1. Weekly News

Argentina

Argentina's Soybean Planting Area Increases Despite Corn Stunting Concerns

Argentina's 2023/24 soybean planting area has been adjusted, reducing it to 16.4 million hectares (ha). Despite this reduction, the average national yield has been slightly revised upward to 31.2 quintals per ha, keeping total production estimates steady at 50 million metric tons (mmt). For the upcoming 2024/25 season, a 7.5% year-on-year (YoY) increase in planting intentions is forecasted, amounting to an additional 1.3 million ha, bringing the total to 17.7 million ha. This would represent the second-largest increase in the past 17 campaigns. Historically, the only more significant increase occurred after the 2008/09 season when soybean acreage jumped by 10% in 2009/10 due to recovery from a severe drought. The current surge in planting is due to concerns over corn stunting disease caused by the insect chicharrita. If the 2024/25 projections hold, this will mark the third consecutive year of soybean expansion after eight years of decline since 2014/15.

Brazil

Brazil's Soybean Export Projections for Sep-24

According to a National Association of Cereal Exporters (ANEC) weekly survey, Brazil's soybean exports are projected to reach 5.514 mmt in Sep-24, slightly down from 5.546 mmt in Sep-23. In comparison, the country exported 7.994 mmt in Aug-24. During W36, Brazil shipped 1.678 mmt of soybeans, and ANEC estimates that 1.561 mmt will be exported in W37. Additionally, soybean meal shipments for Sep-24 are expected to total 2.015 mmt.

China

China’s Soybean Imports Surge to 12.144 MMT in Aug-24

China imported 12.144 mmt of soybeans in Aug-24, up from 9.85 mmt in Jul-24. From Jan-24 to Aug-24, the country’s total soybean imports reached 70.48 mmt, reflecting a 2.8% YoY increase from 68.56 mmt. The market will face growth pressure and continue to experience weak fluctuations due to the significant rise in soybean imports and a shortage of soy meal supplies. Moreover, China plans to boost oilseed processing, particularly for soybeans, to meet the increased demand for feed.

India

India to Achieve Record Soybean Production of 12.8 MMT in 2024/25

India will achieve a record soybean production of 12.8 mmt in the 2024/25 marketing year (MY), exceeding last year's record by 100 thousand metric tons (mt). The favorable monsoon conditions have increased the planting area by 1% YoY, leading to yields forecasted at 0.98 mt/ha. The strong export demand for soybean meal has driven up soybean crushing, with soymeal production estimated at 9.36 million tonnes. Due to robust domestic demand, soybean oil production will also rise to 2.2 mmt.

United States

US 2024/25 Soybean Harvest Slightly Reduced

According to the United States Department of Agriculture (USDA) Sep-24 report, the United States (US) 2024/25 soybean harvest estimate was slightly reduced from 124.9 mmt to 124.8 mmt, while productivity remained stable at 59.63 bags per ha. On a global scale, world production was revised from 428.73 mmt to 429.2 mmt. Similarly, global ending stocks marginally increased from 134.3 mmt to 134.58 mmt. These changes reflect minor adjustments in supply and demand balances worldwide.

2. Weekly Pricing

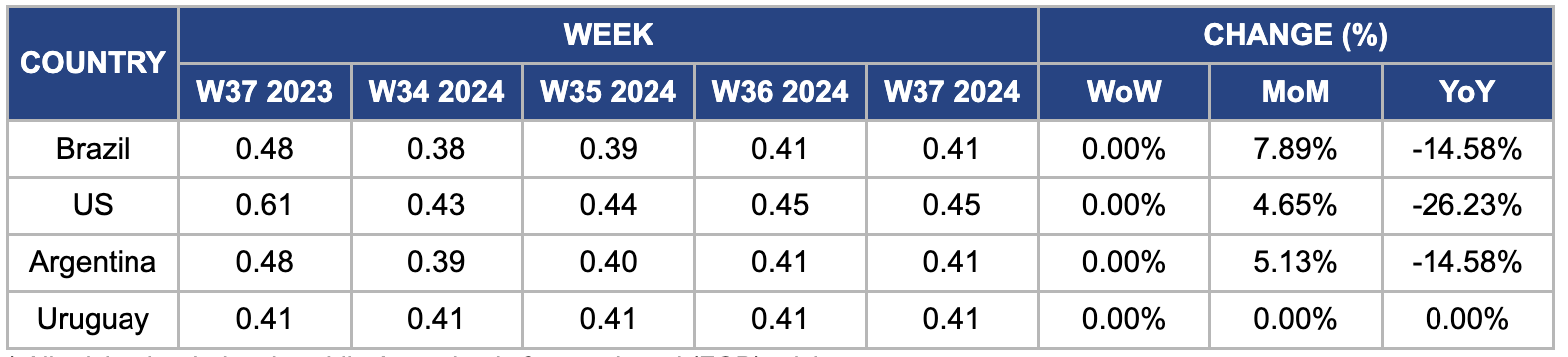

Weekly Soybean Pricing Important Exporters (USD/kg)

* Varieties: Food-grade soybean

Yearly Change in Soybean Pricing Important Exporters (W37 2023 to W37 2024)

* Varieties: Food-grade soybean

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Brazil

In W37, Brazilian soybean prices held steady at USD 0.41 per kilogram (kg), showing no change week-on-week (WoW). However, prices rose 7.89% month-on-month (MoM) due to concerns that the 2024/25 soybean harvest in Mato Grosso might face below-average rainfall, potentially delaying early sowing. Despite this monthly increase, the overall price trend reflects expectations of a record soybean harvest of 165 mmt for 2024/25. Exports are projected to reach 102 mmt, supported by improved productivity of 3.55 mt/ha and an expanded planted area. The market's outlook hinges on favorable weather conditions to achieve the anticipated production boost.

United States

US soybean prices stayed at USD 0.45/kg WoW but dropped by 26.23% YoY. The price stability resulted from strong demand, with the USDA reporting soybean export sales of 2.615 mmt for the week ending August 22, exceeding the trade expectations of 1.5 to 2.5 mmt. Initial concerns about the effects of hot and dry weather in the Midwest created uncertainty, but forecasts of milder conditions have alleviated these worries. Although recent rainfall has improved crop prospects by easing drought conditions, doubts remain about whether the soybean crop will reach its full potential. The steep YoY price decline reflects the USDA's Aug-24 report, which included unexpectedly high estimates for soybean area, yield, production, and stocks for the 2024/25 season. The USDA projected a record soybean crop of 124.9 mmt with a yield of 53.2 bushels per acre, surpassing market expectations.

Argentina

In Argentina, soybean prices remained unchanged WoW at USD 0.41/kg but increased by 5.13% MoM. This recent price rise reflects higher demand and a significant boost in Argentine soybean exports during the first half of the season. Exports surged by 67% YoY to USD 8.98 billion, marking a 39% increase in value despite a 14.58% YoY decline in overall prices. Argentina is set to experience its most substantial expansion in soybean plantings in a decade for the 2024/25 planting season. This expansion could be the most significant annual increase since 2012, potentially boosting global supplies and exerting downward pressure on already low prices.

Uruguay

Uruguayan soybean prices held steady both WoW and MoM at USD 0.41/kg in W37. The 2023/24 soybean harvest concluded with an estimated production of 3 mmt. However, excessive rains during spring and summer resulted in yields falling short of earlier high projections, preventing a record harvest and disappointing farmers who had hoped to recover from previous losses. Current soybean prices are at their lowest levels since 2020, highlighting the ongoing challenges facing Uruguay's agricultural sector.

3. Actionable Recommendations

Enhance Export Opportunities and Manage Production Constraints

With their anticipated increases in soybean output, Brazil and India should focus on strengthening trade relationships with key importing countries. Building strategic partnerships with importers in regions such as China and Europe can facilitate smoother trade negotiations and increase export volumes. Additionally, improving logistical capabilities is essential; this could involve investing in infrastructure improvements at ports and enhancing transportation networks to ensure the efficient movement of goods. Moreover, proactive measures will require addressing potential production challenges such as adverse weather or pest outbreaks. Implementing precision agriculture techniques, which use data analytics to optimize farming practices, can help mitigate risks associated with climate variability. Encouraging collaboration between agricultural producers, government agencies, and research institutions can foster innovation and the development of strategies to enhance resilience in the supply chain.

Address Price Trends and Export Market Dynamics

Uruguayan farmers should adopt more resilient farming techniques, such as crop rotation and improved soil management practices. This is to mitigate the effects of adverse weather conditions in the future. Enhancing marketing strategies by leveraging digital platforms can help reach new markets and attract a broader customer base. Exploring new export opportunities in regions with growing demand, such as Southeast Asia, could stabilize prices and enhance profitability. Investment in research and development focused on developing high-yield and drought-resistant soybean varieties can also support long-term growth and competitiveness, positioning Uruguay as a reliable supplier in the global market.

Adapt to Market Conditions and Optimize Supply Chain Management

Argentina must optimize supply chain management by enhancing logistics and ensuring timely delivery of soybeans, particularly as planting intentions rise for the upcoming season. This could involve investing in transportation infrastructure, such as improving road networks and enhancing port facilities to facilitate quicker shipping times. Furthermore, Argentina could implement a robust digital tracking system to monitor supply chain efficiency in real-time, allowing producers and exporters to react swiftly to market demands and fluctuations. Targeting export strategies to align with emerging markets will also be critical, especially in Asia, where demand is growing. Collaborating with local agricultural cooperatives can help streamline operations and strengthen relationships with buyers, ultimately leading to improved market access and higher profitability.

Source: On24, NoticiasAgricolas, CanalRural, UkrAgroConsult, UkrAgroConsult