W50 2024: Maize Weekly Update

1. Weekly News

Global

Global Maize Production Slips as Adverse Weather Impacts Key Growing Regions

According to the United Nations Food and Agriculture Organization (FAO), the reduction in global maize production forecasts is due to downward revisions in maize and wheat output expectations. World maize production is estimated at 1.22 billion metric tons (mt), slightly lower than the previous month's forecast and 1.9% below the 2023/24 level. This adjustment reflects lower-than-expected yields in major producing regions, particularly in the United States (US) and the European Union (EU), which are facing challenges such as adverse weather conditions and other yield-limiting factors.

Brazil

Brazil's Corn Exports in Dec-24 Fall Short of 2023 Levels

Brazil's corn exports for Dec-24 are now projected at 3.96 million metric tons (mmt), up from the earlier forecast of 3.59 mmt but significantly lower than the 6.46 mmt shipped during the same period in 2023. For 2024, corn exports are estimated at 38.15 mmt, a sharp decline compared to 55.56 mmt in 2023, reflecting reduced demand and increased global competition. Brazil exported 1.17 mmt of unmilled corn as of Dec-24, accounting for just 19.3% of the 6.06 mmt exported in Dec-23, according to the Foreign Trade Secretariat (SECEX). The daily average shipment of 234,175.1 mt during the first five working days represents a 22.8% year-on-year (YoY) decline compared to the same period in Dec-23, which saw a daily average of 303,109.8 mt. Although Brazil typically sees strong corn exports in December and January, export volumes in 2024 are expected to remain below the levels of the past two years. Despite the favorable exchange rate for exports, higher domestic corn prices above export parity have hindered the competitiveness of Brazilian shipments in the global market.

Thailand

Thailand’s Corn Production Up 2% for 2024/25 but Prices Drop 11%

Thailand's corn production for marketing year (MY) 2024/25 is forecasted at 5.4 mmt, a 2% YoY increase due to expanded planted areas and improved yields driven by favorable weather and reduced drought impact compared to MY 2023/24. Despite higher production, corn prices have declined, averaging USD 247/mt in Oct-24, down 11% YoY. This decline is primarily due to increased domestic output and a significant rise in duty-free imports, mainly from Myanmar, Laos, and Cambodia, which benefit from unrestricted quota access between Feb-24 and Aug-24. Feed corn demand has surged due to the recovery of Thailand's pig and poultry sectors. Corn imports in the first three months of MY 2024/25 were 83% higher YoY and 85% above the five-year average.

United States

US Corn Harvest Achieves Record Quality and Yields for 2024/25

The 2024/25 US corn harvest will achieve record-breaking quality and yields. The 2024 growing season benefited from favorable conditions, including quick emergence, warm and moist weather during growth, milder temperatures during pollination, and warm, dry weather during harvest. These optimal conditions contributed to the highest projected 100-kernel weight in the report’s 14-year history and the US's third-largest corn crop ever recorded. Moreover, the crop features lower levels of broken corn, foreign material, total damage, and moisture compared to the previous five years. These improvements reflect the US's ongoing commitment to providing high-quality corn, helping buyers make informed decisions, and strengthening global trade relationships.

2. Weekly Pricing

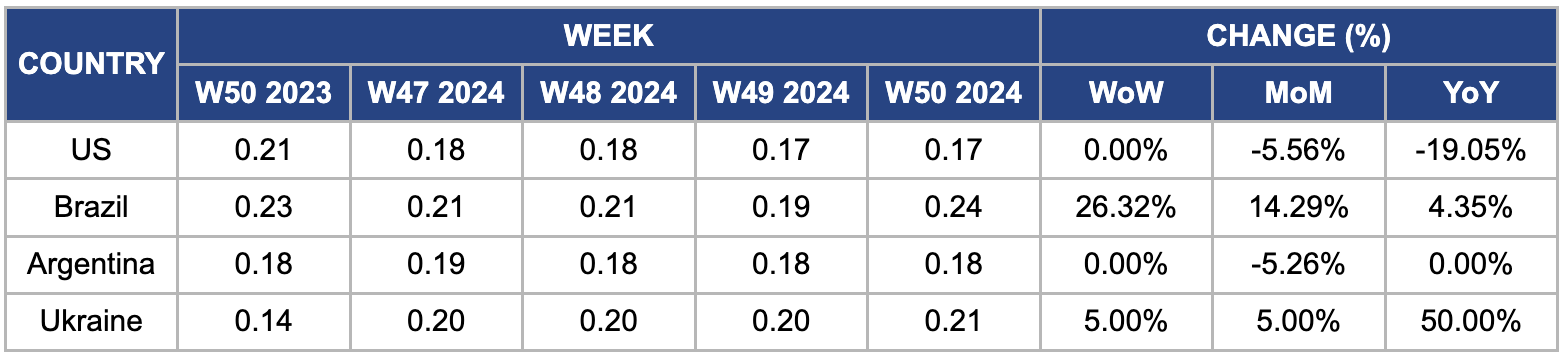

Weekly Maize Pricing Important Exporters (USD/kg)

Yearly Change in Maize Pricing Important Exporters (W50 2023 to W50 2024)

US

In W50, wholesale maize prices in the US remained stable week-on-week (WoW) but declined 5.56% month-on-month (MoM) and dropped 19.05% YoY, reaching USD 0.17 per kilogram (kg). This price decrease is due to favorable weather forecasts in key corn-producing regions, which are expected to result in strong harvests, further contributing to a price decline. Moreover, the 2024 corn yield is forecasted to set a new record, surpassing 12 metric tons (mt) per hectare (ha). The US corn sector has experienced substantial productivity gains over the decades, with yields increasing sixfold since the 1940s, primarily driven by advancements in hybrid seed genetics, biotechnology, and precision farming. Corn remains the most widely grown crop in the US in terms of acreage and output.

Brazil

In W50, wholesale maize prices in Brazil increased significantly by 26.32% WoW, 14.29% MoM, and 4.35% YoY. This rise was despite improved weather conditions and increased rainfall, positively impacting the 2024/25 summer maize sowing. According to the Center for Advanced Studies in Applied Economics (CEPEA), many corn producers, particularly in São Paulo, are holding back from market sales as they focus on cultivating the upcoming summer harvest. Favorable weather in key production regions, especially in Southern Brazil, has supported sowing efforts, with planting nearing completion. These factors have increased confidence in crop yields, pushing up maize prices as producers await the new season’s harvest.

Argentina

In W50, the wholesale price of Argentine corn remained stable WoW but declined by 5.26% MoM, reaching USD 0.18/kg. This price drop is primarily due to recent rainfall, which has improved crop conditions. Rainfall in Eastern Buenos Aires and Central Argentina has enhanced soil moisture levels, facilitating corn planting, with light rain expected to continue. Currently, corn is 41.3% planted, with 75 to 80% completed in core areas and less than 5% in the northern regions. Argentina's corn sowing plans for the 2024/25 campaign are optimistic, as the Dalbulus Maidis National Monitoring Network reported reduced leafhopper and disease pressure. The Association of Argentine Cooperatives (ACA) forecasts increased planting of late corn varieties, which, while yielding less than early varieties, can still be profitable with proper management. The Rosario Stock Exchange estimates nearly 8 million ha will be planted, with potential production ranging from 51 to 52 mmt.

Ukraine

In W50, Ukrainian wholesale maize prices increased by 5% WoW, MoM, and 50% YoY, reaching USD 0.21/kg. The price rise is primarily attributed to dry weather conditions that impacted crop yields, leading the USDA to revise Ukraine's corn harvest forecast downward by 1 mmt to 26.2 mmt. Despite this, Ukraine faces challenges with a 13% YoY export decline through the Constanta Port, mainly due to its dependence on deep-sea ports for shipping. The Ministry of Agrarian Policy and Food confirmed the completion of the harvest season, with a total grain collection of 53.9 mmt. While reduced exports typically lead to lower prices, logistical issues, and transportation constraints have increased costs, keeping maize prices elevated.

3. Actionable Recommendations

Adopt Advanced Irrigation and Water Management Systems

Ukraine, Brazil, and Thailand should prioritize investing in advanced irrigation and water management systems to ensure consistent maize production amidst unpredictable weather patterns, including recurring droughts and irregular rainfall. Technologies like drip irrigation and moisture sensors could improve water efficiency in Ukraine to help stabilize maize production, as dry weather has already impacted yields.. Facing seasonal dry spells, Brazil could benefit from rainwater harvesting and advanced irrigation systems to maintain consistent yields, particularly in its southern regions. Despite favorable forecasts, Thailand still faces challenges with seasonal droughts, and water-saving technologies like precision irrigation could help mitigate these risks, ensuring stable maize production. By adopting these systems, these countries can improve water use efficiency, reduce dependence on groundwater, and increase resilience to climate extremes.

Strengthen Export Competitiveness through Logistics Improvements

Brazil and Ukraine should invest in infrastructure improvements, particularly transportation networks and port facilities, to improve export efficiency. This could involve expanding rail and road networks to ensure smooth transportation from farms to ports and increasing port capacities to handle higher volumes of maize exports, especially during peak seasons. Streamlining customs procedures and reducing delays at border crossings expedite exports, ensuring that maize reaches international markets on time. These improvements would help reduce the costs associated with logistical bottlenecks and make maize more competitive in global markets, even during domestic price fluctuations or harvest surpluses.

Promote Crop Diversification and Climate-Resilient Varieties

Ukraine, Brazil, and Thailand should prioritize crop diversification and the adoption of climate-resilient maize varieties to address the challenges posed by climate change and erratic weather patterns. In Ukraine, where droughts have impacted maize yields, diversifying with drought-resistant varieties like the "Zea mays L.," hybrid maize with better drought tolerance, or planting crops such as drought-resistant beans, sorghum, or millet could provide farmers with additional revenue streams and reduce reliance on maize. Facing unpredictable weather, Brazil should promote using drought-tolerant hybrid maize varieties such as "Drought Tolerant Maize for Africa (DTMA)" or genetically modified maize resistant to pests, like Bt maize, to stabilize yields. Thailand, which has experienced drought and flood risks, could benefit from adopting flood-tolerant varieties, such as the "Sub1" maize, developed to withstand waterlogging and prolonged flooding. By diversifying with resilient crops and adopting these climate-adapted maize varieties, farmers can reduce financial risks, ensure long-term viability, and adapt to shifting environmental conditions through ongoing research and innovation.

Sources: Tridge, Agropopular, Noticias Agricolas, Portal Do Agronegócio, UkrAgroConsult