W6 2025: Maize Weekly Update

In W6 in the maize landscape, some of the most relevant trends included

- Argentina's corn production is under pressure due to hot, dry conditions, with only limited rainfall relief in W6. Production estimates have been lowered to a range of 47 to 49 mmt, with yield potential impacted, particularly for early-planted crops. Soil moisture remains a concern, with 41% of fields rated short/very short.

- Mexico has lifted restrictions on GM corn imports following an unfavorable USMCA dispute ruling, ensuring continued access to US supplies for human, livestock, and industrial use. Meanwhile, Russia introduced regional corn export quotas to support local producers in the Far East.

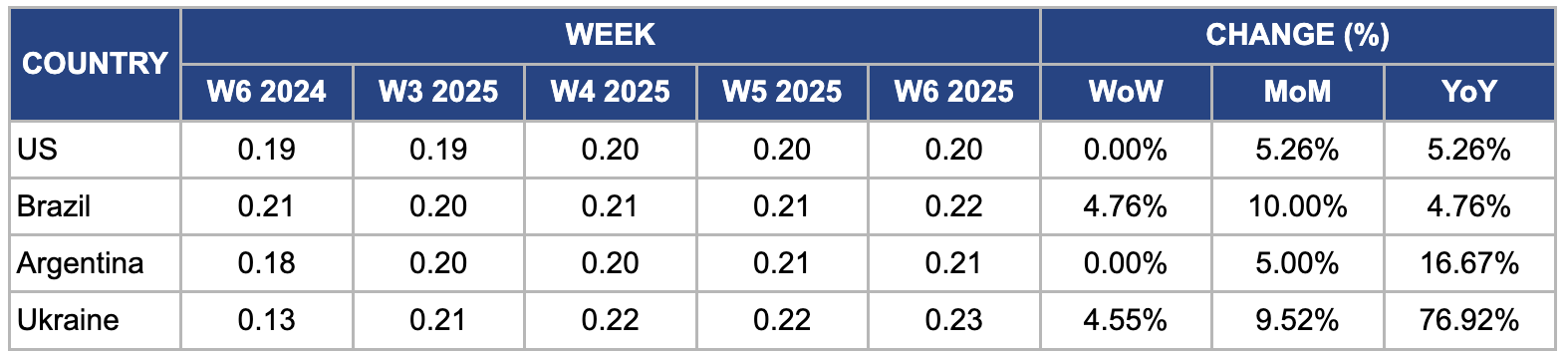

- Global maize prices rose due to supply constraints. US prices remained stable WoW, while Brazil's rose 4.76% WoW due to strong Chinese demand and logistics issues. Argentina's jumped 5% MoM due to adverse weather, and Ukraine's surged 76.92% YoY as drought cut production to a seven-year low.

1. Weekly News

Argentina

Argentina's Corn Crop Struggles as Drought Persists in W6

Argentina's corn crop continues facing prolonged hot and dry conditions, with scattered showers in W6 providing only limited relief. In Northern Buenos Aires, Santa Fe, and Entre Rios, rainfall has been less than 25% of normal over Jan-25, with upcoming rains favoring western and northern areas but insufficient to fully replenish soil moisture. Corn planting is 98.3% complete in W6. The Buenos Aires Grain Exchange (BAGE) cut its estimate to 49 mmt. Corn yield potential has been impacted, particularly for crops planted in Oct-24 and early Nov-24, while later-planted corn is in vegetative stages with lower water demand. Currently, 20% of the crop is rated poor/very poor, 50% fair, and 30% good/excellent, with the latter down 9% from the previous week. Soil moisture remains a concern, with 41% rated short/very short and only 59% favorable/optimum, a 5% decline from the prior week.

Mexico

Mexico Lifts GM Corn Import Restrictions After USMCA Dispute

Mexico has repealed its restrictions on genetically modified (GM) corn imports for human, livestock, and industrial uses after losing a trade dispute under the United States-Mexico-Canada Agreement (USMCA). Initially, the former Mexican President imposed a full ban, revising it to apply only to human consumption. However, the United States (US), a major supplier of GM yellow corn to Mexico for feed and industrial use, challenged the restrictions, pointing that they violated trade commitments. In December, a USMCA panel ruled in favor of the US, prompting Mexico to lift the restrictions, as officially published in its government gazette on February 4. The decision marks a significant shift in Mexico’s policy, ensuring continued access to US GM corn imports while complying with trade obligations.

Russia

Russia Sets Regional Corn Export Quotas for Feb-25 to Jun-25

Russia has introduced regional tariff quotas for corn exports outside the Eurasian Economic Union (EAEU), effective from February 15 to June 30, 2025. These quotas will apply to Primorsky Krai and Amur Oblast producers aiming to balance corn production and consumption in the Far Eastern Federal District. The measure will support local producers by facilitating surplus exports, especially given the limited demand from neighboring regions.

2. Weekly Pricing

Weekly Maize Pricing Important Exporters (USD/kg)

Yearly Change in Maize Pricing Important Exporters (W6 2024 to W6 2025)

United States

In W6, wholesale maize prices in the US remained stable week-on-week (WoW) but increased by 5.26% month-on-month (MoM) and 5.26% year-on-year (YoY), reaching USD 0.20 per kilogram (kg). This price rise follows a reduced global corn production forecast for 2024/25 by the International Grains Council (IGC). The forecast reduction is mainly due to a reduction in the expected US corn crop, now estimated at 377.6 mmt, aligning with the revised figures from the United States Department of Agriculture (USDA).

Brazil

In W6, wholesale maize prices in Brazil increased 4.76% WoW, 10% MoM, and 4.76% YoY reaching USD 0.22/kg. This price rise is driven by strong export demand, particularly from China, as Brazilian corn exports surged by 12.3% YoY in Jan-25. Moreover, domestic logistics disruptions, including transportation delays in key producing states such as Mato Grosso and Paraná due to heavy rains, have slowed the movement of maize to ports, tightening supply in the domestic market. Furthermore, lower-than-expected early harvest yields in some regions have contributed to price support.

Argentina

In W6, Argentinian maize prices rose by 5% MoM and 16.67% YoY to USD 0.21/kg, driven by adverse weather conditions. Hot temperatures and insufficient rainfall have negatively impacted maize production, prompting BAGE to lower its 2024/25 corn production estimate by 1 mmt to 49 mmt. The production decline is mainly due to extreme heat and dry conditions in southern farmlands and central-eastern Entre Ríos province. If unfavorable weather persists, further downward revisions to production and continued price increases may follow.

Ukraine

In W6, wholesale maize prices in Ukraine surged by 4.55% WoW, 9.52% MoM, and 76.92% YoY to USD 0.23/kg, driven by a sharp decline in maize production due to severe drought conditions. The USDA projects Ukraine's 2024/25 marketing year (MY) corn output at 25 mmt, marking a 23% drop from the previous season and the lowest production level since 2017. The drought has significantly impacted crop yields, leading to a tighter domestic maize supply and supporting price increases.

3. Actionable Recommendations

Manage Risks in Argentina’s Maize Supply Chain

Argentina’s 2024/25 maize production forecast has been lowered due to persistent drought and high temperatures, with potential further cuts if conditions do not improve. Given these uncertainties, exporters should consider hedging strategies such as forward contracts or options to lock in current maize prices and mitigate risks from further production declines. Moreover, prioritizing irrigation investments in drought-prone areas and implementing moisture-retaining agronomic practices (e.g., conservation tillage and cover cropping) could help stabilize future yields. Importing countries reliant on Argentine maize, such as China and Vietnam, should diversify sourcing strategies to mitigate supply risks.

Leverage Brazil’s Export Growth

Logistical bottlenecks in key producing states, including Mato Grosso and Paraná, Brazil, have constrained domestic supply. Exporters and traders should anticipate potential delays and secure alternative transport routes, including increased reliance on northern ports such as Itaqui and Barcarena to reduce dependence on congested southern routes. Moreover, strengthening barge and rail networks for inland grain transportation could alleviate port congestion. Importing nations should monitor Brazil’s logistics situation closely to avoid supply disruptions and price volatility.

Secure Alternative Corn Supply Sources in Response to Ukraine’s Production Drop

Due to severe drought conditions, Ukraine projects 2024/25 maize production to decline to the lowest level since 2017. With maize prices in Ukraine rising 76.92% YoY, global buyers, particularly in Europe and China, should consider diversifying their sourcing to alternative suppliers such as the US, Brazil, and Argentina. Feed producers and ethanol manufacturers may need to explore partial feedstock substitutions, including wheat or sorghum. Moreover, Ukraine’s maize export volumes should be closely monitored, as potential supply constraints could further impact global prices.

Sources: Tridge, NoticiasAgricolas, Sinor, UkrAgroConsult, NoticiasAgricolas, The Poultry Site