1. Weekly News

Argentina

Argentina's Soybean Harvest Progress and Yield as of May 23, 2024

According to monitoring data from the Buenos Aires Grains Exchange, Argentina has harvested soybeans on 13.24 million hectares (ha) as of May 23, representing 77.9% of the planted area and up 14.2% week-on-week (WoW). Of this area, 41.29 million metric tons (mmt) of soybeans have been harvested, with an average yield of 3.12 metric tons (mt) per ha. Soybeans in Argentina were rated as follows: 28% poor/very poor, 47% fair, and 25% good/excellent, showing a 1% improvement from the prior week.

Brazil

Brazil's 2023/24 Soybean Production Forecast Slightly Reduced

Brazil’s soybean production for the 2023/24 season is forecasted to be 147.57 mmt, a slight decrease from the previously forecasted 147.96 mmt. This reduction is due to production losses in the flood-affected state of Rio Grande do Sul. However, an increase in the total planted area, which has grown for the 17th consecutive year, partially mitigated these losses. The planted area is now estimated at 45.935 million ha, up from 45.520 million ha, marking a 2.8% increase from the 2022/23 season. Despite the increase in acreage, the expected average soybean yield has been lowered from 3.25 mt/ha to 3.21 mt/ha, which is 10.8% below the record yield of 3.60 mt/ha achieved in the 2022/23 season.

Brazil's May-24 Soybean Exports Expected to Decrease 5% YoY

Brazilian soybean exports are expected to reach 13.745 mmt in May-24, according to a weekly survey by the National Association of Cereal Exporters (ANEC). This represents a 5% year-on-year (YoY) decrease compared to the 14.43 mmt shipped on May-23. In Apr-24, Brazil exported 13.438 mmt of soybeans. In W21, Brazil exported 3.213 mmt. ANEC forecasts shipments of 3.374 mmt between May 26 and June 1.

Brazilian Soybean Harvest 2023/24 Reaches 98.1% Completion

As of May 26, the harvest of the Brazilian soybean crop for the 2023/24 season has reached 98.1% of the planted area, according to the National Supply Company (Conab). This shows a delay of 1.1% YoY but an increase of 1.1% WoW. Only three states are still harvesting soybeans: Santa Catarina, with 98.5% completion; Rio Grande do Sul, with 90%; and Maranhão, with 88%. The states of Tocantins, Piauí, Bahia, Mato Grosso, Mato Grosso do Sul, Goiás, Minas Gerais, São Paulo, and Paraná have already finished harvesting soybeans.

Peru

Peru's Soybean Imports Surge From Jan-24 to Apr-24

From Jan-24 to Apr-24, Peru imported 65,244,950 kilograms (kg) of soybeans, with a CIF (Cost, Insurance, and Freight) value amounting to USD 31,498,163. During this period, Bolivia was the primary soybean supplier of the Peruvian market, accounting for placements totaling USD 17,002,901, representing 54% of total soybean imports. Following Bolivia, Paraguay supplied soybeans with a value of USD 11,931,553, while Chile provided USD 2,543,523 worth of soybeans. Other countries contributed USD 20,186 worth of soybean imports to Peru during this period.

South Africa

South Africa's Maize and Soybean Crop Forecasts Adjusted

The National Crop Estimates Committee (CEC) of South Africa has revised its maize crop forecast slightly downwards from 13.39 mmt to 13.31 mmt. Similarly, the gross soybean harvest estimate has been adjusted to 1.78 mmt, down from the previous forecast of 1.81 mmt. Contrastingly, South Africa harvested 16.43 mmt of corn and 2.77 mmt of soybeans in 2023.

2. Weekly Pricing

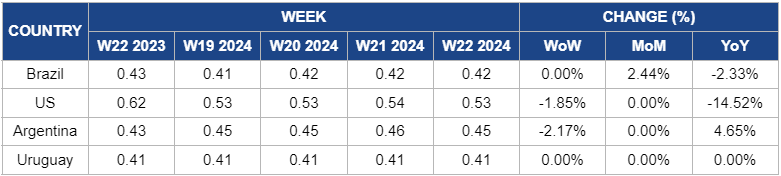

Weekly Soybean Pricing Important Exporters (USD/kg)

* Variety: Food-grade soybean

Yearly Change in Soybean Pricing Important Exporters (W22 2023 to W22 2024)

* Variety: Food-grade soybean * Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data, or seasonality

Brazil

Brazil’s soybean market remains unchanged WoW, with prices at USD 0.42/kg in W22. However, the month-on-month (MoM) price saw a 2.44% increase from USD 0.43/kg. This rise is due to forecasts indicating a decrease in soybean production for the 2023/24 season, primarily due to adverse weather conditions in Rio Grande do Sul and an 8.8% decline in productivity. Despite a slight increase in planted area, production is expected to decline by 5.4% compared to the previous harvest.

United States

US soybean prices decreased 1.85% WoW in W22 to USD 0.53/kg from USD 0.54/kg in W21. This decline is attributed to favorable growing conditions for spring soybean plantings, which saw a notable 10% increase in WoW.

Argentina

In W22, soybean prices in Argentina saw a 2.17% decrease in WoW to USD 0.45/kg from USD 0.46/kg in W21. This is due to the soybean harvest progressing to 86% completion as of May 29, covering 17.3 million ha, marking an 8% WoW increase. Moreover, the total crop yield is estimated at 50.5 mmt, with 44.882 mmt already harvested from 14.582 million ha. Current crop conditions were 22% good, 48% fair, and 30% poor. Forecasts indicate dry weather from June 2 to 8, which could facilitate harvest progress.

Uruguay

Uruguay's soybean prices remain unchanged at USD 0.41/kg in W22. The country is gearing up for what could be one of its most prosperous soybean harvests in recent years, buoyed by favorable rains that have allowed farmers to rebound from a crippling drought in the preceding season. There are expectations that soybean output may double in 2024, due to the improved weather conditions.

3. Actionable Recommendations

Implement Mitigation Measures for Soybean Production Challenges in Brazil and Argentina

Given the challenges faced by Brazil and Argentina in their soybean production, including adverse weather conditions and fluctuating market prices, it's crucial to implement mitigation measures to safeguard production and support farmers. Both governments should prioritize investments in agricultural infrastructure, such as irrigation systems and drainage facilities, to mitigate the impact of floods and droughts on crop yields. Additionally, research and development initiatives to develop climate-resilient soybean varieties can help farmers adapt to changing environmental conditions. Collaborative efforts between government agencies, research institutions, and the private sector are essential in providing timely support and resources to farmers affected by production challenges, ensuring stability in soybean production and market supply.

Enhance Soybean Import Diversification and Food Security in Peru

Considering Peru's significant reliance on soybean imports, efforts should be made to enhance import diversification and strengthen food security measures. The Peruvian government should explore partnerships with a diverse range of soybean-exporting countries to reduce dependence on a few suppliers and mitigate supply chain disruptions. Investing in domestic soybean production through agricultural incentives and capacity-building programs can also help reduce import dependency and enhance food self-sufficiency.

Optimize Harvesting Practices and Market Access in Uruguay

With Uruguay anticipating one of its best soybean harvests in years, optimizing harvesting practices and market access will be critical to capitalize on this opportunity. The Uruguayan government should prioritize investments in post-harvest infrastructure, such as storage facilities and transportation networks, to ensure efficient processing and distribution of soybeans. Facilitating access to export markets through trade agreements and export promotion initiatives can help expand market opportunities for Uruguayan soybean producers. Furthermore, providing technical assistance and financial support to farmers can enhance productivity and competitiveness in the global soybean market, positioning Uruguay as a reliable supplier of high-quality soybeans.

Sources: Oil World, UkrAgroConsult, Canal Rural, Agraria, The Edge Malaysia