1. Weekly News

Ecuador

Ecuador Sees Stronger Banana Export Demand Despite Weather Challenges

Warmer and drier weather across South American banana-producing countries led to lower export volumes, especially in Ecuador, Central America, and Colombia. As a result, buyers are returning to Ecuador for higher volumes of bananas, leading to improved prices. The heat affected banana tree yields, with Ecuadorian plantations producing less fruit per bunch. However, the price increase, including a USD 0.40 rise per 18 kilogram (kg) box for 2025, is expected to benefit Ecuadorian growers by improving their profitability. Additionally, the full implementation of the Ecuador-China Free Trade Agreement (FTA) in 2025 is expected to boost export volumes while strong demand from Russia continues to maintain high spot market prices. Despite the challenges, Ecuador anticipates a better export season in 2025.

Kazakhstan

Kazakhstan Explores Banana Cultivation Projects

Kazakhstan's Deputy Minister of Agriculture highlighted ongoing agricultural projects to increase local banana production in the Turkestan Oblast. An investment initiative is underway to produce approximately 1 thousand tons of bananas annually, accounting for about 1% of the country's total banana imports. Local bananas are becoming competitive in the local market, with strong interest from major supermarket chains and full-order books. The success of this project attracted attention from the Russian Federation, which is keen on Kazakhstan's experience in banana cultivation.

Kenya

Kenyan Farmers Shift to Plantain Cultivation for Higher Profits

In Murang'a County, Kenya, farmers in the Maragua constituency increasingly shift from traditional banana farming to plantain cultivation due to higher market returns. The move comes as profits from conventional bananas dwindle, with middlemen taking a significant portion of the revenue. Requiring proper irrigation and specific soil conditions, plantains allow farmers to earn up to five times more than regular bananas. For example, farmers in Kamahuha earn USD 0.49/kg for mature plantains and USD 2.44 per sucker. This shift boosts farmers' incomes and promotes more sustainable and profitable farming practices.

Peru

Peru's Banana Exports Surged as Ecuador and Dominican Republic Face Challenges

In Oct-24, Peru's banana exports increased by 10.5% year-on-year (YoY) in volume and a 13.9% YoY rise in value, reaching 13.4 thousand tons valued at USD 11.7 million. This growth was driven by higher export volumes and a 3.1% average price per kg increase, reaching USD 0.86/kg. As Ecuador faced adverse weather conditions and the Dominican Republic dealt with quality issues, Peruvian bananas gained market share, particularly in the Middle East and Europe. Fresh bananas accounted for 84.7% of the exports, with major destinations including the Netherlands, the United States (US), and Italy.

Puerto Rico

New Banana and Plantain Hybrids Show Promise Against Disease in Puerto Rico

In Puerto Rico, researchers are developing banana and plantain hybrids resistant to black leaf streak disease (BLSD), a significant threat to banana crops worldwide. This disease causes leaf damage, reduces photosynthesis, and affects fruit size and quality. The FHIA-21 (plantain) and FHIA-17 (banana) hybrids have shown resistance to BLSD while maintaining good yields. These hybrids also produce higher-quality fruit than traditional varieties like Maricongo, though they take longer to harvest. Their resistance to BLSD eliminates the need for costly and labor-intensive fungicide applications, offering potential benefits for farmers, including reduced production costs and the possibility of organic farming.

Russia

Russia Considers Local Banana Cultivation Following Kazakhstan's Success

The Russian Ministry of Agriculture is exploring the possibility of growing bananas following Kazakhstan's successful greenhouse banana production model. Although Ecuadorian bananas are currently cheaper, the Russian Minister of Agriculture acknowledged that market dynamics may shift, prompting Russia to consider local banana cultivation in the future. The minister also emphasized the export potential of food products, noting that not all regions have suitable climates for such crops, and highlighted the role of international collaboration, especially with BRICS countries (Brazil, Russia, India, China, and South Africa), in complementing agricultural production.

2. Weekly Pricing

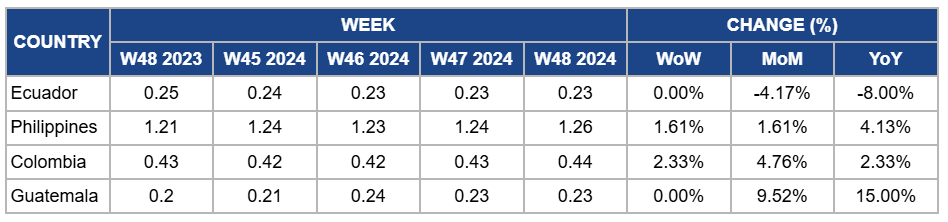

Weekly Banana Pricing Important Exporters (USD/kg)

Yearly Change in Banana Pricing Important Exporters (W48 2023 to W48 2024)

Ecuador

Ecuador's banana prices remained steady at USD 0.23/kg in W48, with a 4.17% month-on-month (MoM) decline and an 8% YoY decrease. The price drop is due to the ongoing logistical challenges, including port congestion, affecting the overall export flow. Additionally, increased competition from other banana-exporting countries continues to exert downward pressure on prices. While demand from key markets such as the US, the Middle East, and Russia remains steady, the lower export volumes caused by the warmer and drier weather have not been enough to offset the competitive pressures in the market. Despite these challenges, implementing the Ecuador-China FTA in 2025 is expected to boost exports in the longer term.

Philippines

In the Philippines, banana prices increased by 1.61% week-on-week (WoW) to USD 1.26/kg in W48, with a 4.13% YoY increase. This is due to sustained strong export demand from key markets such as Japan and South Korea and improved logistics following earlier weather disruptions. Additionally, improving production efficiency, including adopting disease-resistant varieties, supported price stability. While supply gradually recovered after the typhoon, the ongoing demand pressure and improved production practices have helped maintain price growth compared to last year.

Colombia

In W48, Colombia’s banana prices increased by 2.33% WoW to USD 0.44/kg, with a 4.76% MoM increase and a 2.33% YoY increase. The price increase is due to high export demand from key markets like the US and Europe and favorable weather conditions supporting stable production. Additionally, effective management of Fusarium Tropical race 4 (TR4) impacts helped maintain supply levels, while the seasonal adjustment in supply and improved yields from recent rains have eased earlier market tightness. These factors and the continued strong demand contributed to the rise in prices compared to the previous month and the same period last year.

Guatemala

Banana prices in Guatemala remained steady at USD 0.23/kg in W48, with a 9.52% MoM and 15% YoY increase. This is due to sustained international demand for high-quality Guatemalan bananas and favorable weather conditions that improved fruit quality and export readiness. The rise in demand and consistent supply from the region helped support the higher prices compared to the previous month and the same period last year. Additionally, although export demand eased slightly earlier in the season, it remained stable enough to drive the YoY and MoM price increases.

3. Actionable Recommendations

Explore Local Banana Cultivation Opportunities

To reduce dependence on imported bananas, Russian agricultural producers should explore the feasibility of greenhouse banana cultivation, following Kazakhstan's successful model. Producers can assess the viability of adapting this model to Russia's diverse regions by researching suitable climates, technological innovations, and resource availability. This includes evaluating the potential for climate-controlled environments, efficient resource management, and technological advancements in crop production. Collaborating with experts and leveraging international partnerships will ensure a sustainable and adaptable approach to local banana farming.

Capitalize on Growing Banana Exports

Peruvian banana exporters should expand their market share by strengthening relationships with key destinations such as the Netherlands, the US, and Italy. By closely monitoring market trends, especially in the Middle East and Europe, exporters can adjust their strategies to meet rising demand. This includes tracking pricing fluctuations, consumer preferences, and regional shifts in demand to remain competitive. To maintain this momentum, investing in improving supply chain efficiency by optimizing logistics, streamlining transportation networks, and adopting advanced technologies is essential. This will help ensure timely shipments, reduce costs and mitigate risks. Additionally, diversifying product offerings, such as introducing different banana varieties or packaging options, will provide flexibility and meet varied consumer needs, further solidifying Peru's position in the global market.

Sources: Tridge, Agraria, Foodmate, Freshplaza, Kenya News Agency, Kvedomosti, TASS, USDA