In W16 in the mango landscape, some of the most relevant trends included:

- Recent rainfall in Bangladesh’s Rangpur region has led to strong fruit formation and high mango yield expectations. In contrast, yields halve in Andhra Pradesh in India due to pest infestations and thunderstorms, while Mexico’s Jalcomulco is experiencing long-term production decline from drought and aging plantations.

- Egypt significantly expanded its mango exports to Turkey, taking advantage of a 70% production drop in Peru due to the effects of El Niño, showing how global supply shortfalls can shift trade flows.

- A 10% tariff in the US and high freight costs from Red Sea disruptions have slowed India’s mango exports to the US, prompting a strategic shift toward the Middle East and Europe.

- Driven by years of poor productivity and lack of reinvestment in mango farming, farmers in Mexico’s Jalcomulco are replacing old, low-yielding mango orchards with Persian lime and pineapple.

1. Weekly News

Bangladesh

Bangladesh Anticipates High Mango Production in Rangpur Region

In Bangladesh's Rangpur region, recent rainfall following a brief drought has significantly boosted mango fruit formation, fueling strong expectations for a bumper harvest this season. Mango orchards and homestead trees across Rangpur, Gaibandha, Kurigram, Lalmonirhat, and Nilphamari are currently in the tender fruit development stage, with farmers cultivating a diverse range of high-yielding and popular varieties such as 'Haribhanga,' 'Gopalbhog,' 'Amrapali,' 'Mohanbhog,' and 'Lengra.' Field officials are actively supporting growers with pest control and orchard management, and if favorable weather and pest conditions continue, the region is on track for an exceptionally productive mango harvest in May-25 and Jun-25.

Egypt

Egypt Achieves Record Mango Exports to Turkey Amid Global Supply Shifts

Egypt has achieved a significant milestone in mango exports to Turkey during the current 2024/25 season (Jul-24 to Jun-25), shipping over 1 thousand tons valued at USD 1.11 million between Jul-25 and Feb-25 alone. This represents a fourfold increase from the previous season and nearly eight times higher than in 2022/23, reflecting a remarkable compound annual growth rate of 140% over the past four years. Turkey has become one of Egypt’s top seven mango export destinations, with peak imports recorded in October despite limited local production and rising demand. This surge was further heightened by a sharp decline in Peruvian mango availability during the 2023/24 season when Hurricane and El Niño slashed Peru’s production by 70%. Although Peru’s output is rebounding and global mango prices have softened this season, Egypt continues to benefit from strong domestic yields, logistical advantages, and favorable market timing, capturing a 34.3% share of Turkey’s mango imports as of February. While increased competition from Brazil and Peru is anticipated later in the season, Egypt has reinforced its market presence through the export of globally recognized mango varieties and a strategic response to shifting global supply dynamics.

India

Severe Crop Loss Hits Mango Production in Andhra Pradesh Due to Pests and Weather

Mango production in India’s north coastal Andhra Pradesh, particularly in key districts such as Vizianagaram, Anakapalle, Parvathipuram, Manyam, and Srikakulam, has been severely impacted this season due to a combination of pest infestations and adverse weather conditions, including recent thunderstorms. These challenges have led to extensive fruit drop and a sharp yield decline, with harvests falling from the anticipated 5 to 7 metric tons (mt) per ha to just 2 to 3 mt, a reduction of nearly 50%. Farmers cultivating popular mango varieties like Banganapalle, Suvarnarekha, and Panukulu across more than 35 thousand ha are facing significant losses. The widespread crop failure is already affecting market dynamics, with prices surging as the Banganapalle variety reaches USD 9.37 per dozen (INR 800 per dozen) and the Rasalu variety sells for USD 7.03 per dozen (INR 600 per dozen) in local markets, signaling likely continued upward pressure on prices in the weeks ahead.

Early Season and Tariff Challenges Impact Indian Mango Exports

Accounting for over 40% of global mango production, India experienced an early influx of mangoes into domestic markets this year due to favorable weather in several growing regions. While local supply remains strong, international trade has faced notable challenges, particularly in the United States (US) market. Indian exporters were hit by the sudden imposition of a provisional 10% import tariff, potentially rising to 26%, which has disrupted early-season shipments and led many US importers to postpone orders. This has dampened the momentum of what had been a recovering export season following previous COVID-19 disruptions. Compounding the situation are high air freight costs caused by Red Sea shipping issues, further straining trade logistics. In response, Indian exporters are pivoting toward alternative markets such as the Middle East and Europe, aiming to diversify demand and preserve their global competitiveness amidst the shifting trade landscape.

Mexico

Mango Plantations Decline in Jalcomulco as Farmers Shift to Other Crops

In Jalcomulco, Mexico, mango cultivation is steadily declining as aging, low-yield plantations are increasingly being removed and replaced, primarily with Persian lime and, to a lesser extent, pineapple. This transition, underway for the past five years, has been hastened by severe drought conditions that have led to widespread flowering loss and sharply reduced mango yields. With little investment in orchard renewal and many trees growing old, concerns over long-term mango supply are mounting. Felled mango trees are often sold for carpentry, while the few still standing, mostly in residential yards, are expected to produce fruit by May. The absence of an official census of mango producers further complicates efforts to measure the full extent of this agricultural shift.

2. Weekly Pricing

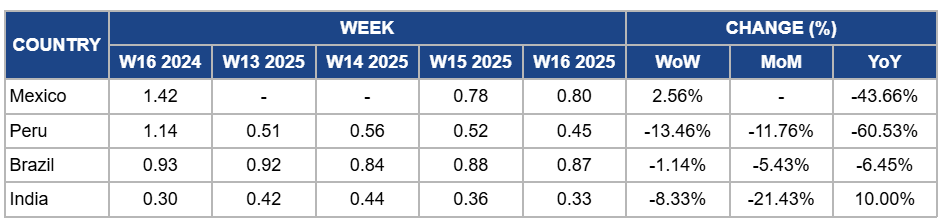

Weekly Mango Pricing Important Exporters (USD/kg)

Yearly Change in Mango Pricing Important Exporters (W16 2024 to W16 2025)

Mexico

Mexico's mango prices increased by 2.56% week-on-week (WoW) to USD 0.80 per kilogram (kg) in W16 due to limited supply availability from Jalcomulco and other drought-affected regions, where aging plantations and declining productivity have reduced the volume entering the market. In addition, some growers in these areas have begun replacing mango trees with Persian lime plantations in response to water scarcity and shifting market demand, further reducing mango acreage and contributing to the tighter supply. This gradual conversion of orchards has placed slight upward pressure on prices. However, year-on-year (YoY) prices dropped significantly by 43.66% due to broader regional oversupply from more productive growing areas in Mexico and other exporting countries like Peru and Guatemala, which have been filling market gaps with competitive pricing, thereby dampening overall price levels despite localized production challenges.

Peru

In Peru, mango prices dropped by 13.46% WoW to USD 0.45/kg in W16, with an 11.76% month-on-month (MoM) drop and a 60.53% YoY decrease. The price decline is due to the winding down of the Peruvian mango season, which has led to a push to clear remaining stocks, thereby increasing downward price pressure. At the same time, Brazil is re-entering the European market with improved quality and consistent supply of Tommy Atkins mangoes, intensifying competition. This market overlap, combined with post-Ramadan volatility and cautious demand from European buyers, has forced Peruvian exporters to adopt more aggressive pricing strategies to maintain market share and move end-of-season volumes.

Brazil

Brazil's mango prices decreased slightly by 1.14% WoW to USD 0.87/kg in W16, with a 5.43% MoM drop and a 6.45% YoY decline due to ongoing logistical and infrastructure hurdles that continue to undermine the fruit's competitiveness in export markets. Limited cold chain capacity compromises fruit quality during transit, making Brazilian mangoes less appealing in distant markets. Additionally, high domestic transportation costs from northeastern production zones increase overall export costs, squeezing profit margins and prompting exporters to lower prices to remain competitive. Delays in phytosanitary certification also hinder timely shipments, leading to missed market windows and reduced buyer confidence. Although the quality of the Tommy Atkins variety has improved and regained some traction in Europe, intensified market volatility after Ramadan and growing competition from the tail end of Peru’s season are contributing to fluctuating demand and cautious pricing strategies, further exerting downward pressure on Brazilian mango prices.

India

In W16, India's mango prices dropped by 8.33% WoW to USD 0.33/kg, with a 21.43% MoM decrease due to weakened export momentum following the imposition of provisional tariffs by the US and elevated air freight rates linked to Red Sea disruptions, which discouraged early-season shipments and increased logistical costs. Domestically, early arrivals from some regions also added short-term supply pressure. However, there is a YoY price increase of 10% due to sharply reduced yields in north coastal Andhra Pradesh, particularly in districts like Vizianagaram and Srikakulam, where adverse weather and pest infestations have cut output by nearly half. These production constraints, especially affecting popular varieties like Banganapalle and Suvarnarekha, are tightening supply and supporting price growth YoY.

3. Actionable Recommendations

Improve Pest and Weather Risk Management

Mango growers in north coastal Andhra Pradesh should adopt integrated pest management (IPM) and weather-resilient practices to reduce crop loss and stabilize yields. This includes using pheromone traps, neem-based biopesticides, and timely canopy pruning to manage pests like fruit flies and hoppers. Farmers should also install rain shelters or windbreaks to reduce damage from sudden storms and use mulching to retain soil moisture. These targeted interventions can protect popular varieties like Banganapalle and Suvarnarekha, minimize fruit drop, and improve harvest outcomes despite adverse conditions.

Streamline Export Logistics to Cut Mango Losses

Brazilian mango exporters should partner with freight forwarders and logistics firms to secure dedicated cold chain solutions and reduce transit losses. This includes leasing mobile refrigeration units near packing stations in northeastern regions and pre-booking reefer containers during peak export windows. Exporters should also digitize phytosanitary documentation and coordinate earlier inspections to avoid certification delays. These steps will protect fruit quality, reduce cost pressures, and improve delivery reliability in high-value markets like Europe.

Sources: Tridge, BSS News, EastFruit, Freshplaza, Kay Bee Exports, Oem, Nuovafrutta, Times of India