W11 2025: Strawberry Weekly Update

In W11 in the strawberry landscape, some of the most relevant trends included:

- Heavy rains in Spain and wet conditions in North Carolina disrupt strawberry production, while European growers face water shortages and irrigation restrictions. These factors are affecting both the quantity and quality of harvests.

- European strawberry growers are burdened by rising labor costs and restrictions on phytosanitary products, while US farmers are dealing with disease management expenses. These challenges are increasing production costs and pressuring profit margins.

- Despite lower production, Spain increased its strawberry exports. Portugal continues to rely on Spanish imports, while Ukraine depends on Greek imports for early-season supply. Brazil's imports of frozen Egyptian strawberries have doubled, highlighting shifting global trade flows.

- Strict phytosanitary regulations are shaping trade policies, with Brazil imposing new import requirements on Egyptian strawberry seedlings. Meanwhile, North Carolina battles the spread of Neo-P disease, threatening local strawberry crops.

- Ukraine faces high and fluctuating strawberry prices due to seasonal supply shifts, while concerns persist in Spain over supermarket pricing strategies that could distort market values.

1. Weekly News

Brazil

Brazil Sets Phytosanitary Rules for Strawberry Seedling Imports from Egypt

Brazil has established phytosanitary requirements for importing strawberry seedlings from Egypt. It mandated that imports should be free from pests such as Naphothrips obscurus, a thrips species that damages plant tissues, and Eutetranychus orientalis, an Oriental red mite that weakens plants by feeding on their leaves. The seedlings must be certified, inspected upon arrival, and undergo laboratory testing at the exporter's expense. If quarantine pests are detected, shipments may be rejected or destroyed, and imports could be suspended pending a Pest Risk Analysis review. Under the Egypt-Mercosur free trade agreement, strawberry plant imports face a 2% tariff. Meanwhile, Brazil’s strawberry imports from Egypt, primarily frozen products, surged to USD 25.07 million in 2024. This figure doubled from USD 12.2 million in 2023.

Europe

European Strawberry Industry Faces Challenges Due to Production Shifts

The strawberry industry in France, Italy, Portugal, and Spain faces restrictions on phytosanitary products, labor shortages, and water limitations. Spain's production fell by 9% last season, yet exports rose by 8%, with irrigation restrictions and pest control challenges posing major concerns. France maintained stable output at 60 thousand tons, primarily for domestic consumption, but rising labor costs remain a burden for growers. Cultivation in Italy increased 2%, driven by strong local demand, while Portugal continues to expand its acreage but still relies on imports from Spain. Industry stakeholders advocate for faster European Union (EU) approval of pest control products and the adoption of precision agriculture to optimize water and nutrient use.

Spain

Heavy Rains Disrupt Strawberry Production in Huelva, Spain

Heavy rains in Huelva, Spain, have disrupted peak-season strawberry production. Ongoing storms and strong winds have reduced output to just 50% of expected levels. While the rainfall has replenished water reserves after years of drought, excessive moisture and low temperatures have created less-than-ideal growing conditions, as strawberries thrive in spring-like weather. Despite these challenges, growers are maintaining high-quality harvests for European markets, while promotional campaigns aim to increase consumption. However, concerns persist over supermarkets using strawberries as a loss leader, which could distort market prices.

Ukraine

Ukraine’s Strawberry Market Sees High Prices Ahead of Peak Season

Strawberries are available year-round in Ukraine through imports, with early spring supplies primarily coming from Greece. Larger shipments are expected in Apr-25, but prices remain high, ranging from USD 3.09 to 10.35 per kilogram (EUR 2.85 to 9.55/kg) in supermarkets and USD 7.48 to 8.99/kg (EUR 6.90 to 8.30/kg) in wholesale markets in Kyiv and Lviv. The first local greenhouse-grown strawberries from Ternopil, Chernivtsi, and Zakarpattia are anticipated in May-25, followed by open-field harvests in mid-May-25 and peak production in Jun-25. In 2024, early-season prices ranged from USD 3.47 to 4.33/kg (EUR 3.20 to 4/kg) before dropping to USD 1.41/kg (EUR 1.30/kg) later. However, this year’s price trends remain uncertain.

United States

North Carolina’s Strawberry Growers Face Threat from Neo-P Disease

Strawberry growers in North Carolina closely monitor the spread of Neo-P, a disease that thrives in wet conditions and poses a serious threat to crops. First detected in the state’s fields in 2022, Neo-P has already disrupted plant supplies, forcing some growers to source plants from California. Farmers are implementing preventive measures such as regular spraying, with the disease spreading more easily in damp weather. Despite these concerns, growers remain hopeful that a warm, dry spring will help mitigate risks. The strawberry season is expected to start between April 20 and 25, 2025.

2. Weekly Pricing

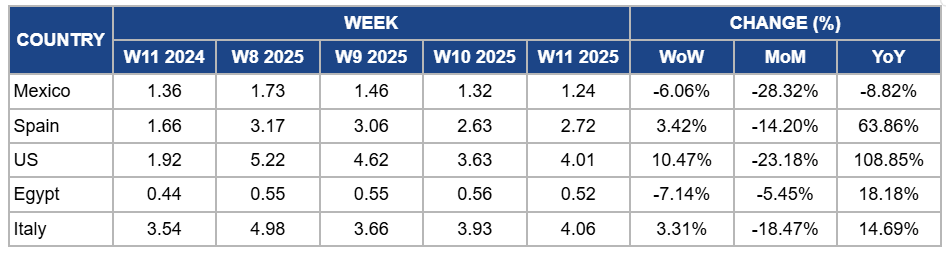

Weekly Strawberry Pricing Important Exporters (USD/kg)

Yearly Change in Strawberry Pricing Important Exporters (W11 2024 to W11 2025)

Mexico

Mexico's strawberry prices dropped significantly by 6.06% week-on-week (WoW) to USD 1.24/kg in W11, showing a 28.32% month-on-month (MoM) decline and an 8.82% year-on-year (YoY) decrease. The price decline is due to weaker export demand and increased competition from alternative berry-producing regions. As the peak harvest season has passed, market supply is gradually normalizing, but lingering stocks from previous weeks have continued to exert pressure on prices. Additionally, adverse weather conditions, including excessive frost and fluctuating temperatures in key growing areas like Irapuato, Abasolo, Valle de Santiago, and Pénjamo, have affected fruit quality, leading to price adjustments. Meanwhile, concerns over new United States (US) import tariffs on Mexican strawberries have contributed to market uncertainty, influencing trade flows and pricing dynamics.

Spain

In Spain, strawberry prices increased by 3.42% WoW to USD 2.72/kg in W11, with a 63.86% YoY surge due to reduced production caused by persistent heavy rains and strong winds in Huelva, the country’s primary growing region. The adverse weather has limited harvest volumes, tightening supply and pushing prices higher. Additionally, steady European demand, particularly from Germany and France, has further supported price increases despite logistical challenges. However, MoM prices dropped by 14.20% due to a gradual stabilization of supply as growers adapted to the weather conditions. Promotional campaigns to boost local and export consumption have also influenced pricing trends, while concerns over supermarkets using strawberries as a loss leader continue to create downward pressure on market prices.

United States

Strawberry prices in the US rose by 10.47% WoW to USD 4.01/kg in W11, marking a 108.85% YoY increase. This surge is primarily due to the spread of Neo-P disease in North Carolina, which thrives in wet conditions and poses a serious threat to crops. However, strawberry prices declined by 23.18% MoM due to seasonal production cycles and increased imports from Mexico, temporarily boosting supply and easing price pressures in the domestic market.

Egypt

In W11, Egypt's strawberry prices fell by 7.14% WoW to USD 0.52/kg, with a 5.45% MoM drop. This decrease is due to a reduced export demand from European markets, where buyers are favoring Spanish and Moroccan strawberries. Additionally, increased local production, bolstered by expanded greenhouse cultivation and efficient irrigation methods, has led to a surplus in local markets, further driving prices down. However, YoY prices increased by 18.18%, reflecting the lingering effects of higher production costs and global demand observed earlier in the season.

Italy

In W11, Italy's strawberry prices increased by 3.31% WoW to USD 4.06/kg, representing a 14.69% YoY increase due to reduced supply and steady local demand. The early onset of the strawberry season in Basilicata, driven by unusually warm autumn weather, led to an initial surge in supply. However, as the season progresses, production volumes have begun to normalize, leading to a tightening of supply and upward pressure on prices. Additionally, the expansion of cultivation areas has contributed to higher overall production volumes, which, coupled with intensified competition from Spain and Portugal, where favorable weather conditions have boosted yields, has led to a significant 18.47% MoM price decrease.

3. Actionable Recommendations

Enhance Efficiency with Precision Agriculture

Strawberry growers in France, Italy, Portugal, and Spain should adopt precision irrigation systems and integrated pest management (IPM) to mitigate water shortages and pest pressures. Techniques like drip irrigation, soil moisture sensors, and biological pest control can improve yields while reducing costs. Expanding protected cultivation, such as greenhouse or hydroponic systems, can also enhance resource efficiency and stabilize production.

Stabilize Prices with Strategic Supply Planning

Strawberry growers in Huelva should coordinate with distributors to manage supply flows and prevent oversupply-driven price drops. Partnering with retailers on fair pricing agreements and adjusting harvesting schedules to align with market demand can help maintain profitability. Expanding controlled-environment farming, such as high tunnels, can mitigate weather-related losses and improve yield stability.

Sources: Tridge, ANBA, CBS 17 News, Fepex, Freshplaza, Rbc