addition, the import tax for refined palm, soybean, and sunflower oils increased to 35.75% from 13.75%.

Türkiye

Türkiye’s Sunflower Production Expected to Decline in 2024

Due to drought and low yield, Türkiye’s sunflower seed production is expected to drop from 1.6 mmt in 2023 to 1 mmt to 1.2 mmt in 2024. Turkey’s annual sunflower requirement is 3 mmt. The shortfall will be covered by imports, leading to a foreign currency loss. The general manager of the Black Sea Oil Seeds Agricultural Sales Cooperatives Association (KARADENİZ BİRLİK) suggests that the country should provide more support to assist the farmers.

Ukraine

Ukraine’s Sunflower Seed Processing Increased 9% YoY in the 2023/24 Season

Ukraine’s sunflower seed processing increased by 9% year-on-year (YoY) to 15 mmt in the 2023/24 season due to a bumper harvest and carry-over stocks from the previous year. This marks the second-largest processing volume in history, following the 15.9 mmt in the 2019/20 season. The processing pace remained relatively high throughout the season but started to decline in Jun-24 due to a significant shortage of sunflower supply. Consequently, some factories switched to processing rapeseed or began preventive repairs earlier due to difficulties purchasing raw materials.

In Aug-24, Ukraine processed 640 thousand mt of sunflower seeds, marking the lowest amount since Aug-22 and a 37% month-on-month (MoM) decrease. Due to limited supply, the sunflower processing increase in the new season may be slower than usual.

Bulgaria

Bulgaria’s Sunflower Seed Harvest Expected to Hit Lowest Level Since 2013

According to the United States Department of Agriculture (USDA), Bulgaria’s sunflower seed production for the 2024/25 season is projected to decrease by 5% YoY due to a hot and dry summer. The expected output of 1.78 mmt would be the lowest since 2013. Starting stocks for sunflower seeds are estimated to fall from 271 thousand mt in the 2023/24 season to 210 thousand mts. As a result, Bulgaria is likely to increase sunflower imports to meet domestic demand, though ongoing production challenges in the Black Sea region may complicate this.

2. Weekly Pricing

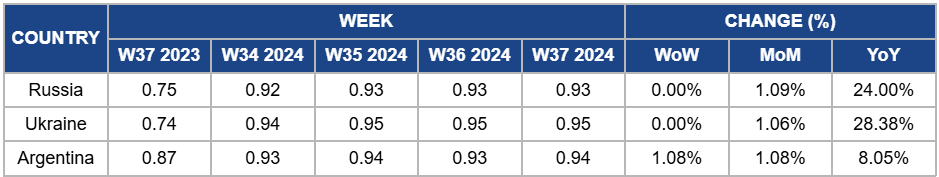

Weekly Sunflower Oil Pricing Top Producers (USD/kg)

Yearly Change in Sunflower Oil Pricing Top Producers (W37 2023 to W37 2024)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Russia

In W37, Russia’s sunflower oil prices remained unchanged week-on-week (WoW) at USD 0.93 per kilogram (kg). The MoM prices increased by 1.09% compared to USD 0.92 in W34. The YoY price increased 24% compared to USD 0.75/kg in W37 2023. Despite the weekly stability, the country’s sunflower oil prices have maintained an upward trend in recent months due to the shortage of sunflower seeds. Sunflower harvesting is currently underway in the south of the country, which was most affected by the prolonged drought. As a result, the yield indicators are still significantly lower than last year, putting pressure on sunflower seed and oil prices.

Ukraine

Sunflower oil prices in Ukraine remained unchanged at USD 0.95/kg in W37. The MoM and YoY prices increased by 1.06% and 28.38% respectively. Similar to Russia, Ukraine's sunflower seed prices remained elevated due to a supply shortage, which has constrained the country’s sunflower oil production. Farmers are holding back on sales, waiting for more favorable prices. Despite the current supply limitations, the forecast for the sunflower harvest in the 2024/25 season is not critically declining, and there are no indications of further price increases in the domestic market.

Argentina

In W37, Argentina’s sunflower oil prices increased by 1.08% WoW to USD 0.94/kg compared to USD 0.93/kg in W36. The MoM rose 1.08%, and the YoY price increased by 8.05%. The WoW price increase is due to global production challenges due to heat and drought, which has declined production forecasts in the black sea region, the EU, and Argentina. However, India’s decision to raise the import tax on edible oils, effective this month, will likely reduce export demand and the prices in Argentina.

3.Actionable Recommendations

Supporting Domestic Oilseed Farmers and Mitigating Import Tax Effects

With the increased import tax on edible oils, Indian vegetable oil processors and refineries should prioritize sourcing oilseeds from domestic farmers. Companies can collaborate with local agricultural organizations to improve oilseed production efficiency, offering incentives for sustainable farming practices. In addition, businesses should monitor international markets closely to adjust their pricing strategies and manage reduced import volumes.

Optimizing Sunflower Seed Sales and Inventory Management

As Ukraine's sunflower seed processing faces a slowdown due to a supply shortage, local farmers should carefully manage their inventories and sales strategies. Coordinating between farmers and processors to set favorable price agreements can help stabilize the market and prevent excessive production delays. Encouraging timely sales and strategic use of carry-over stocks will support consistent processing volumes throughout the season.

Monitoring Market Dynamics Amid Changing Export

Argentinian sunflower oil producers should monitor the impact of India’s increased import tax on global demand for sunflower oil. By diversifying export destinations, such as targeting countries with lower import restrictions, Argentina can mitigate the risks of declining Indian demand. Furthermore, processors should capitalize on the price increase caused by global production challenges, focusing on boosting production efficiency to remain competitive in international markets.

Sources: Tridge,Agrobusiness, Theprint, Sondakika, Seeds, Agroportal