W4 2025: Mango Weekly Update

In W4 in the mango landscape, some of the most relevant trends included:

- Unseasonal rains in Mexico and cold weather in Peru are severely affecting mango production, causing delays and reduced yields.

- Overproduction in Peru and Argentina and market saturation are driving mango prices down significantly.

- Peru faces logistical issues and market saturation, while Pakistan is seeing strong export demand, especially from the UK and the UAE.

- Rising production costs and increased shipping costs in Peru are adding pressure to the mango industry. In Argentina, the rising costs of fertilizer and electricity are impacting profitability despite increased production.

- Producers in Peru are seeking government support to address water shortages, pest issues, and economic challenges. Argentina and Peru have also initiated programs promoting sustainable practices and varietal diversification to enhance competitiveness and reduce market vulnerability.

1. Weekly News

Argentina

Argentina's Mango Producers Face Challenges Due to Increased Bolivian Imports and Rising Costs

Mango producers in Argentina's Jujuy province face significant challenges as an influx of cheaper mango imports from Bolivia saturated the market, undermining profitability despite record production levels this 2024/25 season. Mango production has doubled compared to last year, and premium varieties like Tommy Atkins and Osteen continue to be high quality. However, stagnant prices at 2023 levels and rising production costs, including fertilizer and electricity, have created financial strain. Provincial programs promoting sustainable practices and varietal diversification aim to boost competitiveness, but the ability of Jujuy’s mangoes to secure a foothold in domestic and international markets remains uncertain.

Mexico

Mexico's Ataulfo Mango Production Faces Severe Decline Due to Unseasonal Rains

Mexico’s Ataulfo mango production in the Soconusco region is expected to drop by 30% year-on-year (YoY) in 2025, severely impacting over 3 thousand mango producers and more than 30 thousand hectares (ha) of mango orchards. This sharp decrease is due to atypical rains in mid-Nov-24, which disrupted the flowering process typically occurring in November, delaying the February harvest. The economic impact is substantial, with losses estimated at over USD 146.8 thousand (MXN 3 million), as each affected ha faces losses exceeding USD 489.38 (MXN 10 thousand). Producers have been forced to invest in additional labor, inputs, and aerial and ground applications to mitigate the damage. Efforts to secure support from local authorities and explore insurance programs are ongoing as the region grapples with this crisis.

Pakistan

Pakistan’s Mango Exports Surge with Strong Demand Across Global Markets

Between Jul-24 and Dec-24, Pakistan exported 4.7 thousand metric tons (mt) of mangoes, generating USD 17.97 million in revenue. The United Kingdom (UK) remained a primary importer, while other significant markets included the United Arab Emirates (UAE), Kazakhstan, Germany, Canada, Saudi Arabia, Oman, and Qatar, underscoring Pakistan's strong foothold in traditional and emerging global markets. This solid performance is especially significant given the challenges the mango export industry in Pakistan has faced in previous years. The industry had been facing a series of challenges, including climate-related challenges, such as drought and temperature extremes, which impacted mango yields and quality.

Peru

Peru’s Mango Season for 2024/25 Faces Weather Challenges, Logistics Issues, and Market Saturation

The Peruvian mango season nearing its end, facing several challenges across key regions: Piura has nearly exhausted its fruit supply, Lambayeque is midway through the season, and Ancash is preparing to start. Unseasonably cold weather from Jul-24 to Oct-24 accelerated harvests, creating competition for transport and packaging materials with the overlapping grape and blueberry seasons, driving up box and internal transport costs. Additionally, higher freight rates, a 30% increase in shipping costs, and delays of up to 20 days have disrupted export quality. Compounding these difficulties, Brazil's steady mango exports have saturated the European market, further hindering Peruvian exporters from gaining traction this season.

Peru's Mango Producers Facing Water Shortages and Pest Control Challenges Seek Support

Mango producers in Peru are facing challenges like water shortages and the persistent fruit fly pest, leading to calls for government intervention. Producers have urged the activation of Catastrophic Agricultural Insurance (SAC) to mitigate losses and requested financial support through Agrobanco. In response, Midagri and Agromercado are implementing measures such as establishing dehydrated mango processing centers, promoting mangoes in regional markets, and offering Global Gap (GAP) certification training to increase competitiveness. Producers are also being encouraged to form cooperatives, with the Earth Frut Cooperative highlighted as a successful example. To further ensure sustainability and diversify agricultural production, a pilot raspberry project has been introduced as a potential alternative crop.

2. Weekly Pricing

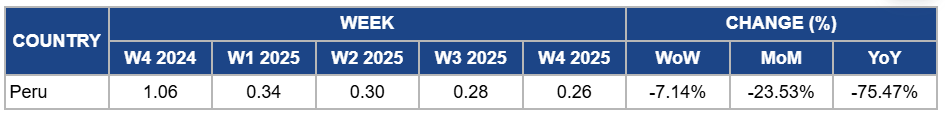

Weekly Mango Pricing Important Exporters (USD/kg)

Yearly Change in Mango Pricing Important Exporters (W4 2024 to W4 2025)

Peru

Mango prices in Peru fell by 7.14% week-on-week (WoW) to USD 0.26 per kilogram (kg) in W4, with a 23.53% month-on-month (MoM) decline and a 75.47% YoY drop due to continued overproduction, particularly in the Lambayeque region, which has contributed to an oversupply of mangoes in the market. Following the previous year's lower yields, this surplus has created a significant imbalance between supply and demand, further driving down prices. Additionally, the local prices have remained below production costs, prompting producers to abandon mangoes in the fields. Ongoing water shortages and early fruit ripening have compounded these challenges, intensifying the market pressure. The situation has been worsened by higher freight rates and delays in exports, which have further disrupted the Peruvian mango industry.

3. Actionable Recommendations

Optimize Transport and Focus on Timely Exports

Peruvian mango exporters should prioritize streamlining transport and packaging processes to address current supply chain challenges. With the overlapping harvests of grapes and blueberries, growers must plan logistics to minimize delays and higher costs. Collaborating with transport providers to secure timely shipping and packaging materials will ensure product quality and prevent export disruptions. To address market saturation, exporters should explore differentiated marketing strategies and targeted promotions to increase their competitiveness in the European market.

Mitigate Losses and Optimize Recovery Efforts

Mango producers in Mexico should prioritize recovery efforts by investing in targeted measures to counter the delayed flowering caused by unseasonal rains. This includes optimizing the use of additional labor and agricultural inputs to address the damage. To minimize further economic loss, producers should explore partnerships with insurance programs and local agricultural experts for cost-effective risk management strategies. Early intervention in the upcoming harvest season will be crucial to mitigate the drop in production and stabilize losses.

Sources: Tridge, Agraria, Agronegociosperu, Eldeber, Freshplaza, Oem, The News