1. Weekly News

India

India Increased Import Tax on Edible Oils to Protect Local Farmers

On September 13, 2024, India declared a 20% increase in the basic import tax on crude and refined edible oils, effective September 14, 2024, to support domestic oilseed farmers. This change is anticipated to raise local edible oil prices, lower demand, and reduce palm, soy, and sunflower oil imports. With the Agriculture Infrastructure and Development Cess (AIDC) included, the total import tax on crude soybean, palm, and sunflower oils rose from 5.5% to 27.5%. In addition, the import tax for refined palm, soybean, and sunflower oils increased to 35.75% from 13.75%.

FAS Projects Increased Soybean Oil Production for India

According to the United States Department of Agriculture’s (USDA) Foreign Agricultural Service (FAS), India’s soybean production is anticipated to reach a record of 12.8 million metric tons (mmt) in the 2024/25 season due to early monsoon rains and favorable weather conditions during the planting period. Soybean oil production also saw an 11% year-on-year (YoY) increase, rising from 1.98 mmt to 2.2 mmt, in response to solid domestic vegetable oil demand. Due to anticipated lower international soybean oil prices, FAS revised its import forecast, predicting a 21% YoY increase, with imports expected to total 3.7 mmt.

Mexico

Mexico Initiates Antidumping Investigation on Epoxidized Soybean Oil Imports from Brazil and China

The Secretariat of Economy in Mexico has announced in the Official Gazette of the Federation the initiation of an antidumping investigation on imports of epoxidized soybean oil from Brazil and China. The investigation focuses on epoxidized soybean oil in pure or concentrated form, either unmixed or in mixtures containing 85% to 99% of soybean oil combined with other plasticizers. The investigation period spans from April 1, 2023, to March 31, 2024, with the injury analysis covering April 1, 2021, to March 31, 2024. Interested importers, exporters, and domestic producers have 28 business days to submit their responses, arguments, and evidence, with a deadline of 32 days by October 22, 2024.

2. Weekly News

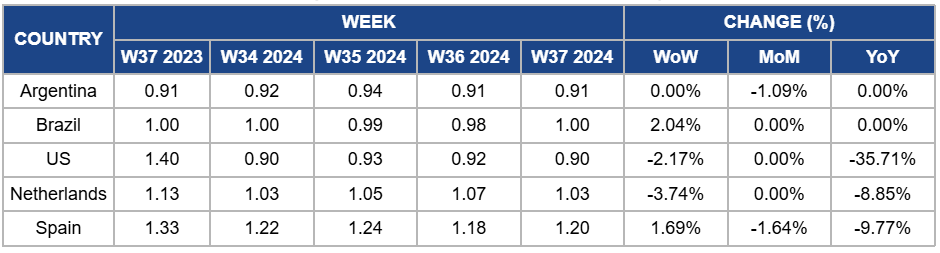

Weekly Soybean Oil Pricing Important Exporters (USD/kg)

Yearly Change in Soybean Oil Pricing Important Exporters (W37 2023 to W37 2024)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Argentina

In W37, Argentina’s soybean oil price remained flat at USD 0.91 per kilogram (kg). This stability is attributed to Argentina’s solid production outlook, with soybean production expected to increase by 4.1% YoY in the 2024/25 season. Despite this weekly stability, Argentina faces challenges from high inflation and a depreciated currency, which have reduced export revenues from soybeans and soybean oil. These economic pressures may hinder processors’ ability to operate efficiently, potentially affecting future production and processing activities.

Brazil

Brazil's soybean oil price rose by 2.04% WoW, reaching USD 1/kg in W37, showing a slight recovery from the previous week's decline. The month-on-month (MoM) and YoY prices remained unchanged. Despite the global decline in soybean oil prices, Brazil's local prices remained stable due to limited local supply and stable export demand. Market agents are awaiting the supply and demand report from the USDA to make decisions about their selling strategy. In addition, the record soybean harvest in the United States (US) and the increasing local demand from the biofuel sector will continue to influence the prices.

United States

In W37 2024, US soybean oil prices dropped by 2.17% WoW to USD 0.90/kg, reflecting stable MoM pricing but a significant 35.71% YoY decrease. The decline is primarily due to an expected increase in US soybean production, which is projected to grow by 10.2% YoY in the 2024/25 season. The ample soybean supply has led to higher crushing capacity, although tighter margins and increased production costs have tempered some expansion efforts. In addition, the uncertainties on the soybean and soybean oil imports from China due to political reasons put further downward pressure on US soybean oil prices.

Netherlands

In the Netherlands, soybean oil prices dropped by 3.74% WoW to USD 1.03/kg in W37, indicating stable MoM prices but an 8.85% YoY decrease. The oversupply in the global vegetable oil market, particularly from Argentina and Brazil, has led to downward adjustments. In addition, the ongoing trade conflict between China and the US has brought uncertainties to global soybean oil futures prices. However, the European Union’s (EU) push for increased biofuel use is expected to support prices in the country.

Spain

In W37, Spain’s soybean oil prices increased by 1.69% WoW to USD 1.2 /kg due to currency fluctuations. However, the MoM and YoY prices declined by 1.64% and 9.77% respectively. The WoW price increase was supported by strong demand from the biofuels sector and uncertainties in Brazilian production caused by prolonged drought. Consistent rainfall is expected only from Oct-24, which could allow sowing activities to progress more steadily at that time.

3. Actionable Reccomendations

Enhancing Market Stability Amid Production Increases

To manage the significant increase in soybean production, US producers should prioritize expanding processing capacity through strategic investments in efficient crushing plants. This would allow them to handle excess supply without compromising margins. Exporters should also focus on securing alternative trade partnerships outside of China to mitigate the risk posed by political tensions. Moreover, US producers could consider capitalizing on emerging biofuel markets in the EU and Asia to absorb some of the increased supply and stabilize prices.

Stabilizing Processing Capabilities Amid Economic Pressures

Stakeholders should collaborate with local financial institutions to secure flexible financing options to counteract the adverse effects of high inflation and currency depreciation on soybean oil exports. These loans would enable processors to maintain operational efficiency and continue investing in modern technology to maximize yields. In addition, exporters should diversify their markets by targeting regions less affected by global oversupply, such as Africa and the Middle East. This diversification will help mitigate risks associated with global price fluctuations and weak foreign currency inflows.

Leveraging Biofuel Demand for Price Stability

Given the rising domestic demand for soybean oil in Brazil’s biofuel sector, producers should focus on securing long-term contracts with biofuel companies to ensure stable pricing. Moreover, Brazilian producers should work closely with government bodies to encourage policies that support the biofuel industry, such as incentives for biofuel production and consumption.

Sources: Tridge, Theprint, Portal Do Agronegocio, Whitecase