W50 2024: Potato Weekly Update

.jpg)

1. Weekly News

Europe

EU-4 Potato Production Rises, but Prices Remain Low Due to Sustainability Concerns

The EU-4 region experienced a 7.2% year-on-year (YoY) increase in the potato planting area, resulting in a 6.9% YoY production rise to 24.6 million metric tons (mmt). Despite this growth, potato prices remain 20% lower YoY, even with an 18% seasonal increase in Dec-24. According to the North-Western European Potato Growers (NEPG), this season's average yield was 43.8 metric tons (mt) per hectare (ha), slightly below the 5-year average of 44.4 mt/ha and last year's levels. While the harvest was more favorable than the wet 2023 season, concerns about sustainability in EU potato farming persist. Rising production costs and risks press smaller producers, leading to industry consolidation as more significant, better-equipped farms increasingly dominate the market, leveraging their capacity to manage financial and operational challenges more effectively.

Belarus

Belarus Implemented Temporary Licensing for Potato Exports

The Belarusian government introduced a temporary licensing system for potato exports, effective for three months, per a decree signed by the Prime Minister. The measure aims to ensure a sufficient supply of agricultural products in the domestic market during the off-season.

Regardless of origin, potato exports will now require one-time licenses issued by the Ministry of Antimonopoly Regulation and Trade in coordination with the Ministry of Agriculture and Food, regional executive committees, and the Minsk City Executive Committee. Licenses granted will be based on an assessment of Belarus’s free potato resources and domestic demand at the time of application approval.

Türkiye

Türkiye's 2024 Potato Production Exceeds Consumption, Increased Exports Urged

Turkey produced 6.5 mmt of potatoes in 2024, marking a surplus of 1.5 mmt compared to the country's annual consumption of 5 mmt. According to the President of the Nevşehir Chamber of Agriculture, Cappadocia alone holds approximately 2.1 mmt of potatoes in its 1,321 natural cold storage facilities. There is an urgent need to boost exports to address the surplus. Current export destinations include Ukraine, Macedonia, Georgia, Azerbaijan, and Iraq, but challenges such as customs duties in importing countries limit the volume of exports. Without increased export opportunities or support for farmers, producers might need to sell their potatoes at significantly lower prices of around USD 0.17 to 0.20 per kilogram (kg), leading to substantial financial losses.

Ukraine

Ukrainian Potato Market Saw Pre-Holiday Price Surge

The Ukrainian potato market is witnessing heightened trade and purchasing activity driven by increased demand from wholesale companies and retail chains ahead of the New Year holidays. This has increased selling prices to USD 0.53 to 0.72/kg, marking a 22% week-on-week (WoW) increase in W50. The average potato price in Ukraine is 85% higher than last year due to reduced production caused by summer droughts in key potato-growing areas. Experts foresee further price increases but do not expect a sharp surge.

2. Weekly Pricing

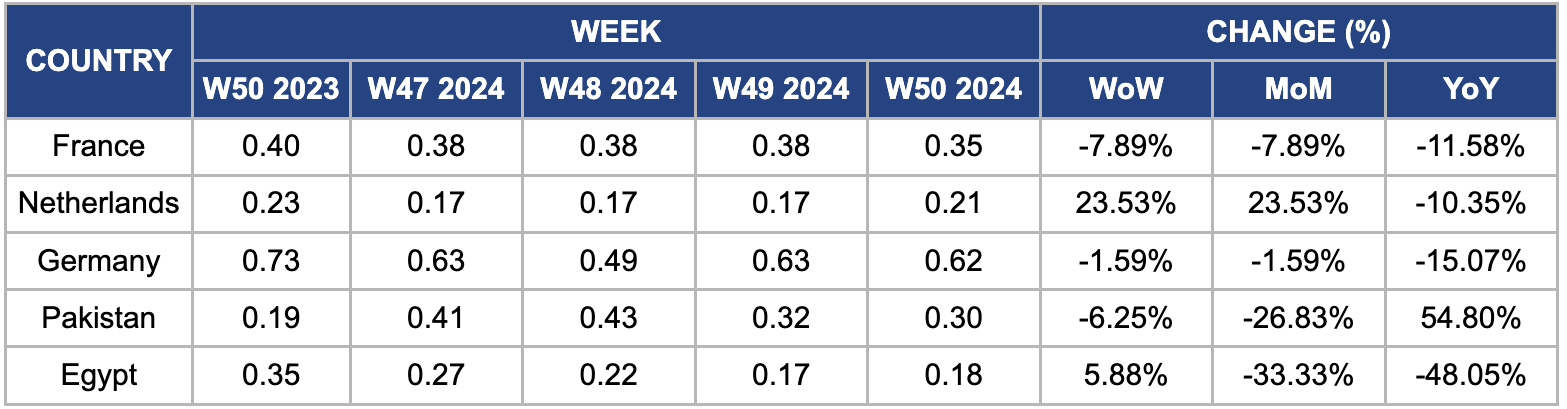

Weekly Potato Pricing Important Exporters (USD/kg)

Yearly Change in Potato Pricing Important Exporters (W50 2023 to W50 2024)

France

In W50, wholesale potato prices in France declined both 7.89% WoW, month-on-month (MoM), and 11.58% YoY to USD 0.35/kg. This decline is due to higher production volumes as France's potato harvest increased by 10% YoY in 2024 due to favorable weather conditions during the growing season and expanded cultivation areas. The increased supply has outpaced demand, putting downward pressure on prices. Furthermore, subdued export demand, particularly from key markets like Spain and Italy, has further contributed to the price decline, as these countries rely on domestic production or alternative suppliers with surplus stocks.

Netherlands

In W50, wholesale potato prices in the Netherlands reached USD 0.21/kg, surging 23.53% WoW and MoM due to multiple challenges during the European potato season. A shortage of seed supply earlier in 2024 increased input costs, while heavy rainfall, aggravated by climate change, delayed planting and harvesting. Research highlights that climate change intensifies the hydrological cycle, causing extreme rain and heightened flood risks. These disruptions contributed to an anticipated 9% YoY decline in European potato production, with the Southern Netherlands particularly affected by prolonged rainfall that extended the planting season beyond the typical 10 weeks. Despite these challenges, prices dropped 10.53% YoY to USD 0.17/kg due to improved supply stabilization and ongoing market adjustments.

Germany

In W50, Germany's wholesale potato prices declined both 1.59% WoW and MoM to USD 0.62/kg, reflecting a bumper 2024 harvest of 12.7 mmt, 9% higher YoY and 17% above the five-year average. This increase in production was due to a 9% expansion in planting areas, combined with favorable weather conditions that allowed for a successful harvest. The surplus is expected to put downward pressure on prices, particularly for smaller sack sizes, as supply overabundance exists. Moreover, the decline in potato prices can be due to changes in consumer preferences, with potato consumption in Germany decreasing by 28% since 1990 due to a shift towards alternatives such as rice and pasta. Moreover, high production costs and energy prices have led many farmers to reduce their margins, further intensifying the price decline.

Pakistan

In W50, potato prices in Pakistan declined 6.25% WoW and 26.83% MoM to USD 0.30/kg, primarily due to a significant increase in supply from the new potato crop in Punjab, which accounts for approximately 85% of the country's total potato production. Favorable growing conditions, including optimal temperatures and sufficient rainfall, contributed to a bumper harvest. However, logistical constraints counterbalanced this supply surge, which reduced export opportunities. Transportation bottlenecks at border crossings, currency depreciation, rising export costs, and limited trade facilitation impacted exports, particularly to key markets like Afghanistan, the Middle East, and Central Asia. Simultaneously, economic pressures, including inflation and reduced consumer purchasing power, further weakened domestic demand. This combination of increased supply and weakened demand led to significant downward pressure on prices.

Egypt

In W50, Egypt's wholesale potato prices increased 5.88% WoW to USD 0.18/kg due to a combination of factors. The country experienced a lower-than-expected potato harvest earlier in the season caused by unfavorable weather conditions, which reduced overall production and created a tighter supply in the domestic market. Moreover, potato demand rose ahead of the upcoming holiday season as consumers and retailers stocked up. Logistical challenges increased market prices, such as higher transportation and fuel costs. These factors combined to push wholesale potato prices higher in Egypt. However, prices dropped 33.33% MoM and 48.05% YoY, driven by increased supply from the start of the winter harvest and new crop arrivals compared to the previous season. Despite the increased supply, economic challenges, including high inflation, currency depreciation, and a United States (US) dollar shortage, have hindered the import of essential potato seeds, contributing to lower yields, which fell from 14 to 16 mt per acre in 2023 to 9 to 12 mt per acre in 2024.

3. Actionable Recommendations

Boost Export Opportunities for Surplus Potatoes in Turkey

Türkiye's potato market is experiencing a surplus, which poses challenges for local farmers, who cannot sell their produce at profitable prices. One effective solution is to increase export opportunities by targeting new markets, particularly in regions with growing potato demand, such as parts of Africa and the Middle East. Establishing new trade agreements or expanding the export network can alleviate the surplus, allowing farmers to sell their potatoes at higher prices. Moreover, providing financial and logistical support for exporters can help overcome challenges like high customs duties and transportation costs in importing countries. For example, establishing trade support programs or offering export subsidies could help Turkish producers tap into under-served markets, improving their market access and profitability.

Provide Sustainability Initiatives for Small Producers

In the EU, smaller potato producers face increased production costs and pressure to meet sustainability goals. Targeted sustainability programs could be introduced to support these farmers, making it easier for them to adopt efficient farming practices. Measures such as grants for investing in water-efficient irrigation systems, renewable energy, and sustainable pest management techniques could reduce operational costs and enhance productivity. Furthermore, facilitating collaboration between smaller producers through cooperative models could provide economies of scale, allowing them to share resources such as storage and transportation facilities. By investing in sustainability, the EU can ensure that small producers remain competitive and continue to supply high-quality potatoes while contributing to the region’s environmental goals.

Improve Logistical Efficiency for Pakistan's Potato Exports

Pakistan potato prices were impacted by logistical bottlenecks and difficulties accessing key export markets. Improving the transportation infrastructure and reducing export barriers should be a priority in addressing these challenges. Private sectors could invest in enhancing border crossing facilities, expanding cold storage capacity, and streamlining the export process. Establishing dedicated export lanes or partnerships with shipping companies to reduce transport costs would also help make Pakistani potatoes more competitive internationally. Moreover, financial incentives to exporters facing currency depreciation or rising fuel costs could help stabilize potato prices and boost export volumes, benefiting farmers and the national economy.

Sources: Tridge, Agrotimes, Campocyl, Eastfruit, Interfax, Sondakika