W31 2024: Rice Weekly Update

.jpg)

1. Weekly News

Indonesia

Indonesia's BULOG Imports 2.5 MMT of Rice to Stabilize Prices and Support Food Aid

Indonesia Logistics Bureau (BULOG) has imported 2.5 million metric tons (mmt) of rice, mainly from Thailand and Vietnam. Alongside imports, the government has also absorbed 768,716 metric tons (mt) of locally harvested rice to support the Government Rice Reserve (CBP). This includes 613,724 mt for CBP and 154,992 mt of commercial rice. As of July 27, 2024, BULOG's total rice stock is 1.61 mmt, with 1.53 mmt for CBP and 78,467 mt for commercial use. The rice is used for price stabilization through the Food Supply and Price Stabilization Program (SPHP) rice program and food aid distribution. For the phase III food assistance program, BULOG aims to distribute food aid to 22 million beneficiary families starting August 1, 2024.

Iraq

Iraq Resumes Rice Cultivation with New Strain Amid Improved Water Conditions

After a two-year ban due to water scarcity, Iraq has resumed rice cultivation in W31 and is testing a strain that requires less water. The Deputy Minister of Agriculture announced that 150 square kilometers (sq km) have been allocated for rice growing this season, with a forecasted yield of 150 thousand mt, supported by heavy winter rainfall and increased water flows from Turkey. The previous ban restricted rice planting to 5 to 10 sq km annually for seed extraction, driven by a water crisis linked to upstream dams, reduced rainfall, and climate change. Despite resuming cultivation, Iraq, one of the world's top 10 importers of rice and wheat, will still need to import around 1.25 mmt of rice in 2024 to meet domestic demand. Historically, Iraq was self-sufficient in rice, but soil salinity, poor irrigation, drought, and conflict have impacted its agriculture. Rice farming in Iraq begins in June and ends with a November harvest, with the famous Amber rice being an essential variety.

Pakistan

Pakistan Achieves Record Rice Exports Amid Anticipated Policy Changes in India

Pakistan reported record rice exports of USD 3.88 billion in the 2024 Fiscal Year (FY), a 78% year-on-year (YoY) increase. Despite this achievement, the industry faces challenges due to India's expected easing of its rice shipment restrictions. India's bans on broken rice exports in Aug-22 and non-basmati rice in Jul-23, followed by further restrictions on basmati and parboiled rice in Aug-23, had boosted Pakistan's exports. India imposed these measures to curb domestic inflation ahead of an election year. However, with less than impressive results in the general elections and challenging state assembly polls ahead, India is likely to lift these restrictions soon. Indian rice's return to the market is expected to impact Pakistan and international rice prices significantly. It could reclaim the market share gained by Pakistani exporters over the past year.

Singapore

Singapore Increases Rice Imports from Vietnam Amid India's Export Ban

Singapore's top rice source continues to be Vietnam, importing rice worth over USD 54.6 million from Jan-24 to Jun-24, marking a YoY increase of 54.67%. According to the Vietnam Trade Office data in Singapore, there is significant growth in specific rice categories. Vietnamese glutinous rice imports surged fivefold to USD 6.72 million, broken rice increased by 187.3% to USD 1.13 million, and milled or husked fragrant rice rose by 161.35% to USD 20.59 million. Conversely, earnings from white rice saw a modest increase of 1.91% to USD 26.05 million, while revenue from regular brown rice fell by 51.2% to USD 77,016. In comparison, Thailand and India exported rice worth USD 53.41 million and USD 44.10 million to Singapore. The rise in Singapore's rice imports is due to India's rice export ban and the country's tourism recovery, with overall spending on rice increasing by 13.62% YoY to nearly USD 169.51 million.

2. Weekly Pricing

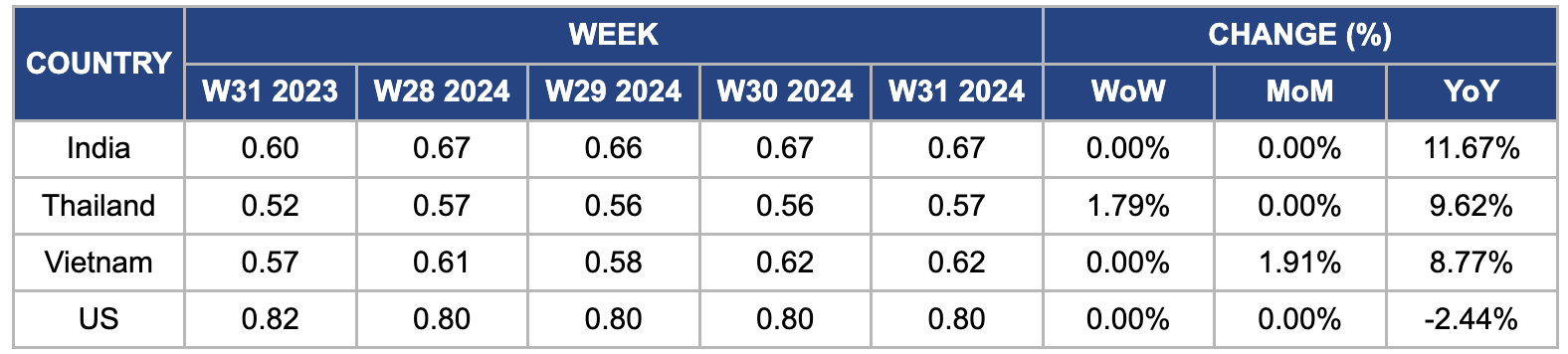

Weekly Rice Pricing Important Exporters (USD/kg)

Yearly Change in Rice Pricing Important Exporters (W31 2023 to W31 2024)

India

In W31, wholesale rice prices in India remained stable at USD 0.67 per kilogram (kg) week-on-week (WoW). However, the YoY price increased by 11.67%. This price rise is due to a prolonged dry spell and intense heat waves that have severely impacted paddy fields, leading to significant agricultural losses. The India Meteorological Department (IMD) has forecasted rainfall, expected to mitigate some of these adverse effects. Additionally, increased international demand for rice from countries such as Malaysia contributes to the upward price trend.

Thailand

In W31, wholesale rice prices in Thailand rose by 1.79% WoW to USD 0.57/kg, up from USD 0.56/kg. The price increased by 9.62% YoY from USD 0.52/kg in the same week of 2023. Thailand's rice exports increased significantly by 25% YoY in the first half of 2024, reaching 5.08 mmt. This growth is driven by strong demand from markets such as Indonesia and the Philippines, higher expected production, and a weakened baht (THB). The country anticipates exporting 8.2 mmt of rice in 2024, up from the previous forecast of 7.5 mmt, aided by the diminishing effects of El Niño.

Vietnam

In W31, wholesale prices for Vietnamese regular rice remained steady WoW at USD 0.62/kg but increased by 8.77% YoY from USD 0.57/kg in the same week of 2023. This price surge is due to strong demand, with Vietnam's rice exports forecasted to rise due to robust supply and increasing demand towards the year's end. Critical markets for Vietnamese rice include the Philippines, Indonesia, China, Malaysia, Singapore, and Ghana. In the first half of 2024, Vietnam exported over 4.5 mmt of rice, generating nearly USD 3 billion in revenue. For the first half of Jul-24, exports surpassed 290 thousand mt, valued at USD 177 million, marking a 15% YoY increase in quantity and a 30% YoY rise in value. The Ministry of Agriculture and Rural Development projects that Vietnam will produce 43 mmt of rice in 2024, with 8 mmt set for export, aiming for a total export value of USD 5 billion.

United States

In W31, the wholesale price of US-milled white long rice held steady at USD 0.80/kg, reflecting a 2.44% YoY decrease. Despite the summer months presenting challenges, such as Iraq's banking issues and the crisis in Haiti, the US milled rice market is demonstrating resilience with favorable harvest conditions. The focus is strengthening export markets and improving internal relations to sustain market stability.

3. Actionable Recommendations

Strengthen Export Strategies and Market Diversification

Pakistan should continue to build on its strong export performance by diversifying its market reach and negotiating long-term trade agreements. This will help buffer the potential impact of India’s anticipated policy changes. A stable supply of Pakistani rice will benefit emerging and existing markets such as the Philippines, Malaysia, and African countries. Diversified export strategies will ensure consistent availability for importing countries and maintain Pakistan's competitive edge in the global rice market.

Enhance Domestic Rice Production and Reduce Dependency on Imports

Indonesia should implement sustainable agricultural practices, including water-efficient irrigation, reduced pesticide use, and soil conservation. Supporting farmers adopting these practices can enhance long-term rice production resilience and mitigate environmental impacts. By reducing import dependency, Indonesia can strengthen its domestic food security, benefiting local farmers and consumers.

Strengthen International Collaboration for Rice Research and Development

Countries like Vietnam and Russia should invest in research and development to produce higher-yield and climate-resilient rice varieties. Collaboration with agricultural research institutions and increased funding for innovation can drive advancements in rice breeding and farming techniques. Rice-importing countries such as the Philippines, Indonesia, Nigeria, Bangladesh, and Malaysia would benefit significantly from this initiative. Increased production of resilient and high-yield rice varieties would enhance rice availability, improve supply stability, and potentially reduce import costs, contributing to global food security.

Sources: Tridge, WTO Center, Kontan, UkrAgroConsult, Planetaarroz, Bangkokpost