W36 2024: Sunflower Oil Weekly Update

1. Weekly News

Global

Global Vegetable Oil Prices Rose 0.8% MoM in Aug-24

According to the Food and Agriculture Organization of the United Nations (FAO), vegetable oil prices rose by 0.8% month-on-month (MoM) in Aug-24. The price increase is due to the rise in global palm oil prices, which offset a decrease in soybean, sunflower, and rapeseed oil prices. Moreover, following consecutive increases, global sunflower and rapeseed oil prices declined MoM, mainly due to a slowdown in global demand and the seasonal rapeseed harvest pressure in Canada.

India

India's Cooking Oil Imports Dropped in Aug-24

India's cooking oil imports declined by 17% MoM to 1.53 million metric tons (mmt) in Aug-24. Sunflower oil imports dropped by 21% MoM to 288 thousand metric tons (mt) during this period, with Argentina, Brazil, Russia, and Ukraine emerging as the leading exporters. In contrast, soybean oil imports increased by 16% MoM to 456 thousand mt, reaching a two-year high. The rise in soybean oil demand is driven by increased rapeseed oil prices, prompting processors to blend more affordable soybean oil with rapeseed oil. In Jul-24, the country's vegetable oil imports exceeded domestic demand, reducing purchases in Aug-24. In addition, palm oil prices recently climbed to the same level as soybean oil, removing its price advantage.

Pakistan

Pakistan Promotes Domestic Edible Oil Production

The Pakistani government plans to plant 0.77 million hectares (ha) of sunflowers and 0.85 million ha of canola in the 2024/25 season to meet local edible oil demand and reduce dependence on imports. The government offers various incentives to encourage farmers to grow oil seeds and boost domestic edible oil production, such as providing financial subsidies and building agriculture research centers. In addition, the government allocated USD 2.88 million for the National OilSeed Development Program as part of its annual development agenda.

Ukraine

Ukraine's Sunflower Oil Prices Increased in Sep-24

Dry and warm weather in Ukraine sped up Ukraine's sunflower harvesting. As of September 5, 1.39 mmt of sunflower have already been harvested from 780.8 thousand ha of land, representing 16% of the cultivation area with a 1.78 mt/ha yield. Sunflower oil price with delivery to ports increased by USD 10/mt week-on-week (WoW) to USD 920/mt to USD 930/mt in W36, while the prices at the Ukraine-Poland border fell to USD 910/mt to USD915/mt. The increasing rapeseed supply in the European Union (EU) has significantly reduced the demand for Ukrainian sunflower oil from biodiesel producers, who actively imported it during the summer. Therefore, in Aug-24, the country's sunflower export decreased by 48% MoM to 227 thousand mt, marking the lowest since Jun-22.

2. Weekly Pricing

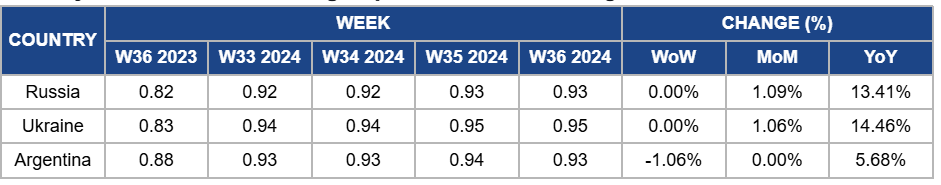

Weekly Sunflower Oil Pricing Top Producers (USD/kg)

Yearly Change in Sunflower Oil Pricing Top Producers (W36 2023 to W36 2024)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Russia

In W36, Russia's sunflower oil prices remained unchanged at USD 0.93 per kilogram (kg). The MoM prices increased by 1.09%, and the year-on-year (YoY) price increased by 13.41%. The price increase is due to rising sunflower seed costs driven by declined production in Ukraine. However, the sunflower oil demand has declined in recent months. High prices made sunflower oil less appealing to major buyers like India and China, who are now turning to more competitive soybean oil.

Ukraine

Sunflower oil prices in Ukraine stood at USD 0.95/kg in W36. The MoM and YoY prices increase by 1.06% and 14.46%, respectively. Due to heat and drought, Ukraine’s sunflower harvest faces challenges, leading to faster harvest and low oil content. In response, soybean oil prices have maintained an upward trend. Despite the price increase, the county’s sunflower oil exports have declined by 48% MoM in Aug-24 due to lower demand from the biofuel sector. As the rapeseed harvest in the EU starts, the demand for sunflower oil will likely decline further due to the high prices.

Argentina

In W36, Argentina’s sunflower oil prices decreased by 1.06% WoW to USD 0.93/kg compared to USD 0.94/kg in W35. The MoM remained unchanged, and the YoY price increased by 5.68%. Sunflower oil prices have been affected by intense competition from soybean and rapeseed oils, putting downward pressure on prices. In addition, the country’s sunflower crushing from Jan-24 to Jul-24 reached 2.35 mmt, marking the third-highest volume of the decade for the same period. The abundant supply has further contributed to the decline in prices.

3.Actionable Recommendations

Expand Market Opportunities

To counter declining demand from the biofuel sector, Ukrainian sunflower oil producers should explore new markets and alternative uses for their products, such as food-grade sunflower oil and non-food applications. Ukrainian exporters could also work on strengthening trade ties with non-EU countries, particularly in Asia and Africa, where demand for edible oils remains strong. Additionally, collaborating with international biofuel producers to adjust oil formulations could help maintain competitiveness in the biodiesel market.

Encourage Domestic Production Collaboration

Pakistan sunflower oil producers should collaborate with agricultural experts and industry stakeholders to enhance sunflower yields, reduce reliance on imports, and boost local edible oil production. The government should promote private sector-led initiatives, and industry-driven research can help increase production efficiency. Additionally, oil processors and producers can explore technological innovations to improve the processing of domestically grown oilseeds and optimize output.

Optimize Sunflower Crushing Capacity and Export Strategies

Argentine sunflower oil producers should optimize their crushing operations to improve yields and maintain competitive prices in the global market. Given the country's high sunflower-crushing volume, increasing the efficiency of production and transportation processes can help sustain low prices and attract more buyers. Exporters should focus on building stronger relationships with emerging markets, such as Africa and Southeast Asia, to offset decreased demand from traditional buyers like India.

Sources: Tridge, FAO, Sinor, UkrAgroConsult, GrainTrade