W14 2025: Maize Weekly Update

In W14 in the maize landscape, some of the most relevant trends included:

- The progress of Argentina's corn harvest reached 13.6% in W14, with average yields of 8.27 mt/ha. Dry weather aided progress, but upcoming rains may slow harvests.

- Brazilian corn prices dropped by WoW due to weather affecting production, while Ukrainian prices fell due to reduced production and logistical disruptions.

- In contrast, US corn prices rose MoM due to weather challenges and increased demand, while Argentine prices increased MoM due to global supply shortages and strong export demand.

1. Weekly News

Argentina

Argentina Corn Harvest Progress Slows Amid Wetter Forecasts

As of W14, Argentina's corn harvest reached 13.6% nationally, with the core region 40 to 50% complete, while northern and southern areas saw minimal activity. Average yields rose to 8.27 metric tons (mt) per hectare (ha). Dry weather aided harvest progress, though recent rains and expected wetter conditions in the coming weeks may slow the harvest of corn and early soybeans.

Brazil

Brazil 2024/25 Soybean and Corn Crop Estimates Adjusted Due to Weather Conditions

Brazil's 2024/25 soybean crop estimate stood at 167.54 million metric tons (mmt), a slight downgrade from the previous forecast of 168.34 mmt, primarily due to unfavorable weather conditions in Rio Grande do Sul state. The first corn crop will reach 25.90 mmt, a decrease from the earlier estimate of 26.53 mmt, while the second crop is forecast at 101.62 mmt, down from 102.13 mmt.

South Africa

South Africa's 2025/26 Corn Production Up 2% YoY

South Africa’s agricultural outlook for 2025/26 is positive, with expected production increases for corn alongside modest consumption growth, according to the United States Department of Agriculture's (USDA) Foreign Agricultural Service (FAS). Corn production will rise by 2% year-on-year (YoY) to 16 mmt, with consumption reaching 12.6 mmt-continuing a 2% annual growth trend. Corn exports are also expected to increase nearly 25% to 1.9 mmt, driven by the larger harvest. Despite this growth, challenges such as policy uncertainty, poor infrastructure, and high unemployment remain potential risks to the long-term sustainability of the sector.

Ukraine

Ukraine's 2024/25 Corn Exports Decline by 14.8% YoY

As of April 2, Ukraine exported 32.9 mmt of grain and leguminous crops in the 2024/25 marketing year (MY), 9.5% less YoY. Ukrainian corn exports reached 17 mmt, representing a 14.8% YoY decline, or 2.53 mmt, compared to 2023/24 MY.

United States

US Corn Acreage Forecast Revised Up 5%, Stocks Declined 2% in Mar-25

In the USDA's Prospective Plantings report released on March 31, 2025, experts surprised the market by increasing the forecast for United States (US) corn acreage estimates. Corn planting will grow 5% YoY to 38.6 million ha. Meanwhile, the USDA’s Grain Stocks report showed that as of March 1, 2025, corn stocks declined 2% YoY to 207 mmt, aligning with market forecasts and reflecting strong domestic consumption and steady export demand.

2. Weekly Pricing

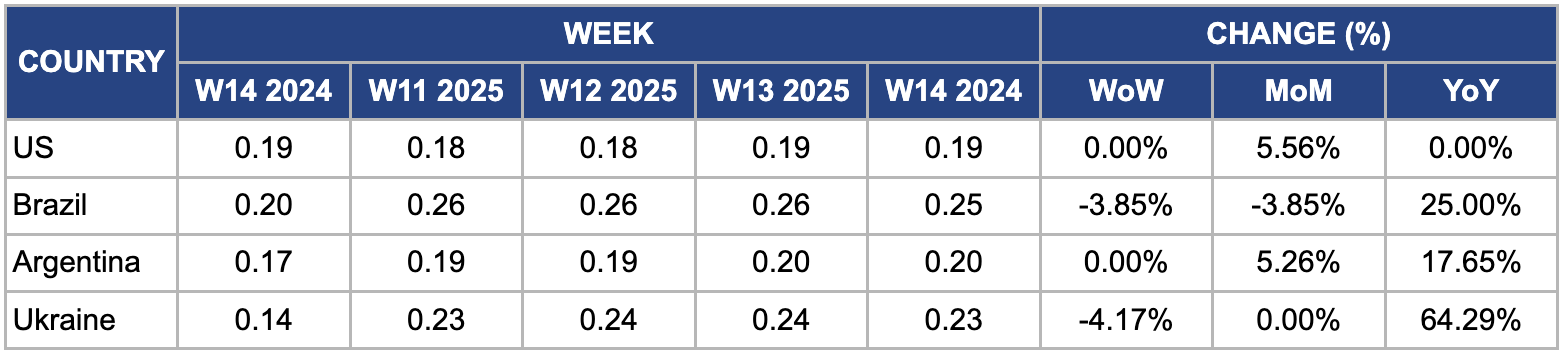

Weekly Maize Pricing Important Exporters (USD/kg)

Yearly Change in Maize Pricing Important Exporters (W14 2024 to W14 2025)

United States

In W14, US wholesale maize prices remained stable week-on-week (WoW) but saw a 5.56% increase month-on-month (MoM), reaching USD 0.19 per kilogram (kg). This price rise was due to weather challenges, such as persistent wet conditions and colder temperatures in key maize-growing regions, which delayed planting and reduced crop yields. Moreover, there was a surge in domestic demand, especially from processors and the biofuels sector. Export dynamics also contributed, with global demand and potential tariff impacts, especially from markets like China, potentially limiting the supply available for international trade.

Brazil

In W14, Brazil's wholesale maize prices decreased by 3.85% WoW and MoM, reaching USD 0.25/kg. Although dry weather negatively impacted the southern Safrinha corn, recent rainfall in key regions like Parana, São Paulo, Minas Gerais, Mato Grosso do Sul, and Goias benefited the crop. Additional rain is expected, which should help stabilize the southern Safrinha corn production. As of W14, 97% of the Safrinha corn was planted, with the planting window now effectively closed. The Mar-25 Crop Report from National Supply Company (CONAB) also reduced the Safrinha corn acreage by 90 thousand ha, bringing the total to 16.74 million ha.

Argentina

In W14, Argentine maize prices remained stable WoW but rose 5.26% MoM and 17.65% YoY to USD 0.20/kg. This price increase was due to global supply constraints caused by climate-related disruptions in major maize-producing regions, such as the US, Ukraine, and Brazil, which led to a market imbalance. As a result, Argentina experienced a surge in demand, particularly from Europe, Southeast Asia, and parts of Africa. The weaker Argentine peso also made exports more competitive, boosting international demand. Additionally, regional buyers in Latin America and the Middle East, who rely on Argentina as a key supplier, contributed to the price increase, further amplified by the global supply shortfall.

Ukraine

In W14, Ukrainian wholesale maize prices declined 4.17% WoW to USD 0.23/kg. Increased global competition, particularly from Brazil and Argentina, pressured prices as their maize exports surged and decreased Ukrainian maize prices. Additionally, reduced export demand from the European Union (EU), which lowered imports of Ukrainian maize from 21.1 mmt in 2023 to an expected 18 mmt in 2024, contributed to the price drop. Logistical challenges, including ongoing bottlenecks at Ukrainian export terminals and infrastructure issues, further hindered the efficient distribution of maize, exacerbating the supply constraints and reducing price.

3. Actionable Recommendations

Diversify Export Markets for Argentina and Brazil

To mitigate the impact of regional disruptions and capitalize on shifting global demand, Argentina and Brazil should consider diversifying their export markets beyond traditional buyers like the EU and Southeast Asia, targeting regions such as Africa (especially sub-Saharan countries) and the Middle East. With Argentina's competitive pricing due to the weak peso and Brazil's stable production, both countries could gain market share in these emerging regions where demand for corn is increasing. Expanding into diverse markets helps to reduce dependency on specific regions and stabilizes export revenues in the event of regional supply disruptions, such as the ongoing issues in Ukraine or political instability in major buyer countries.

Strengthen Infrastructure and Logistics in Ukraine

Ukraine should strengthen its agricultural infrastructure by investing in grain handling and logistics. This includes repairing and modernizing key transport routes, particularly those facilitating exports through the Black Sea. Furthermore, Ukraine could explore partnerships with global logistics firms to ensure smoother transit of corn and other grains to international markets. By improving the logistical flow of grains, Ukraine can reduce delays, mitigate price volatility, and improve its global competitiveness. Moreover, stabilizing infrastructure will help the country capitalize on its high corn production potential, especially if it can tap into growing demand from Middle Eastern and Asian markets.

Enhance Weather-Resilient Farming Practices in the US and Ukraine

The US and Ukraine should invest in weather-resilient farming practices, such as drought-resistant seed varieties, advanced irrigation systems, and precision agriculture technologies that monitor and adjust for variable weather conditions. Integrating climate-smart agriculture techniques can be supported by public-private partnerships, focusing on research and developing crop varieties that can withstand extreme weather. This will help stabilize yields, even during adverse weather events, reducing the risk of production shortfalls and price volatility. Furthermore, these innovations can improve the overall efficiency and sustainability of farming operations, enhancing long-term profitability and reducing dependency on weather patterns that can fluctuate unpredictably.

Sources: Tridge, UkrAgroConsult