W34 2024: Tomato Weekly Update

1. Weekly News

Europe

Moroccan Tomato Imports to EU Declined 6.8% in 2023/24 Season

From Sept-23 to May-24, the European Union (EU) experienced a 6.8% decline in tomato imports from Morocco, with total imports falling to 464,052 metric tons (mt) from 497,928 mt in the previous period. This decrease is notable as it contrasts with the overall reduction of 5.7% in EU tomato imports, which have dropped from 1.37 million metric tons (mmt) to 1.29 mmt. The decline in Moroccan tomato imports is significant given that Morocco remains the EU's top supplier despite a decrease in volume compared to the record levels of the previous period. Imports from non-EU countries have also decreased by 5.9% year-on-year (YoY), totaling 705,482 mt. However, this represents a 13.4% increase compared to the five-year average. Among third countries, Turkey has seen the most substantial growth in tomato exports to the EU from Sept-23 to May-24, rising by 40.4% from 80,018 mt to 191,769 mmt. Tunisia remains a smaller supplier, contributing 24,286 mt.

Australia

Biosecurity New Zealand Restricts Tomato Seed Imports from Australia Following Virus Detection

Biosecurity New Zealand implemented import restrictions on tomato seed imports from Australia following the detection of Tomato Brown Rugose Fruit Virus (ToBRFV) at two growing properties in South Australia. Therefore, all tomato seeds imported from Australia must be tested for ToBRFV before arrival in New Zealand. This requirement aligns with existing protocols for seeds from countries where the virus is present. Tomato imports from all Australian states, except Queensland, have been temporarily suspended. Queensland has been excluded from the restrictions as there is no evidence of the virus or connections to the affected properties in South Australia.

Brazil

Brazil's Wholesale Tomato Prices Declined 43.96% MoM in Jul-24

In Jul-24, the prices of most vegetables and fruits in Brazil's main wholesale markets fell significantly, as reported in the 8th Bulletin of the Brazilian Program for the Modernization of the Fruit and Vegetable Market (Prohort), released by the National Supply Company (CONAB) on August 16. The price of tomatoes fell by 43.96% month-on-month (MoM) compared to Jun-24. This is due to a 13% MoM increase in supply, which marked the highest volume in 2024.

India

Tomato Prices in Bangalore Plummet Due to Political Unrest in Bangladesh

Tomato prices in Bangalore, India, drastically dropped from nearly USD 1.19 per kilogram (kg) in 2023 to a range of USD 0.12 and 0.24/kg in W34, primarily due to political unrest in Bangladesh. This unrest significantly reduced tomato exports to Bangladesh from Kolar district, Bangalore’s leading tomato supplier. Exports have decreased from 800 and 1 thousand mt to just 50 and 60 mt in recent weeks, negatively impacting local farmers and traders. Additionally, outstanding payments from Bangladeshi traders amount to USD 4.77 to 5.96 million. In contrast, India’s agricultural sector is bracing for potential price increases for various vegetables due to heavy rains, threatening crops like tomatoes, groundnuts, pulses, sunflowers, and betel leaves. Excess moisture has already caused issues in the Nayakanahatti region, making it difficult for farmers to manage water storage and exacerbating the risk of crop spoilage.

Nepal

Kathmandu Vegetable Prices Surged Amid Supply Stabilization Efforts

On August 16, vegetable prices in the Kathmandu Valley, Nepal, surged sharply over the past two weeks, impacting seasonal and non-seasonal vegetables like tomatoes, potatoes, and onions. This increase has led many locals to reduce their daily vegetable consumption. Vendors attribute the price hikes to rising production costs, exacerbated by a heat wave in the early rainy season, negatively affecting yields. An information officer from Nepal's largest fruit and vegetable market noted that price increases are typical during the rainy season. Specifically, the price of cherry tomatoes has soared by 101.52%, reaching USD 0.34/kg.

2. Weekly Pricing

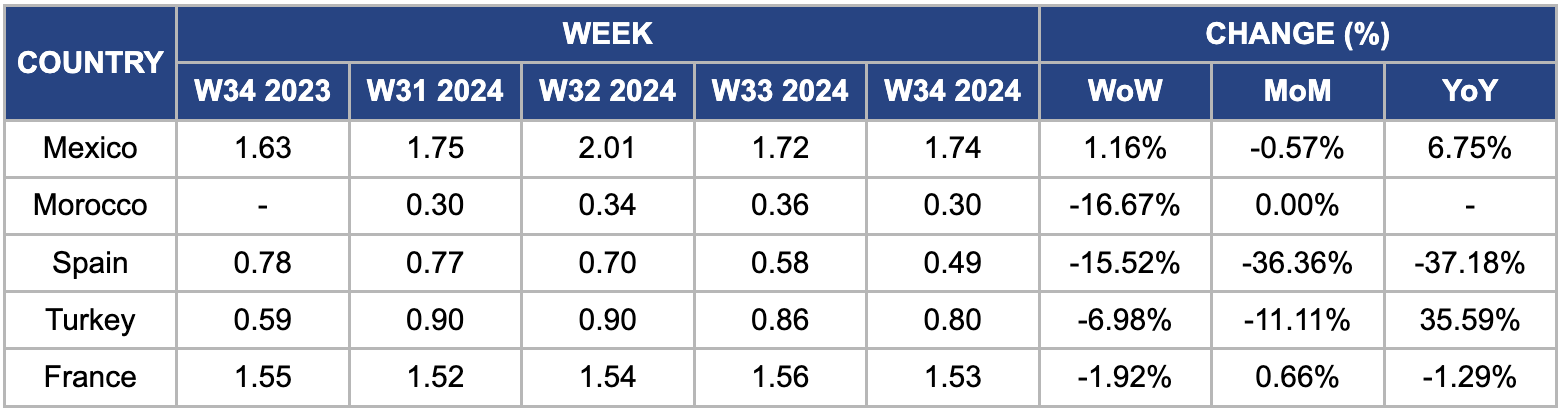

Weekly Tomato Pricing Important Exporters (USD/kg)

* Varieties: All tomato pricing is for round tomatoes.

Yearly Change in Tomato Pricing Important Exporters (W34 2023 to W34 2024)

* Varieties: All tomato pricing is for round tomatoes

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Mexico

In W34, wholesale tomato prices in Mexico slightly increased by1.16% week-on-week (WoW), rising from USD 1.72/kg to USD 1.74/kg. Mexican tomato prices remain the highest among other suppliers, including Morocco, Turkey, Spain, and France. Prices have also risen 6.75% YoY, driven by growing export demand. Mexico's 2024 tomato production is forecasted to reach 3.30 mmt, marking a 2% YoY increase from the 3.22 MMT estimated for 2023, which could help with price stabilization and drops in the upcoming weeks. Despite investments in protected production by some producers, many regions still rely on open-field cultivation, which exposes them to climatic risks and results in lower yields.

Morocco

In W34, Moroccan tomato prices significantly declined 16.67% WoW, falling to USD 0.30/kg from USD 0.36/kg. This drop reverses the price increases observed in the previous two weeks. The price decrease is due to rising temperatures in several Moroccan cities, aiding in higher production. Moreover, the price decline is also influenced by a 6.8% drop in Moroccan tomato exports to the EU from Sept-23 to May-24. This reduction is part of a broader trend, with overall EU tomato imports falling by 5.7% compared to the previous period and 9.6% compared to the average of the past five years. The drop in demand influences the price drops.

Spain

In W34, Spain's wholesale tomato prices dropped, falling 15.52% WoW from USD 0.58/kg in W33 to USD 0.49/kg. This decline represents a significant YoY decrease of 37.18%. The reduction in prices is due to the conclusion of the greenhouse tomato campaign in Almería, which has led to expectations for an earlier start to the 2024/25 season. Additionally, increased tomato imports from Morocco have contributed to the price drop. The tomato influx from various sources has intensified downward pressure on prices, particularly in Almería during the winter tomato campaign.

Turkey

In W34, Turkey's tomato prices declined slightly by 6.98% WoW to USD 0.80/kg and 11.11% MoM. This decrease is due to an overproduction of tomatoes in 2024 and an ongoing export ban on tomato paste, which has led to a surplus and consequently reduced prices. Despite this, prices surged by 43% YoY. The YoY increase is due to drought conditions exacerbated by climate change, severely impacting agricultural output and driving up diesel fuel and transport costs. These challenges have led to frequent protests by farmers in provinces such as Bursa, Kahramanmaras, Balikesir, Aksaray, and Nigde. Farmers have used tractors to block roads and draw attention to economic hardships. In Gaziantep, some farmers have protested by dumping unsold tomatoes on the road, highlighting their struggles with rising costs and declining profits despite higher consumer prices due to inflation.

France

In W34, tomato prices in France decreased by 1.92% WoW to USD 1.53/kg from USD 1.56/kg the previous week. After a challenging start to the season, the French tomato market is showing signs of recovery, with increased consumption and moderated production. However, forecasted high temperatures across Europe will likely lead to additional production losses and further price increases. This trend is expected to persist, particularly in the Mediterranean region, where extreme heat could further impact tomato crops grown in tunnels, shelters, or open fields.

3. Actionable Recommendations

Strengthen Regional Market Integration and Collaborative Efforts

The varying price trends and market dynamics across regions, including France, Turkey, and Morocco, highlight the need for regional market integration and collaborative efforts. France's price decrease amid forecasted high temperatures and production challenges indicates regional cooperation's importance in addressing climate impacts and ensuring market stability. Collaborating with neighboring countries and engaging in regional agricultural forums can help develop strategies to manage production losses and stabilize prices. For Turkey, addressing the impact of drought and high costs through regional partnerships and support initiatives can mitigate the effects of climate change and economic challenges. Countries can better manage production and pricing dynamics by enhancing regional market integration and fostering collaborative efforts, supporting overall market stability and resilience.

Leverage Price Drops for Market Positioning and Export Growth

The significant drop in tomato prices in Brazil and India allows these countries to enhance their market positioning and export growth. In Brazil, the 43.96% MoM price drop due to increased supply provides a chance to capture international market share by offering competitively priced tomatoes to global buyers. Brazil should focus on expanding its export reach to markets such as the United States and Europe, where price-sensitive consumers and buyers will likely respond positively to lower prices. Similarly, India’s drastic price drop due to reduced exports to Bangladesh highlights the need to explore new export opportunities and strengthen market linkages with countries in the Middle East and Southeast Asia. By capitalizing on lower prices and expanding export markets, Brazil and India can enhance their global market presence and stabilize their domestic markets.

Enhance Diversification and Strategic Partnerships for Tomato Imports

Given the decline in EU imports of Moroccan tomatoes, Morocco should focus on diversifying its export markets and strengthening trade partnerships. Despite being the EU's top supplier, the reduced import volumes highlight the need for Morocco to explore alternative markets to offset this decline. Expanding exports to emerging markets in the Middle East, such as Saudi Arabia and the United Arab Emirates (UAE), and growing markets in Asia, like India and China, could provide new revenue streams. Additionally, strengthening bilateral trade agreements with key EU countries and exploring new trade opportunities in regions with rising demand for tomatoes, such as Eastern Europe, will help stabilize Moroccan tomato exports. This strategy will support Moroccan producers by mitigating the impact of EU market fluctuations and providing a more balanced global market presence.

Sources: Tridge, Portal Do Agronegócio, Foodmate, East Fruit, Agro Popular, Mpi, Hortidaily