W41 2024: Mango Weekly Update

1. Weekly News

Egypt

Egypt's Mango Exports Lead Fruit Exports in W41

In W41, Egypt's mango exports led the country's fruit shipments with 12 thousand tons, followed by pomegranates at 9 thousand tons and strawberries at 4 thousand tons. A National Food Safety Authority report revealed that Egypt exported 32 thousand tons of 40 different fruit varieties. The General Administration Information Center also reported 3.7 thousand food shipments totaling 200 thousand tons, strengthening Egypt's position in the global agricultural market.

India

India Boosts Mango Exports with Radiation Processing for Global Market Access

India's mango export industry has effectively used radiation processing to meet international phytosanitary standards, enabling access to key markets like the United States (US). With a projected 3 thousand metric tons (mt) of exports in 2024, India's major mango-producing states are Andhra Pradesh, Uttar Pradesh, Karnataka, and Tamil Nadu. The Krishi Upaj Suraksha Kendra (KRUSHAK) irradiation facility in Maharashtra must ensure compliance and extend the fruit's shelf life. Since resuming exports to the US in 2007, volumes have steadily grown, reaching 1.1 thousand mt by 2017. India has also expanded exports to Australia, Malaysia, and South Africa and introduced cost-effective sea-route shipments to the US.

Peru

Peruvian Mango Exports Dropped Sharply in Aug-24

In Aug-24, Peru's mango exports dropped significantly, with a 68% year-on-year (YoY) volume decrease and a 55% YoY value decline, despite a 39% YoY rise in the average price per kilogram (kg). The country exported 1.3 thousand tons worth USD 3.2 million, with Canada overtaking the US as the top destination but still experiencing a 71% YoY volume reduction. The US and South Korea also saw sharp declines in imports, though prices increased across all markets, with South Korea paying the highest price of USD 3.40/kg.

Pests and Weather Challenges Threaten Mango Crops in Peru's Ancash

Mango crops in the Ancash region, especially in areas like Moro, Casma, and Nuevo Chimbote, are threatened by pests due to high humidity levels that promote the spreading of diseases like Cladosporium and botrytis. Last season, 70% of the mango production was lost due to extreme temperatures, and while this year's weather has been favorable for flowering, persistent cold and humidity remain challenges. Farmers are struggling with increased pest control costs, worsening the difficulties from the previous season's poor yields and limited capital.

2. Weekly Pricing

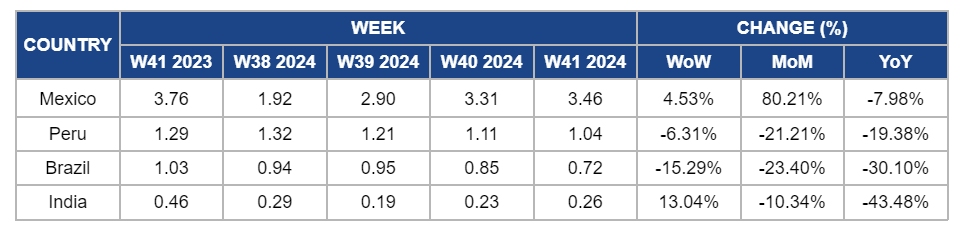

Weekly Mango Pricing Important Exporters (USD/kg)

Yearly Change in Mango Pricing Important Exporters (W41 2023 to W41 2024)

* Varieties: Mexico (Manilla), Peru (Kent), Brazil (Tommy), and India (overall average)

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data or seasonality

Mexico

In W41, mango prices in Mexico rose 4.53% week-on-week (WoW) to USD 3.46/kg. This reflects an 80.21% month-on-month (MoM) increase due to ongoing production challenges from drought and extreme heat in Sinaloa and Nayarit. These conditions have significantly reduced harvest volumes, and with the end of Mexico’s 2024 mango export season, competition for the remaining limited supply has driven prices higher. Additionally, ongoing United States Department of Agriculture (USDA) restrictions on phytosanitary controls have worsened production challenges, further contributing to the price rise. Despite a YoY decline of 15.79%, weather impacts and regulatory constraints have led to the observed price surge.

Peru

Peruvian mango prices dropped by 6.31% WoW in W41 to USD 1.04/kg, with MoM and YoY prices declining by 21.21% and 19.38%, respectively. The price decline is due to ongoing oversupply in the market, as seasonal demand remains weak during the transition between harvests. Additionally, persistent cold and humidity have worsened pest problems, further affecting fruit quality and limiting marketability. The lingering effects of last season's extreme temperatures, which caused a significant loss in mango production, continue to impact the market, driving prices down. Increased pest control costs have also put additional pressure on farmers, further contributing to the price decline.

Brazil

In W41, Brazil's mango prices declined by 15.29% WoW to USD 0.72/kg, reflecting a 23.40% MoM dip and a 30.10% YoY drop. This is due to continued strong local supply and weakening export demand from primary markets. The market remains under pressure as the previous weather-related challenges that had supported higher export demand have subsided, contributing to the ongoing price decrease.

India

In India, mango prices increased by 13.04% WoW to USD 0.26/kg in W41. This is due to a temporary tightening of supply as production levels stabilize following weather-related disruptions. Additionally, both domestic and international demand have contributed to upward price pressure. However, MoM and YoY prices declined by 10.34% MoM and 43.48% YoY, respectively. The price decline is due to the earlier-season oversupply, which continues to influence price comparisons and the larger availability of mangoes in recent months.

3. Actionable Recommendations

Enhance Pest Control and Crop Resilience in Mango Farming

Peruvian mango farmers should implement integrated pest management strategies to address the growing threat of pests due to high humidity. Utilizing fungicides and biological pest control methods can reduce the impact of diseases like Cladosporium and botrytis. Additionally, farmers should invest in weather-resistant crop varieties and strengthen their irrigation systems to maintain optimal conditions despite persistent humidity and cold temperatures. By adopting these practices, farmers can minimize crop losses and reduce the rising costs of pest control while building resilience against future environmental challenges.

Strengthen Export Strategies to Stabilize Mango Prices

Mango producers in Brazil should focus on diversifying export markets to reduce the impact of weakening demand from traditional buyers. They can better maintain price stability by identifying new export opportunities in emerging markets and improving product quality through enhanced storage and packaging techniques. Additionally, investing in marketing efforts to promote Brazilian mangoes in underutilized regions can help create consistent demand and mitigate the effects of strong local supply on pricing.

Mitigate Mango Price Volatility Through Strategic Supply Management

Mango producers in Mexico should implement water conservation techniques and invest in heat-resistant crop varieties to minimize the impact of ongoing weather challenges. Additionally, strengthening partnerships with key export markets, especially the US, could help reduce the uncertainty caused by phytosanitary restrictions. By improving storage and transportation efficiency and focusing on post-harvest quality control, producers can better manage supply and demand, ensuring price stability even in the face of production challenges.

Sources: Tridge, Agraria, Eastfruit, Freshplaza, MENAFN, Mxfruit, New Indian Express, RSD News