W24 2024: Grape Weekly Update

1. Weekly News

Egypt

Mediterranean Table Grape Season Adaptation to Climate Change

The Mediterranean table grape season started about ten days earlier than last year in 2024 due to higher temperatures, heat waves, and changing rainfall patterns, which impacted harvest timing and quality. Grape growers in Egypt, Morocco, and Italy are adapting by shifting to more resilient grape varieties with shorter growing cycles, such as ARRA varieties. The quality of Egyptian grapes, known for their sustainability and short growing cycles, remains strong in the market. The new ARRA Honey Pop™ is starting to be available, and the first shipment of Grapa's Early Sweet™ from Egypt to Europe was in early May-24. Egyptian growers have expanded their market offerings by planting mid and late-season varieties, enhancing the potential for later ARRA red varieties like ARRA Fire Crunch™ and ARRA Cherry Crush™. Meanwhile, the Moroccan harvest of Early Sweet and ARRA Passion Fire™ is ongoing, and Italy began harvesting greenhouse-grown Sicilian ARRA Sugar Drop™ in mid-May, shifting the supply window earlier. Different Mediterranean growing regions are strategically positioned to optimize their supply windows, providing retailers with a consistent and wide-ranging selection of ARRA varieties.

Moldova

Moldova Enhances Fruit Exports with Focus on Grapes, Plums, and Cherries

Moldova is making significant strides in enhancing its fruit exports, particularly grapes, plums, and cherries. Moldova Fruct has launched a new export coaching program for producers and exporters of these fruits. As part of the program, 12 companies received guidance from experts on developing export marketing plans and conducting business with European buyers. Moldovan fresh fruit production has rapidly advanced, incorporating GlobalGap certification and other protocols to meet international standards.

Peru

Vanguard's Commercial Head Reveals Trends and Strategies for Peru's 2023/24 Table Grape Exports

The commercial head in Peru for Vanguard highlighted the primary trends, challenges, and opportunities for the 2023/24 Peruvian table grape export campaign. The season runs from August to March, with climate factors like high temperatures affecting production last year. Major markets include California and China, with Peruvian grapes seeing the highest prices in eight years, particularly in the northern zone. The demand for patented varieties such as Bloom Fresh and Sun World is increasing. Emphasis was placed on maintaining quality and condition to preserve commercial relationships with importers and supermarkets. The industry should focus on production and packaging efficiency and leverage the new Port of Chancay to enhance competitiveness. Social issues, such as strikes, must be considered for their market impact.

South Korea

Daejeon's Seedless Delaware Grapes Enter the Southeast Asian Market

The seedless grape variety Delaware, harvested in the Daejeon mountain area, has debuted in the Southeast Asian market. Daejeon City recently exported this 2024’s Delaware production to Malaysia and Cambodia using a public shipping method. These grapes, known for their soft flesh, high sugar content, and near-seedless nature, are shipped three months earlier than those from other regions due to advanced experience and technology. The export initiative aims to showcase the excellence of Daejeon grapes in Southeast Asia and expand their market presence.

2. Weekly Pricing

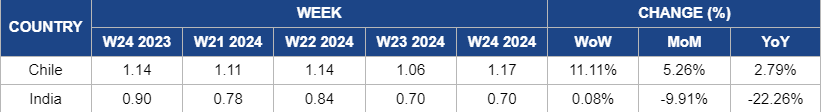

Weekly Grape Pricing Important Exporters (USD/kg)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), South Africa (White Seedless), and India (Green Grape)

Yearly Change in Grape Pricing Important Exporters (W24 2023 to W24 2024)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), South Africa (White Seedless), and India (Green Grape)

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data, or seasonality

Chile

Grape prices in Chile increased by 11.11% WoW to USD 1.17/kg in W24, compared to USD 1.06/kg in W23. Despite a 7.69% WoW decrease in W23, the prices rebounded in W24 due to factors like improved market demand and limited availability of high-quality grapes. Additionally, the off-season of grapes in Chile reduced overall supply, contributing to higher prices. The 2.79% YoY increase reflects a longer-term trend of rising prices, driven by ongoing market dynamics and challenges in the global grape industry.

India

In W24, grape prices in India remained stable at USD 0.70/kg, showing a 9.91% MoM decrease compared to May-24. The season was challenging due to the Red Sea crisis, which extended shipping times to Europe, leading to increased freight costs. Additionally, logistical issues affected the fruit's condition upon arrival, leading to mixed fruit conditions and higher labor costs for re-checking and re-packing. These challenges have left several shippers and exporters struggling financially, unable to recover their costs for the season.

3. Actionable Recommendations

Expanding Market Reach for Daejeon's Seedless Grapes

Daejeon should focus on enhancing the grape's reputation through targeted marketing campaigns in Southeast Asia to further capitalize on the success of Delaware grape exports. Collaborate with local distributors and retailers to increase visibility and availability in key markets. Additionally, continue to invest in technological advancements and agricultural practices that allow for early harvests, ensuring a competitive edge in the market.

Optimizing Mediterranean Grape Harvests with ARRA Varieties

To maximize the potential of Mediterranean grape harvests, growers should prioritize the cultivation of ARRA grape varieties known for their resilience and shorter growing cycles. Collaborate with breeders and research institutions to identify and adopt suitable ARRA varieties tailored to specific regional conditions. Implement sustainable farming practices to maintain grape quality and ensure market competitiveness. Additionally, strengthen partnerships with retailers and distributors to promote the wide-ranging selection of ARRA grapes and expand market reach.

Strategies for Peru's 2023/24 Table Grape Export Season

Peru's table grape industry should prioritize efficiency and quality to succeed in the 2023/24 export season. Invest in production technologies to combat climate challenges and exceptionally high temperatures. Focus on popular patented varieties like Bloom Fresh and Sun World to meet market demand. Improve packaging practices for optimal grape conditions upon arrival. Collaborate with stakeholders to mitigate social issues like strikes that could disrupt exports.

Source: Tridge, Freshplaza, MXfruit, Foodmate