W34 2024: Banana Weekly Update

1. Weekly News

Cambodia

Cambodia's Banana Exports Decline Amid Climate and Competition Challenges

According to the Ministry of Agriculture, Forestry, and Fisheries, Cambodia's banana exports fell by 20.59% from Jan-24 to Jul-24, totaling 143.4 thousand metric tons (mt) and generating over USD 96.7 million. This decline is mainly due to climate change and increased competition from neighboring countries, affecting key markets like China, Japan, Korea, and Vietnam. Despite this setback, there is optimism for a recovery next year. The government is actively enhancing the agricultural sector by transitioning from household to commercial farming and providing technical support to farmers, aiming to boost production and income.

Dominican Republic

Electricity Crisis Threatens Banana Production in the Dominican Republic's Barahona Region

Farmers in the Barahona region of the Dominican Republic are facing a serious banana production crisis due to low voltage levels that have made 17 electric pumps unusable. These pumps are essential for irrigating Yaque del Sur River banana fields. As a result, crops are in critical condition, and many farmers fear the damage may be irreversible. Although electricity company EDESUR is aware of the problem, no solution has been provided. Farmers, especially in Bombita Canoa, urgently ask the President to intervene, warning that the local banana industry and many families' livelihoods are at risk without immediate action.

Ecuador

Ecuador Faces Major Banana Losses Due to Moko Disease

In Ecuador, the banana industry is losing about USD 700 thousand each week due to Moko disease, which affects around 70 thousand boxes of bananas. The Ecuadorian government has set up a Scientific Technical Committee in Guayaquil comprising officials, bankers, producers, and academics to address the issue. BanEcuador offers loans up to USD 150 thousand to affected producers, with a one-year grace period and a 16% interest rate. The committee will also address other agricultural issues like drug contamination. Current efforts include inspecting abandoned plantations and applying biosecurity measures, but only 11% of farms follow these practices. In Los Ríos province, around 8% of banana crops are infected, up from less than 3% last year. Drones in Manabí have identified about 2.5 thousand hectares (ha) of affected bananas. An early warning system will soon be introduced to improve communication and response to potential outbreaks.

Netherlands

Banana Market in the Netherlands Shows Resilience Amid Seasonal Dip

The Netherlands’ banana market briefly dropped over the past three weeks due to heat and summer holidays. However, prices quickly rebounded, with green bananas now costing about USD 13.30 (EUR 12), up from a recent low of USD 11.08 (EUR 10). Prices are expected to stay stable because of strong banana consumption, likely due to their affordability compared to other fruits. In addition, banana exports to Ukraine have increased, shifting from Odessa to Northern Europe, and organic bananas are slowly gaining market share as part of a sustainability effort.

Philippines

Philippine Banana Exports to China Decline Amidst Rising Competition

The export of Philippine bananas to China sharply decreased as Vietnamese bananas gained market share. Unfavorable weather in the Philippines reduced production and raised prices, making room for the more affordable and high-quality Vietnamese bananas, which Chinese consumers now prefer. Additionally, expanding banana plantations in Vietnam, Cambodia, and Laos have increased supply and reduced demand for Philippine bananas. Geopolitical tensions, including disputes in the South China Sea, have also led some Chinese consumers to avoid Philippine bananas. In China, banana prices vary, with moderate supply and fluctuating demand in Guangdong and Hainan.

Spain

Canary Bananas Struggle Amid Overproduction and Price Crisis

Since Jul-24, the Canary Islands banana industry has been in a severe price crisis due to overproduction and climate issues. Banana supply dramatically exceeded demand, especially in the summer months of July and August. High temperatures and climate change worsened this problem, leading to an oversupply. In W34, the market will have about 7.5 million kilograms (kg) of bananas, but only 5 million kg will be sold, leading to significant waste. By Aug-24, an estimated 3 million kg of bananas will be discarded. Despite this, retail prices remain high because the market share of imported bananas increased from 50% to nearly 60% at Mercabarna, Spain's second-largest wholesale market. The situation is expected to improve with the return of the school year, which usually boosts demand and stabilizes the market.

Thailand

Surge in Thailand's Nam Wa Banana Prices Amid Extreme Weather Challenges

Nam Wah banana prices in Thailand have surged to USD 1.77/bunch (THB 60/bunch), with expectations to rise further to USD 2.35/bunch (THB 80/bunch). Nam Wah bananas are usually priced at USD 0.89 to 1.18/bunch (THB 30 to 40/bunch), but prices have sharply increased due to extreme weather conditions. Intense heat and drought have caused widespread diseases and pest infestations, severely impacting banana yields. Farmers report that middlemen are struggling to secure sufficient supplies, and while farm prices have doubled to USD 0.59/bunch (THB 20/bunch), market prices have tripled. The price increase started in Jun-24 and is expected to continue until the end of the year. Normal yields are likely to return by late 2024 or early 2025.

2. Weekly Pricing

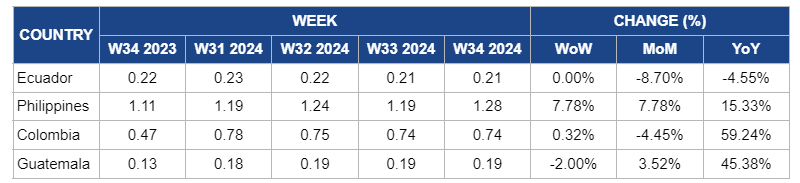

Weekly Banana Pricing Important Exporters (USD/kg)

Yearly Change in Banana Pricing Important Exporters (W34 2023 to W34 2024)

Ecuador

In Ecuador, banana prices remained steady at USD 0.21/kg in W34, reflecting an 8.7% month-on-month (MoM) and a 4.55% year-on-year (YoY) decline. Despite the ongoing challenges posed by Moko disease and the significant financial losses impacting the industry, prices have not increased as might be expected. This stability is due to the current high inventory levels and efforts by the Ecuadorian government to address the disease's impact, such as providing loans to affected producers and implementing biosecurity measures. Additionally, the low adherence to recommended practices and the gradual introduction of new measures may delay the anticipated price increase. As the industry adapts to these measures and works to control the disease, price movements may stabilize further depending on the effectiveness of these interventions and the overall impact on production.

Philippines

Philippine banana prices increased by 7.78% week-on-week (WoW) and MoM to USD 1.28/kg in W34, up from USD 1.19/kg in W33, with a 15.33% YoY rise. This increase is due to adverse weather conditions, including heavy rainfall, which has reduced local banana production and increased prices. The diminished supply has been worsened by the growing presence of Vietnamese bananas in the Chinese market, which are seen as more affordable and of higher quality, driving demand for Philippine bananas down. Additionally, geopolitical tensions and expanded banana plantations in neighboring countries have further pressured the export market. Despite the price rise, the Philippine banana sector faces ongoing challenges as it adjusts to these adverse weather conditions and shifting market dynamics.

Colombia

In W34, banana prices in Colombia rose slightly by 0.32% WoW to USD 0.74/kg, marking a significant 59.24% increase YoY. The minor weekly rise indicates a stabilization in production and supply after the disruptions caused by heavy rains in Q2-24. Although production has normalized and exports continue to grow, prices remain high compared to the previous year due to the lingering effects of climate-related issues, particularly the El Niño phenomenon, which previously led to substantial production setbacks and tighter supply. The sharp YoY increase underscores the persistent impact of these disruptions on the market.

Guatemala

Guatemalan banana prices decreased by 2% WoW to USD 0.19/kg in W34. The weekly decline reflects a modest adjustment in the market as supply and demand reach a temporary equilibrium. However, prices increased by 3.52% MoM and 45.48% YoY. The MoM and YoY price increases continue to reflect the strong global demand and the ongoing logistical challenges that impact export costs. The persistent YoY surge underscores the pressures from international market dynamics and the rising costs associated with banana exports from Guatemala.

3. Actionable Recommendations

Strengthen Resilience in Nam Wah Banana Supply Chain

To stabilize the sharp rise in Nam Wah banana prices in Thailand, farmers should enhance resilience by adopting advanced farming practices. This includes using drought-resistant banana varieties, such as FHIA-17 or Cavendish, better suited to withstand extreme weather. Additionally, implementing integrated pest management (IPM) techniques, like biological controls and regular crop rotation, can reduce pest infestations. Collaborating with supply chain partners to improve distribution efficiency and implement weather monitoring systems will ensure a more consistent supply. These strategies will allow farmers to better manage price volatility and secure steady income despite environmental challenges.

Balance Supply to Reduce Banana Waste in the Canary Islands

Producers should immediately adjust production and distribution strategies to match market demand better and mitigate the ongoing price crisis in the banana industry in the Canary Islands. This includes temporarily reducing banana harvest volumes and coordinating with local markets to prioritize the sale of domestic bananas over imports. By closely monitoring demand fluctuations and aligning supply accordingly, they can minimize waste and prevent further price instability. These actions will help stabilize the market and reduce the financial impact of overproduction.

Revitalize Philippine Banana Exports to China Through Enhanced Quality and Strategic Positioning

To regain market share in China, Philippine banana exporters should focus on improving the quality and consistency of their products through better farming practices, such as adopting sustainable and efficient cultivation techniques and implementing advanced post-harvest handling processes to reduce spoilage and maintain freshness. Additionally, they should strengthen relationships with Chinese importers by offering competitive pricing and exploring new marketing strategies highlighting the superior quality of Philippine bananas. Addressing geopolitical tensions through diplomatic channels could also help restore consumer confidence in Philippine products.

Sources: Tridge, Nationthailand, Dominicantoday, N Digital, Khmer Times, Agricultural Finance Network Banana, Expreso