1. Weekly News

Argentina

Argentine Soybean Harvest Projected to Reach 51 MMT in 2024/25 Season

According to the Foreign Agricultural Service (FAS) of the United States Department of Agriculture (USDA), Argentine farmers are forecasted to harvest approximately 51 million metric tons (mmt) of soybeans in the 2024/25 season, marking a 1 mmt increase from the previous year and more than double the 25 mmt harvested in the 2022/23 season. This is due to the expansion of soybean acreage by nearly 8% year-on-year (YoY) to 17.8 million hectares (ha) in 2024. Additionally, soybean processing is expected to grow by 1 mmt, reaching 40 mmt.

Brazil

Heavy Rainfall in Rio Grande do Sul Puts 5 mmt of Soybeans at Risk

Heavy rainfall has caused significant flooding in Rio Grande do Sul, Brazil's second-largest soybean-producing region. Approximately 25% of the soybean crops in the state remain unharvested. Between 150 to 540 mm (millimeters) of rain fell from late Apr-24 to early May-24, severely affecting the area. This downpour has submerged entire towns and farms, potentially reducing production by up to 15%. Analysts estimate that around 5 mmt of soybeans are at risk, although actual losses might be between 1 to 2 mmt. Brazil's total soybean crop is projected to be 155 mmt.

China

Chinese Importers Favor South American Soybeans Amid Declining Overall Imports

Since the beginning of 2024, Chinese soybean importers have shifted their preference from United States (US) soybeans to South American soybeans, primarily from Brazil. Despite this shift, overall soybean imports by China have fallen to their lowest level since 2020. According to the General Administration of Customs of the People's Republic of China (GACC), soybean imports from the US decreased by 1.5 times in Q1-24, totaling 7.14 mmt. In contrast, imports from Brazil increased by 2.5 times during the same period, reaching 10 mmt. This competition is driven by a record harvest in Brazil, allowing suppliers to offer competitive prices. Overall, soybean supplies in Mar-24 dropped to a four-year low of 5.54 mmt.

Kazakhstan

Farmers Urged to Expand Soybean Cultivation Amid Forecasted Demand

The Kazakhstan Ministry of Agriculture advised farmers to expand the cultivation of fodder crops and soybeans due to forecasted domestic demand. The Ministry predicts increased durum wheat production in Russia and Türkiye and linseed in Russia, which could pose competition for Kazakhstani producers. Therefore, farmers were urged to focus on fodder crops with expected domestic demand and increase soybean cultivation, as there was a critical deficit and record imports of soybeans in 2023.

Malawi

Malawi Makes Inroads into Chinese Market with Soybean Exports

Malawi's soybean industry has achieved a significant milestone by entering the Chinese market, aiming to bolster the country's agricultural exports and enhance the economy. A trial consignment of 240 metric tons (mt) was successfully exported by a local company and approved by Chinese authorities. This achievement is due to collaborative efforts among government agencies, private enterprises, and Chinese representatives. Additionally, the Chinese market has a substantial demand for soybeans, with a need for 100 thousand mt.

United States

Soybean Inspection Volumes Increased in W18

According to the USDA’s weekly inspection report on grain shipments, soybean volumes inspected at US ports increased in W18, while corn and wheat volumes decreased. Soybean volumes inspected for export rose 26.3% week-on-week (WoW) to 348,654 mt.

2. Weekly Pricing

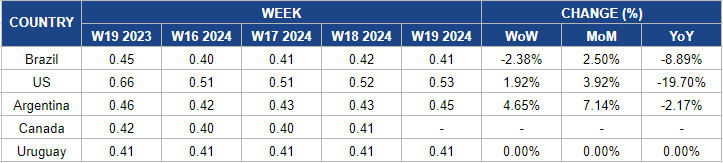

Weekly Soybean Pricing Important Exporters (USD/kg)

* Varieties: Food-grade soybean

Yearly Change in Soybean Pricing Important Exporters (W19 2023 to W19 2024)

.png)

* Varieties: Food-grade soybean

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data, or seasonality

Brazil

The soybean market in Brazil saw a decrease of 2.38% WoW, pricing at USD 0.41 per kilogram (kg) in W19, down from USD 0.42/kg in W18. Similarly, YoY prices also declined by 8.89%. Despite reports of severe rain and flooding in Brazil, which may have destroyed some unharvested soybeans, increased soybean production so far has more than offset these losses. As a result, the impact on global soybean prices remains negligible, according to the USDA.

United States

Soybean prices in the US saw an upward trend in W19, reaching USD 0.53/kg, an increase of 1.92% WoW. Recent rains in the US Midwest have slowed down the soybean planting pace, causing varied price movements. Earlier this week, the USDA reported that soybean planting progress was slightly ahead of schedule. However, weather forecasts suggest more precipitation for W20 in those growing regions, which could further impact planting and prices.

Argentina

In W19, soybean prices in Argentina rose 4.65% WoW to USD 0.45/kg, and month-on-month (MoM) prices increased by 7.14%. We are going through a cycle with rising values in soybean operations, with a range of active buyers in the short delivery segment. Moreover, the floods occurring in southern Brazil have caused the price of soybeans to skyrocket in the international market.

Uruguay

Soybean prices in Uruguay remained unchanged at USD 0.41/kg despite the concerns over the impact of heavy rains on Brazilian soybean crops, particularly in the Southern region. Attention is focused on the delayed harvests, which elevate the risk of quality deterioration and shelling losses in soybeans.

3. Other Outstanding Price Anomalies

Taiwan's Soybean Price Declined 4.86% YoY In Apr-24 as Feed Demand Rebound

As of Apr-24, the wholesale price of soybeans in Taiwan stood at USD 2.22/kg, indicating a slight 4.86% YoY decrease, while the MoM price remained unchanged. This decline follows a trend from Dec-23, when prices were at USD 2.26/kg.

The price drop is due to consumption expectations in the 2023/24 season, which are projected to rebound, leading to higher soybean imports. A report from the FAS USDA forecasts a 3.5% YoY increase in soybean imports to 2.65 mmt to address the rising feed demand driven by the recovery in both the hog and poultry sectors. In 2023, weakened feed demand in Taiwan was observed due to animal diseases.

4. Actionable Recommendations

Implement Contingency Plans for Delayed Harvests

Given the wet weather conditions impacting soybean harvest progress in Argentina and Brazil, farmers should develop and implement contingency plans to mitigate potential yield losses and operational disruptions. Strategies include optimizing machinery maintenance schedules, adjusting harvesting techniques to suit field conditions, and prioritizing harvesting in areas with enhanced weather forecasts. Additionally, farmers should closely monitor weather updates and collaborate with local agricultural extension services for timely guidance on harvest management practices.

Promoting Farmer Cooperatives and Collective Action

In response to the challenges posed by weather-related disruptions and market dynamics, farmers can benefit from collective action through farmer cooperatives and producer associations. By pooling resources, sharing knowledge, and collectively negotiating input costs and market access, farmers can enhance their bargaining power and resilience in the face of external pressures. Farmer cooperatives can facilitate joint investments in infrastructure, such as storage facilities and processing plants, to improve post-harvest management and value addition.