.jpg)

1. Weekly News

Europe

Potato Production in Northwestern Europe Rose Despite Higher Costs

In 2024, potato production in France, Germany, the Netherlands, and Belgium reached 24.6 million metric tons (mmt), a 6.6% year-on-year (YoY) increase, according to the North-Western European Potato Growers (NEPG). The expansion was due to a 7.2% YoY increase in the planted area to 513,753 hectares (ha), primarily in Germany by 8.9% YoY and France by 7.3% YoY. However, the average yield of 43.8 metric tons (mt) per ha fell slightly below the five-year average of 44.4 mt/ha. French growers achieved the highest yields at 45.4 mt/ha, up 5% YoY, while Belgium saw a 7% decline to 42.8 mt/ha. Production costs rose significantly in 2024, with increases of at least USD 1,050.77/ha attributed to higher expenses for processing seed potatoes, Phytophthora treatments, and increased storage costs.

Belgium

Belgium's 2024 Potato Production Reaches 3.27 MMT

As of mid-Nov-24, Belgium estimates its potato production at 3.27 mmt, 2% above the five-year average but slightly below the previous year's output, which declined from 4.43 mmt to 4.31 mmt. Despite this, sales have been sluggish, with only 1.04 mmt sold by mid-Nov-24, marking a notable decline compared to earlier years. However, the delivery of contract potatoes has risen by 21% over the five-year average. This has left a larger share of available potatoes in storage, around one-third, compared to last year and the five-year average, reflecting shifting market dynamics and slower offloading of stock.

Brazil

Potato Prices Under Pressure Amid Harvest Progress in Rio Grande do Sul

In Rio Grande do Sul's Passo Fundo region, the potato harvest has begun, with 5% of the 650 ha harvested. Crops are developing well, and the quality of the harvested product is good. However, nationwide oversupply has pressured prices, with producers receiving USD 11.75 per bag of white potatoes and USD 16.79 for pink potatoes, posing profitability challenges. With year-round harvests, sweet potato production, concentrated in the Lajeado region, continues gradually. Farmers are also working on vine multiplication to restore areas impacted by adverse weather.

Spain

Spain's 2024 Potato Production Sees Modest Increase and Record Export Value

As of Sep-24, Spain's potato production reached 1.93 mmt, a 0.6% increase from the previous season but 5.2% lower than the 2019 to 2023 average. This marks the second consecutive year of growth. Export volumes from Jan-24 to Sep-24 totaled 298,594 mt, a 1.7% YoY rise from 2023 and 19% higher than the five-year average, with export value reaching a record USD 186.01 million, up 5.8% YoY and 60.4% above the average. The national average price for potatoes in 2024 was USD 0.60 per kilogram (kg), 22.3% higher than in 2023 and 65.3% above the five-year average, driven by shorter campaigns in Andalusia and Murcia and lower production in France.

Ukraine

Ukraine's Potato Imports Surge by 90% YoY Amid Poor Harvest

Ukraine faced significant challenges with its vegetable harvest in 2024, leading to a notable increase in potato imports, which rose by 90% YoY. According to the Institute of Agricultural Economics (IAE), this surge was due to an underwhelming domestic harvest. However, imports of other vegetables showed a contrasting trend, with a decline in value and volume over the first 10 months of 2024.

2. Weekly Pricing

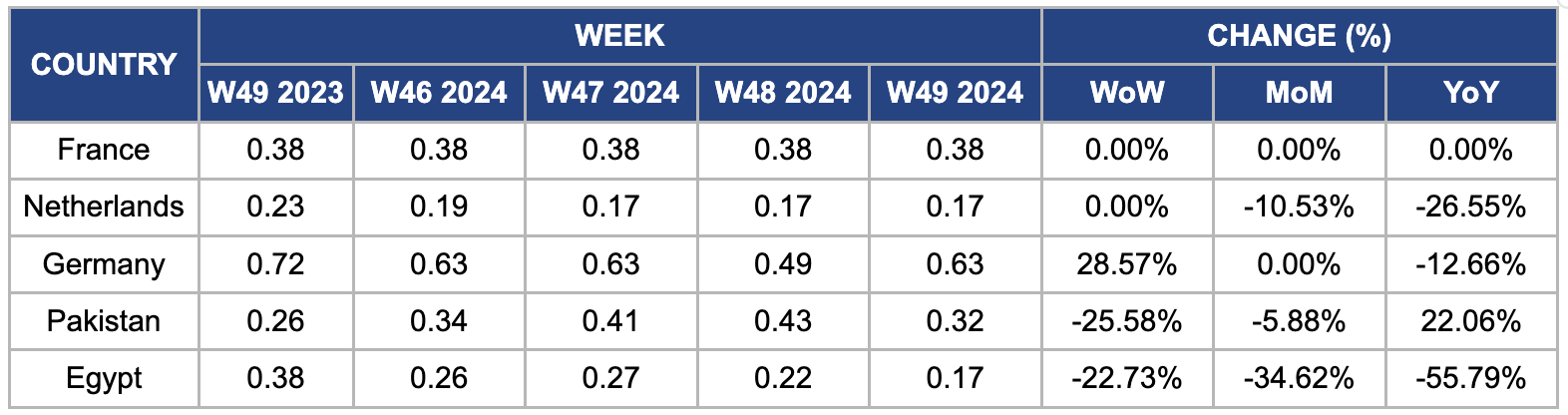

Weekly Potato Pricing Important Exporters (USD/kg)

Yearly Change in Potato Pricing Important Exporters (W49 2023 to W49 2024)

France

In W49, wholesale potato prices in France remained steady at USD 0.38/kg week-on-week (WoW). However, the prices could rise as the National Union of Potato Producers (UNPT) warned of a significant rise in production costs for the 2025/26 campaign, with costs per ha expected to increase by 2% to 3%, making potato cultivation four times more expensive than growing wheat. This cost surge is due to factors such as mechanization, higher seed supply expenses, reduced production tools, and the impact of extreme weather events. The UNPT is urging all stakeholders in the potato value chain to adjust contracts to accommodate these higher costs and ensure the sector's long-term viability.

Netherlands

In W49, wholesale potato prices in the Netherlands remained stable WoW but saw a significant drop of 10.53% month-on-month (MoM) and 26.55% YoY, settling at USD 0.17/kg. This year's European potato season has presented considerable challenges to farmers, starting with a shortage of seed supply that drove up prices. The situation worsened due to heavy rainfall, which delayed planting and harvesting. Research shows climate change exacerbates the hydrological cycle, leading to more extreme rain and increased flood risks. As a result, the European potato sector is expected to experience a nearly 9% YoY decline in production, with the Southern Netherlands particularly affected by extended rainfall that prolonged the planting season beyond the typical 10 weeks.

Germany

Germany's wholesale potato prices surged 28.57% WoW to USD 0.63/kg in W49, driven by supply constraints from earlier adverse weather, including heavy rainfall and flooding that disrupted planting and harvesting, and rising production costs from energy, fertilizer, and transportation. Seasonal holiday demand and strong export interest further tightened domestic availability, contributing to the price spike. However, prices declined 12.66% YoY, reflecting a bumper 2024 harvest of 12.7 mmt, 9% higher YoY and 17% above the five-year average supported by a 9% expansion in planting areas. This surplus is expected to lower prices, especially for smaller sack sizes. Despite this abundant harvest, potato consumption in Germany has decreased by 28% since 1990 as consumers increasingly prefer rice and pasta, underscoring long-term demand challenges.

Pakistan

Potato prices in Pakistan declined 25.58% WoW to USD 0.32/kg in W49, reflecting a 5.88% MoM. A significant increase in supply caused this as the new potato crop from Punjab, which accounts for approximately 85% of the country's total potato production, entered the market. Favorable growing conditions, including optimal temperatures and sufficient rainfall, contributed to a bumper crop. Simultaneously, logistical constraints reduced export opportunities, including transportation issues at border crossings, currency depreciation, increasing export costs, limited trade facilitation, and reduced overseas sales to key markets in Afghanistan, the Middle East, and Central Asia. Economic pressures, including inflation and reduced consumer purchasing power, further weakened demand, intensifying the downward pressure.

Egypt

In W49, Egypt's wholesale potato prices dropped sharply by 22.73% WoW, 34.62% MoM, and 55.79% YoY to USD 0.17/kg, driven by increased supply from the start of the winter harvest and new crop arrivals. The market is experiencing abundant production, with prices expected to continue falling as the season progresses, reversing the sharp price spikes observed in Aug-24 and Sep-24. However, economic challenges, including high inflation, currency depreciation, and a United States (US) dollar shortage, have hindered the import of essential potato seeds, contributing to lower yields, which fell from 14 to 16 mt per acre in 2023 to 9 to 12 mt per acre in 2024.

3. Actionable Recommendations

Diversify Potato Varieties to Mitigate Yield Variability

To address the yield variability caused by changing weather conditions and diseases, farmers in France, Belgium, Germany, and the Netherlands should diversify the potato varieties they plant. Growers can improve their chances of consistent yields by choosing varieties resilient to different climatic challenges, such as Lady Rosetta, Bintje, and Agria. For example, in France, where yields have fluctuated, opting for disease-resistant and adaptable varieties like Desiree or Amandine could help mitigate the impact of extreme weather conditions. Diversification helps stabilize yields across different growing conditions, reducing the risk of total crop failure. This strategy also provides a buffer against market fluctuations and could lead to higher profitability due to more reliable production and better crop quality.

Optimize Storage and Handling Practices to Maximize Profitability

Optimizing storage systems becomes crucial with a growing surplus of unsold potatoes, mainly in Belgium, where one-third of the crop is still in storage. Modern, climate-controlled storage facilities can help maintain the quality of potatoes longer, allowing farmers to sell them at better prices when market conditions improve. Moreover, improved sorting, grading, and packaging processes ensure potatoes meet export market standards, which is essential for boosting sales. By investing in advanced storage techniques, farmers in Belgium, France, and Germany can extend the shelf life of their crops, reduce spoilage, and prevent waste. This will lead to higher-quality potatoes being available for export, ultimately improving profitability as potatoes can fetch better prices in both domestic and international markets.

Strengthen Contract Farming and Long-term Export Agreements

Strengthening contract farming models and securing long-term export agreements should be prioritized in Spain, Belgium, and the Netherlands to stabilize a volatile market. In Belgium, contract deliveries have increased, showing that this model helps ensure consistent sales. Farmers can avoid the risks associated with oversupply and fluctuating prices by negotiating long-term contracts with processors and international buyers. Spain's recent success in potato exports, with a rise of 19% above the five-year average, is partly due to robust export partnerships. Long-term contracts provide farmers with predictable income and a guaranteed product market. This stability helps reduce the financial strain during periods of oversupply, allowing for better planning and more efficient market access. Moreover, it secures export opportunities, leading to higher revenues from international markets.

Sources: Tridge, Agri Holland, Agrodigital, Eastfruit, Mercados, Nieuwe Oogst, Portal Do Agronegócio